Last Update 01 Dec 25

Fair value Increased 0.18%WFC: Future Results Will Balance Improved Margins With Easing Regulatory Pressures

Analysts have modestly increased their price target for Wells Fargo from $93.54 to $93.71, citing stronger fee revenue and improved profit margins in recent quarterly results.

Analyst Commentary

Recent street research reflects both optimism and caution from analysts regarding Wells Fargo's outlook following its latest financial results and updated strategic targets.

Bullish Takeaways

- Bullish analysts have raised price targets for Wells Fargo, citing better-than-expected fee revenue and a core EPS beat in recent quarters. This supports a favorable view of the bank's near-term financial momentum.

- Management's introduction of a new medium-term target for return on tangible common equity (ROTCE) of 17 to 18 percent is seen as an ambitious and positive signal regarding the company's long-term profitability.

- Improved assumptions for fee revenues in the latter half of the year and increased share buybacks have contributed to higher earnings per share estimates among some firms.

- Higher-than-anticipated results in segments such as fees and provision are supporting upward revisions to price targets, close to or above the $90 mark.

Bearish Takeaways

- Bearish analysts maintain a cautious view, highlighting relatively low estimates for net interest income and signaling limited near-term upside despite estimate increases.

- A key point of concern remains the need for consistent execution, as future progress toward new return targets is essential to justify recent valuation increases.

- Some continue to prefer other banking institutions over Wells Fargo, even as targets are raised, due to perceived stronger growth prospects elsewhere.

- Despite favorable recent results, certain analysts stress the importance of delivering on strategic initiatives to sustain and build on current valuation levels.

What's in the News

- Wells Fargo CEO Charlie Scharf stated the bank is not under pressure to pursue mergers and acquisitions. He emphasized growth opportunities within existing businesses after regulatory restrictions were lifted (Reuters).

- The Federal Reserve is proposing smaller capital increases for major U.S. banks, including Wells Fargo. This could potentially ease some of the regulatory burden compared to previous proposals (Bloomberg).

- Wells Fargo, along with other large banks, could face higher costs if proposals to increase the FDIC insured deposit cap to $10 million move forward, as debated in the U.S. Senate (Wall Street Journal).

- Banks, including Wells Fargo, are competing for roles in the potential IPOs of Fannie Mae and Freddie Mac, which may become some of the largest ever seen in the U.S. market (Wall Street Journal).

- Wells Fargo's expanded push into credit cards is benefiting related businesses. Cardlytics is noted as a direct beneficiary from this growth and increased card offers (Citron Research via X).

Valuation Changes

- Fair Value: The fair value estimate has risen slightly from $93.54 to $93.71.

- Discount Rate: The discount rate has declined marginally from 8.21% to 8.21%, reflecting a minor decrease.

- Revenue Growth: Revenue growth assumptions remain effectively unchanged, holding steady just above 7%.

- Net Profit Margin: The net profit margin has increased from 23.52% to 25.24%, indicating stronger projected profitability.

- Future P/E: The future price-to-earnings ratio forecast has fallen from 14.20x to 13.26x, suggesting lower expected valuation multiples.

Key Takeaways

- Regulatory restrictions lifted, enabling aggressive balance sheet growth and expansion across deposits, lending, and wealth management for diversified and robust revenue streams.

- Strategic digital initiatives, expense discipline, and technology investments are driving scalable growth, higher margins, and improved customer satisfaction, strengthening long-term competitiveness.

- Competitive and regulatory pressures, slow digital transformation, and changing consumer preferences threaten Wells Fargo's profitability, efficiency, and long-term deposit and revenue growth.

Catalysts

About Wells Fargo- A financial services company, provides diversified banking, investment, mortgage, and consumer and commercial finance products and services in the United States and internationally.

- The removal of the asset cap and resolution of multiple regulatory orders unlocks Wells Fargo's ability to aggressively grow its balance sheet-including deposits, loans, and trading assets-after years of constraint, likely resulting in higher revenue and earnings growth over the coming quarters and years.

- A strong focus on digital banking and client experience improvements has driven consistent gains in mobile banking adoption, digital account openings, and customer satisfaction, positioning Wells Fargo for scalable growth and cost efficiencies-supporting both revenue growth and net margin expansion as more banking activity shifts online.

- Ongoing U.S. economic growth, solid labor markets, and steady consumer spending trends support loan and deposit demand, with management noting growth in checking accounts, credit cards, and auto lending-all likely to sustain and broaden Wells Fargo's revenue base as population and wealth rise.

- The strategic buildout of wealth management and advisory businesses, including significant net asset flows and affluent client acquisition, should increase fee-based income, support revenue diversification, and drive higher margins, reducing earnings volatility from cyclical lending operations.

- Management reiterated a continued commitment to expense discipline and scalable technology investments, including early-stage AI initiatives, which should offset investment for growth and enable structurally lower efficiency ratios-positively impacting net margins and long-term earnings power.

Wells Fargo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Wells Fargo's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 25.1% today to 24.4% in 3 years time.

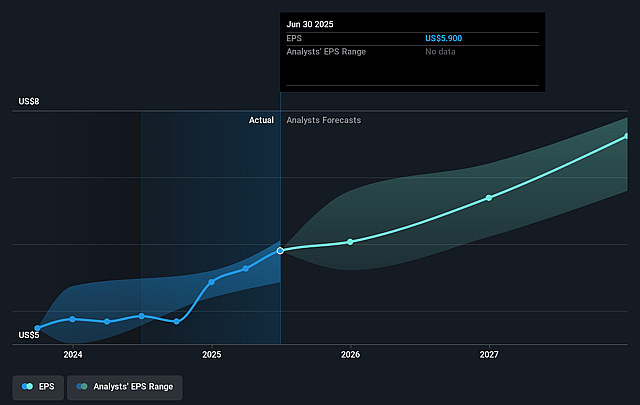

- Analysts expect earnings to reach $22.1 billion (and earnings per share of $7.34) by about September 2028, up from $19.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.3x on those 2028 earnings, up from 13.3x today. This future PE is greater than the current PE for the US Banks industry at 11.9x.

- Analysts expect the number of shares outstanding to decline by 3.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.26%, as per the Simply Wall St company report.

Wells Fargo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intense competition from both traditional banks and non-bank lenders, combined with limited spread widening in commercial lending, could constrain loan yields and net interest margins, pressuring both revenue growth and future profitability.

- While Wells Fargo is investing heavily in technology and digital platforms, the ramp-up in AI and digital initiatives is still in very early stages; if execution lags or if fintech and big tech competitors outpace Wells Fargo's digital transformation, the company risks customer attrition, lower deposit growth, and higher cost-to-income ratios, negatively impacting earnings and margins over the long term.

- Persistent regulatory and compliance obligations remain a risk despite the removal of the asset cap, as ongoing consent orders continue to require substantial resources, limiting the speed at which Wells Fargo can reduce compliance costs and reinvest in growth, potentially weighing on net margins and efficiency improvements.

- Structural changes in consumer behavior, including the rise of digitally native younger customers who may choose fintechs or non-bank platforms over traditional banks, could limit Wells Fargo's ability to grow core deposits and cross-sell products, challenging long-term revenue and deposit growth.

- The medium

- to long-term interest rate environment remains highly uncertain; any period of sustained low or volatile rates, or increased competition driving up deposit costs, could compress net interest income and slow earnings expansion despite recent improvements in fee income and trading revenues.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $87.0 for Wells Fargo based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $95.0, and the most bearish reporting a price target of just $72.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $90.6 billion, earnings will come to $22.1 billion, and it would be trading on a PE ratio of 14.3x, assuming you use a discount rate of 8.3%.

- Given the current share price of $80.76, the analyst price target of $87.0 is 7.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Wells Fargo?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.