Last Update 04 Dec 25

Fair value Decreased 1.32%IAG: Upgraded Profit Outlook Will Drive Strong Earnings From RACQ Acquisition

Analysts have nudged their price target on Insurance Australia Group slightly lower to approximately A$8.83 from about A$8.95, reflecting marginally softer revenue growth expectations, partly offset by a modest improvement in forecast profit margins and valuation multiples.

What's in the News

- Raised fiscal 2026 guidance for gross written premium growth to around 10%, up from a previous low to mid single digit range, driven by the planned inclusion of RACQ Insurance from 1 September 2025 (company guidance).

- Upgraded reported insurance profit outlook for fiscal 2026 to AUD 1,550 million to AUD 1,750 million, an increase of AUD 100 million at both ends of the prior range (company guidance).

- Signalled stronger scale and earnings contribution from the RACQ Insurance acquisition, with integration benefits now reflected in medium term forecasts (company guidance).

Valuation Changes

- Fair Value Estimate has edged down slightly to approximately A$8.83 from A$8.95, reflecting a modestly lower intrinsic valuation.

- Discount Rate is unchanged at 6.67%, indicating no revision to the assumed cost of capital.

- Revenue Growth assumption has weakened marginally, with the forecast decline deepening from around 10.78% to about 10.93%.

- Net Profit Margin forecast has risen slightly, improving from roughly 9.59% to about 9.63%.

- Future P/E multiple has eased modestly to about 21.24x from 21.51x, implying a small contraction in the valuation multiple applied to earnings.

Key Takeaways

- Overly optimistic assumptions on customer growth, margin expansion, and M&A synergies could expose downside if execution or market conditions disappoint.

- Rising competition, technological uncertainty, and climate-related claims risk threaten growth, profitability, and long-term sector dominance.

- Strong growth momentum, conservative risk management, and ongoing tech investment position IAG for sustained margin expansion, market share gains, and improved shareholder returns.

Catalysts

About Insurance Australia Group- Insurance Australia Group Limited underwrites general insurance products and provides investment management services in Australia and New Zealand.

- The stock appears to be pricing in continued robust revenue and earnings growth from expected organic customer gains, boosted by IAG's strong brand portfolio and advanced digital platforms that increase policy retention and simplify customer acquisition; any disappointment in customer growth rates or market share could pressure top-line and net income in future periods.

- Investors seem to be assuming substantial near

- and medium-term operating margin expansion as heavy investment in risk analytics, AI underwriting, and process automation will rapidly drive higher efficiency and lower claims ratios; however, if technology implementation lags, or cost savings prove slower to materialize, operating leverage and net margins could be lower than current expectations.

- Current valuation likely factors in sustained favorable conditions for property and catastrophe insurance, as heightened climate risk awareness is expected to expand IAG's gross written premiums and addressable market; if future weather events are more severe or frequent than modeled, claims could spike and reinsurance costs rise, harming profitability.

- The market may be too optimistic regarding long-term sector consolidation benefiting IAG, assuming disciplined pricing and low competition will persist; if disruptive digital-first competitors or insurtechs gain traction faster than anticipated, market share erosion and price competition could crimp revenue growth and profitability.

- There seems to be an expectation for the integration of large acquisitions (RACQ, RAC WA) to deliver quick and substantial synergy benefits to group earnings and EPS; however, if integration is slower, cost savings less than forecast, or reinsurance/IT challenges emerge, realized earnings accretion could lag current projections, impacting reported earnings growth.

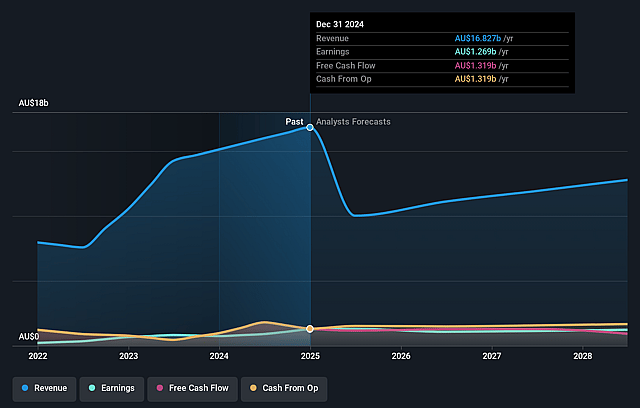

Insurance Australia Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Insurance Australia Group's revenue will decrease by 10.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.8% today to 9.6% in 3 years time.

- Analysts expect earnings to reach A$1.2 billion (and earnings per share of A$0.5) by about September 2028, down from A$1.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.3x on those 2028 earnings, up from 15.1x today. This future PE is greater than the current PE for the AU Insurance industry at 19.9x.

- Analysts expect the number of shares outstanding to decline by 0.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.48%, as per the Simply Wall St company report.

Insurance Australia Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent organic growth in retail customer numbers and high policy retention rates, along with scalable technology platforms, suggest IAG is well positioned to expand revenue and market share, especially with the successful migration of policies to the Retail Enterprise Platform expected to drive further customer and premium growth.

- The acquisition of RACQ and RAC in WA, which will add around $3 billion of premiums and at least $300 million in insurance profits, is projected to deliver double-digit earnings per share accretion and support ongoing revenue and earnings growth.

- Mature and conservative reinsurance arrangements, featuring downside protection against perils volatility and profit-sharing mechanisms, provide margin stability and potential upward bias to net margins and earnings in periods of benign claims experience.

- Robust capital position, disciplined underwriting, and consistent margin delivery (targeting 14%-16%, with a through-the-cycle goal of 15%) backed by improving claims efficiency and supply chain management, indicate the likelihood of maintaining healthy net margins and sustainable earnings.

- Continued investment in technology (including AI and advanced efficiencies), process automation, and integration of acquisitions is forecast to lower the expense ratio, expand operating leverage, and further enhance net margins and shareholder returns over the medium to long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$8.982 for Insurance Australia Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$10.2, and the most bearish reporting a price target of just A$7.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$12.4 billion, earnings will come to A$1.2 billion, and it would be trading on a PE ratio of 21.3x, assuming you use a discount rate of 6.5%.

- Given the current share price of A$8.68, the analyst price target of A$8.98 is 3.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Insurance Australia Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.