Last Update 22 Aug 25

Fair value Increased 17%Despite a marked slowdown in forecast revenue growth, Central Pacific Financial’s consensus future P/E has risen substantially, indicating a multiple expansion which underpins the significant increase in the analyst price target to $35.00.

What's in the News

- Amended and restated bylaws adopted, enhancing procedural mechanics and disclosure for shareholder nominations and proposals, detailing powers for regulating meetings, clarifying voting standards, and requiring director candidates to be available for board interviews.

- Net charge-offs for Q2 2025 increased to $4.7 million from $3.8 million the previous year, mainly due to a $2.0 million full charge-off of a commercial and industrial loan.

- Completed repurchase of 180,393 shares (0.67%) for $4.74 million under the January 2025 buyback program, including 103,077 shares (0.38%) for $2.6 million in Q2 2025.

Valuation Changes

Summary of Valuation Changes for Central Pacific Financial

- The Consensus Analyst Price Target has significantly risen from $29.96 to $35.00.

- The Consensus Revenue Growth forecasts for Central Pacific Financial has significantly fallen from 14.1% per annum to 10.1% per annum.

- The Future P/E for Central Pacific Financial has significantly risen from 8.65x to 11.05x.

Key Takeaways

- Expansion in wealth management, digital banking, and a growing Hawaii market are expected to diversify and enhance revenue streams.

- Operational efficiency improvements and higher-yield loans position the company for stronger earnings and improved margins.

- Geographic concentration, reliance on traditional interest income, and rising competition heighten earnings risk, while technology investments could further pressure profitability without efficiency improvements.

Catalysts

About Central Pacific Financial- Operates as the bank holding company for Central Pacific Bank that provides a range of commercial banking products and services to businesses, professionals, and individuals in the United States.

- As the aging population and generational wealth transfer drive increased demand for wealth management and advisory services, Central Pacific Financial's established reputation and strong client relationships in Hawaii positions the company to grow fee-based income, boosting non-interest revenue and diversifying income streams.

- The continued digitalization of banking, including CPB's ongoing investments in technology (such as its new data center and digital banking initiatives), should reduce operating expenses and improve efficiency ratios, supporting higher net margins and stronger earnings growth in the coming years.

- Migration trends boosting Hawaii's population-coupled with ongoing large-scale construction and residential development projects-suggest potential for increased economic activity in CPB's core markets, translating into rising deposits, loan origination opportunities, and revenue growth.

- Management's progress on branch rationalization and expense discipline, including the exit of its operations center and focus on core deposit growth, enhances future operating leverage, setting the stage for improved earnings even without significant top-line expansion.

- Attractive new loan yields significantly above portfolio averages, along with a healthy loan pipeline expected to deliver net loan growth in the second half of the year, should support further increases in net interest margin and drive revenue growth.

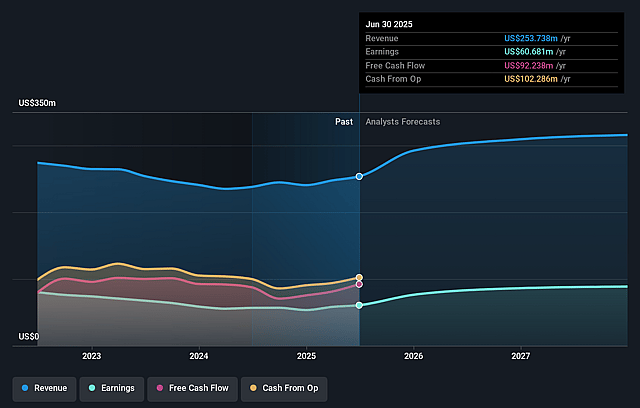

Central Pacific Financial Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Central Pacific Financial's revenue will grow by 10.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 23.9% today to 29.6% in 3 years time.

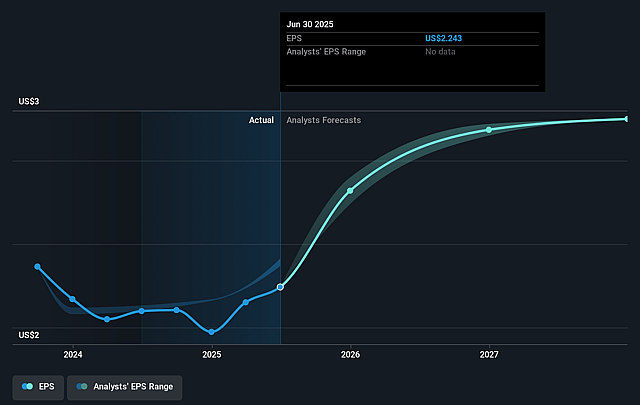

- Analysts expect earnings to reach $100.2 million (and earnings per share of $3.25) by about September 2028, up from $60.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.1x on those 2028 earnings, down from 13.7x today. This future PE is lower than the current PE for the US Banks industry at 11.9x.

- Analysts expect the number of shares outstanding to decline by 0.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Central Pacific Financial Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Central Pacific Financial's heavy geographic concentration in Hawaii exposes it to the state's sluggish population growth, tepid home sales volumes, and economic risks, which may limit opportunities for robust loan and revenue expansion in the long term.

- Ongoing runoff in residential mortgage and HELOC portfolios, coupled with only low single-digit loan growth and muted first-half results, suggests it may struggle to grow its core lending business, placing pressure on future earnings.

- The bank remains reliant on traditional interest income, with fee-based revenue not highlighted as a significant contributor; this dependency exposes net interest margins and earnings to potential yield curve compression or adverse interest rate changes.

- Rising competition from both entrenched local banks and nonbank fintech lenders threatens to erode market share, increase customer acquisition costs, and compress net margins over time.

- Expense pressures from ongoing technology investments (such as a new data center) and anticipated restructuring charges may elevate operating expenses if not offset by sufficient efficiency gains, weighing on net margin and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $35.0 for Central Pacific Financial based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $338.8 million, earnings will come to $100.2 million, and it would be trading on a PE ratio of 11.1x, assuming you use a discount rate of 6.8%.

- Given the current share price of $30.73, the analyst price target of $35.0 is 12.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Central Pacific Financial?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.