Last Update 03 Nov 25

Fair value Increased 2.22%Analysts have raised their price target for AIA Group, increasing the fair value estimate from $91.70 to $93.74. This adjustment is based on improved revenue growth projections and a slightly higher anticipated forward price-to-earnings ratio.

What's in the News

- AIA Group has completed a repurchase of 87,235,600 shares, representing 0.83 percent, for HKD 5,643.01 million between May 23, 2025 and June 30, 2025 (Key Developments).

- From July 1, 2025 to July 14, 2025, AIA Group repurchased 39,001,340 shares, totaling 0.36 percent, for $345 million. This finalized a tranche of 196,936,221 shares, or 1.83 percent, for $1,600 million under the buyback announced in March 2025 (Key Developments).

- Between March 14, 2025 and June 30, 2025, the company completed another repurchase of 157,934,881 shares, making up 1.47 percent for $1,255 million as part of its ongoing buyback plan (Key Developments).

- AIA Group Limited announced an interim dividend of HKD 0.49 per share for the six months ended June 30, 2025. The dividend will be payable on September 23, 2025, with an ex-dividend date of September 5, 2025 and a record date of September 8, 2025 (Key Developments).

Valuation Changes

- The Fair Value Estimate has risen slightly from HK$91.70 to HK$93.74.

- The Discount Rate remains effectively unchanged at 6.77%.

- Revenue Growth projections have improved, with the estimated decline narrowing from -0.50% to -0.28%.

- The Net Profit Margin is nearly stable, edging down marginally from 33.69% to 33.66%.

- The Future P/E Ratio has increased from 16.62x to 17.01x.

Key Takeaways

- Strategic expansion across emerging Asian markets and a focus on protection products position AIA to capitalize on rising insurance demand and ensure sustained, predictable growth.

- Digital investments and disciplined capital management are driving efficiency gains, resilient cash flows, and strong shareholder value in a changing regional landscape.

- Reliance on sustained growth faces threats from slowed economies, tighter regulations, rising costs, and growing digital competition, risking profitability and long-term earnings potential.

Catalysts

About AIA Group- Provides life insurance based financial services in Hong Kong.

- The ongoing expansion into high-growth emerging Asian markets-particularly China (with new regions growing VONB at a 36%+ pace and expectations of 40% CAGR in these areas), India, and ASEAN-position AIA to significantly capture rising demand for protection, health, and long-term savings products as regional affluence, financial penetration, and urbanization increase; this is expected to drive sustained revenue and new business growth.

- Rapid urbanization and wealth creation across Asia, coupled with demographic shifts such as a rising middle class and aging population, are boosting demand for private insurance and health solutions; AIA's strong regional brand and innovative product development are likely to support higher premium volumes and persistency, contributing to earnings growth and predictable, recurring cash flow.

- Continued investments in digital transformation, AI, and automation-especially in agency management, customer engagement, and operations-are already yielding productivity gains and efficiency improvements; this creates the potential for further reductions in expense ratios and improved net margins over the medium to long term.

- The company's focus on high-value protection and low-guarantee fee-based products (now nearly 90% of new business) has resulted in resilient, predictable cash flows and strong margins, supporting sustainable earnings and embedded value growth; this positions AIA defensively against interest rate volatility and market cycles, underpinning profitability.

- AIA's disciplined capital management (progressive dividends, ongoing share buybacks, and investment in organic growth) alongside strong free surplus generation (10% per share growth) and record-high operating ROE (16.2%) creates a virtuous circle for shareholder value, with further upside potential if currently muted investor sentiment underappreciates the compounding power of AIA's profitable new business layering model.

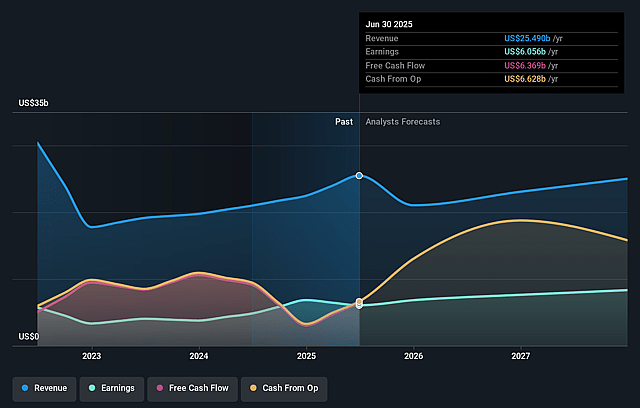

AIA Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AIA Group's revenue will decrease by 0.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 23.8% today to 33.7% in 3 years time.

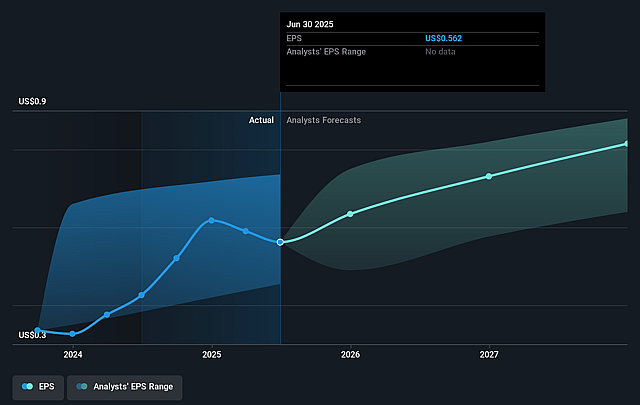

- Analysts expect earnings to reach $8.5 billion (and earnings per share of $0.88) by about September 2028, up from $6.1 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $6.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.6x on those 2028 earnings, up from 16.0x today. This future PE is greater than the current PE for the HK Insurance industry at 8.5x.

- Analysts expect the number of shares outstanding to decline by 2.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.77%, as per the Simply Wall St company report.

AIA Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- AIA's substantial dependence on continued double-digit new business growth and high productivity in both agency and partnership channels may be challenged by a slowdown in economic growth or increased regulatory intervention in key markets such as Mainland China and Hong Kong; this could lead to revenue and earnings volatility given current growth targets.

- Prolonged low or declining interest rates in Asia, particularly Mainland China and Thailand, can negatively affect investment returns and required capital levels, weakening profitability and potentially putting pressure on embedded value and net margins.

- Intense competition from digital-first insurers, insurtech entrants, and evolving customer demand for more commoditized, transparent, and low-margin insurance products could erode AIA's pricing power and persistency rates, thereby compressing net margins and long-term earnings growth.

- Rising distribution and recruitment costs-driven by the company's focus on maintaining the largest and most professional agency force-may strain expense ratios if agent productivity growth slows or market competition increases, directly impacting profitability.

- Ongoing regulatory reforms (e.g., product repricing, mandatory lower pricing caps, higher capital requirements, and tax regime changes like BEPS 2.0) across Asian markets may constrain product innovation, raise compliance costs, and limit margins, ultimately reducing AIA's future revenue and net earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of HK$91.698 for AIA Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$104.77, and the most bearish reporting a price target of just HK$80.82.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $25.1 billion, earnings will come to $8.5 billion, and it would be trading on a PE ratio of 16.6x, assuming you use a discount rate of 6.8%.

- Given the current share price of HK$72.3, the analyst price target of HK$91.7 is 21.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.