Last Update 18 Jan 26

Fair value Increased 33%ISRG at FV

Update on Valuation (18.10.26)

Over the next 5 years I calculate with (actual values from 18.01.26, price/shr at 533 USD):

Revenue Growth p.a.: 12% (Currently at 14,7%) – we saw the peak of revenue growth with nearly 15%, now even 12% is sporty, but with the „abo like“ revenues from spare parts and software licences, based on a still growing bases of installed systems, realisitc.

Profit Margin: 30% (currently at 28,6%) - because spare parts in general have more margin then system sales, and the sales out of spare parts is still growing.

Future PE: 50 (currently at 69) – the high PE’s are tipical for fast growers, but over time the PE will go down, I see for next 5 years 50, in 10 years it could come down to 40.

Interest rate: 6,77% (same as current)

Wich leads to an FV of 533 USD, means ISRG trades with 0,5% at fair value.

I calculate the internal rate of return (IRR) of an investement at current stock price on a period of 5 years. At current value I get 6,8% annual return on share price.

This is below my expectation of 10%.

But ISRG is always very expensive, but if you price further drops to 480 USD, you would reach 9% annual return.

This is below my expectation of 10%.

Intuitive Surgical (ISRG) is a pioneer in robotic-assisted surgery, revolutionizing the medical field with its da Vinci surgical system. Founded in 1995, the company has continuously innovated, making minimally invasive surgery more precise and efficient.

The Military Origins of Surgical Robots

The origins of robotic-assisted surgery trace back to military research in the 1980s. The U.S. Defense Advanced Research Projects Agency (DARPA) explored the idea of remote-controlled robotic surgery to treat wounded soldiers on the battlefield without having to transport them to a hospital. The goal was to enable highly skilled surgeons to operate remotely, reducing the time between injury and treatment.

From Military Research to Intuitive Surgical

A key player in this transition was Dr. Frederic Moll, who, along with Dr. Robert Younge and John Freund, saw the potential of robotic surgery in civilian healthcare. In 1995, they founded Intuitive Surgical, refining the technology from the military prototypes to create the first commercially viable surgical robots.

In 1997, the prototype “Lenny” was created, linguistically based on the young Leonardo da Vinci. The introduction of the “da Vinci Surgical System” began in 2000 (FDA approval in USA). The system was initially used for heart surgery and then primarily for urological procedures.

In 2009 they introduced an updated model da Vinci S / Si, followed by da Vinci X / Xi in 2014. Recently (12.2024) they introduced the most advanced system da Vinci 5 with several advancements, e.g. force feedback for sensing force at the instrument tip and feedback to the operator.

Building a Digital Ecosystem for Surgeons

Once the da Vinci System was successfully introduced to the market, ISRG took the next step: building a digital ecosystem around its robotic system. This ecosystem allows surgeons to:

Track their performance, compare with peers worldwide, learn from the best (the platform provides access to training videos, surgical case analyses, and insights from top-performing surgeons) and monitor their improvement over time.

By integrating data analytics, AI-powered insights, and global knowledge-sharing, Intuitive has not only revolutionized robotic surgery but also created an ecosystem that continuously enhances surgical skills and patient outcomes.

A Growing Installed Base is good but the Recurring Revenue makes the Difference

Today, 9,539 da Vinci systems are installed worldwide, with an annual growth rate of 15.1%. Each year, these systems perform approximately 2.2 million procedures, a number that has been growing at a rate of 22.2% per year.

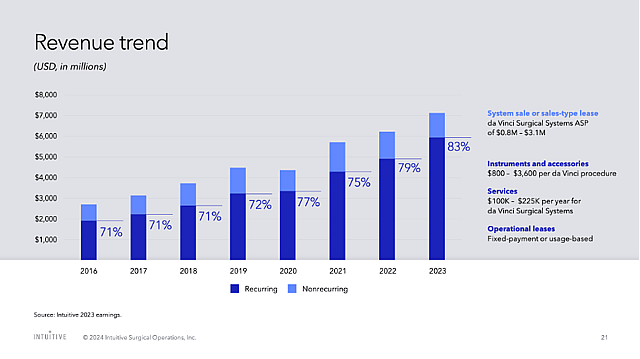

This high number of procedures ensures a strong demand for replacement parts and services, which now account for 83% of Intuitive’s total revenue. This share has increased from 79% in the previous year, highlighting how the company’s business model has evolved into a high-margin, subscription-like revenue stream.

ISRG’s robust business model and strong moat come from this recurring revenue, as hospitals must continuously purchase instruments, maintenance services, and software updates to keep their da Vinci systems operational. This ensures consistent and predictable cash flow, making Intuitive one of the most resilient and attractive investments in the medical technology space.

Great Company – But No Buy for Me Right Now

No doubt, ISRG is an outstanding company and will continue to perform well in the future. I am happy that I invested early in ISRG, but I am far away from buying more, even though the stock price has dropped from $606 (20.02.24) to $484 (14.03.25).

Currently, ISRG trades at 37% above fair value (SWS FV: $352, 14.03.25).

Based on a reasonable Free Cash Flow (FCF) outlook:

2025: $3,000 million

2028: $4,600 million

Based on the underlaying FCF from SWS I calculated the interest rate of an investment at current stock price $484 (14.03.25). At current value I get only 1% annual return.

That’s why I am still waiting for a lower price.

However, buying ISRG at a fair price is nearly impossible—the stock rarely drops to an attractive level. I predict it won’t fall below $400, making it a waiting game for patient investors.

<<< To see my other narratives, please scroll up and klick on Tokyo (next to my profile picture) >>>

Have other thoughts on Intuitive Surgical?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

The user Tokyo has a position in NasdaqGS:ISRG. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.