Last Update 03 Sep 25

Fair value Decreased 28%Fleet Renewal And Global Demand Will Drive Shipping Success

Despite a strong upward revision in revenue growth forecasts and a substantially lower future P/E multiple, the consensus analyst price target for Diana Shipping has fallen markedly from $4.00 to $2.90.

What's in the News

- Entered into multiple new time charter contracts for its Ultramax, Post-Panamax, Kamsarmax, and Ice Class Panamax vessels, with gross charter rates ranging from USD 9,000 to USD 14,250 per day and anticipated gross revenues per contract from approximately USD 3.28 million to USD 5.64 million.

- All recent charters are expected to commence between early June and mid-August, with minimum durations through mid-2026 and some extending up to late 2026.

- Fleet currently stands at 36 dry bulk vessels (4 Newcastlemax, 8 Capesize, 4 Post-Panamax, 6 Kamsarmax, 5 Panamax, and 9 Ultramax), with combined carrying capacity (excluding two on order) of around 4.1 million dwt and a weighted average age just under 12 years.

- Company expects delivery of two methanol dual fuel new-building Kamsarmax dry bulk vessels in the second half of 2027 and first half of 2028.

Valuation Changes

Summary of Valuation Changes for Diana Shipping

- The Consensus Analyst Price Target has significantly fallen from $4.00 to $2.90.

- The Consensus Revenue Growth forecasts for Diana Shipping has significantly risen from 1.8% per annum to 10.9% per annum.

- The Future P/E for Diana Shipping has significantly fallen from 12.04x to 4.22x.

Key Takeaways

- Ongoing fleet upgrades and environmental compliance position Diana Shipping for improved margins and adaptability to industry regulations.

- Stable charter contracts and a strong financial position enhance resilience and support growth amid shifting supply-demand dynamics in dry bulk shipping.

- Declining demand, structural oversupply, aging and undiversified fleet, regulatory pressures, and industry-wide capital needs threaten Diana Shipping's profitability and financial stability.

Catalysts

About Diana Shipping- Provides shipping transportation services worldwide.

- Continued global population growth and urbanization, along with ongoing economic development in emerging markets (especially in Asia and Africa), are set to drive increasing demand for dry bulk commodities like grains and iron ore, which should translate into stable or rising shipping volumes and potential freight rate upside-supporting future revenue growth.

- The company's focus on fleet renewal, as evidenced by the ongoing sale of older vessels and the delivery of new, eco-efficient dual-fuel ships in 2027/2028, positions Diana Shipping to benefit from lower operating costs and compliance with tighter environmental regulations, enhancing future net margins and profitability.

- Adoption of medium

- to long-term charter contracts provides better earnings visibility and cushions against freight rate volatility, allowing for more stable and predictable revenue and cash flow even during cyclical downturns in the dry bulk market.

- Industry-wide slowdown in new vessel orders and an aging global fleet are likely to result in future supply constraints, particularly as more vessels are scrapped to meet environmental standards, which could tilt the supply-demand balance in favor of higher rates and improved earnings for Diana Shipping over the next several years.

- Strategic positioning and conservative balance sheet management-including reduced net debt and significant cash reserves-enhance Diana Shipping's ability to invest opportunistically in fleet upgrades and take advantage of positive long-term industry trends, which should support stronger future earnings and return on equity.

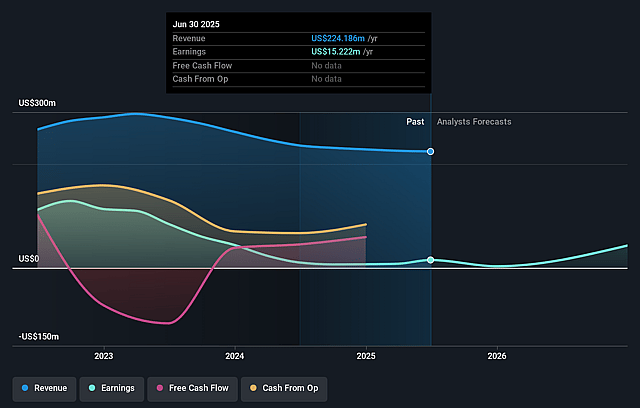

Diana Shipping Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Diana Shipping's revenue will grow by 10.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.8% today to 32.5% in 3 years time.

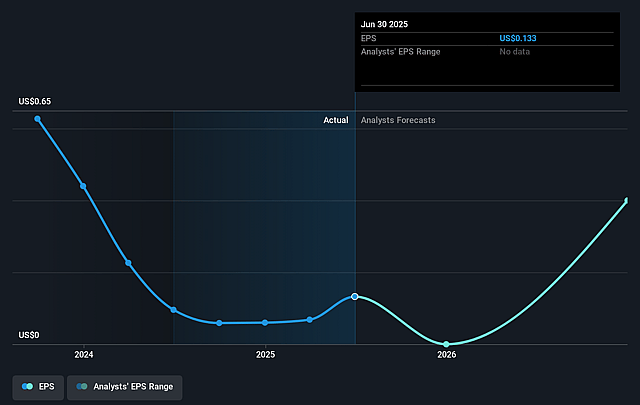

- Analysts expect earnings to reach $99.4 million (and earnings per share of $0.85) by about September 2028, up from $15.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 4.2x on those 2028 earnings, down from 14.2x today. This future PE is lower than the current PE for the US Shipping industry at 8.4x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 18.0%, as per the Simply Wall St company report.

Diana Shipping Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Secular demand risks are evident, as global steel production outside India is declining, Chinese crude steel output is down 2% year-on-year, and seaborne iron ore shipments are expected to be flat or slightly weaker through 2026; these trends directly threaten future vessel utilization rates and pressure Diana Shipping's revenue growth.

- The dry bulk fleet is expanding at a rate (3% annual growth) that outpaces expected demand growth (0.4% in ton-miles for 2025–2026), which could lead to structural oversupply, lower time charter rates, and significant pressure on Diana's long-term earnings and net margins.

- Continued aging of Diana Shipping's fleet-with an average vessel age of 11.7 years and only two methanol dual-fuel newbuilds expected by 2028-leaves the company exposed to rising regulatory costs related to decarbonization and environmental compliance, steadily increasing OpEx and CapEx while reducing margin competitiveness.

- Diana's fleet and revenue base remain highly concentrated in the dry bulk segment; ongoing reduction in coal shipments (declining 1–7%/year), the global energy transition, and lack of diversification exposes the company to commodity-specific downturns, amplifying revenue volatility and cash flow risk.

- Industry-wide capital commitments needed to meet new propulsion and emission standards, coupled with stagnant rates and decreasing asset values (noted by newbuilding and secondhand price declines), threaten Diana Shipping's ability to maintain profitability, modernize its fleet in a timely manner, and preserve shareholder value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $2.9 for Diana Shipping based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $305.4 million, earnings will come to $99.4 million, and it would be trading on a PE ratio of 4.2x, assuming you use a discount rate of 18.0%.

- Given the current share price of $1.97, the analyst price target of $2.9 is 32.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.