Last Update 23 Sep 25

Fair value Decreased 7.25%The consensus analyst price target for Regis Healthcare has been revised down from A$8.61 to A$7.98, primarily reflecting weaker profitability as net profit margin declined and valuation multiples edged higher.

What's in the News

- Regis Healthcare announced a fully franked ordinary dividend of AUD 0.0813 per share for the six months ended June 30, 2025.

Valuation Changes

Summary of Valuation Changes for Regis Healthcare

- The Consensus Analyst Price Target has fallen from A$8.61 to A$7.98.

- The Net Profit Margin for Regis Healthcare has significantly fallen from 6.47% to 5.75%.

- The Future P/E for Regis Healthcare has risen slightly from 31.59x to 32.72x.

Key Takeaways

- Sustained demand from an aging population and supportive government reforms position Regis for growth in occupancy, pricing, and profitability.

- Expansion initiatives, operational efficiencies, and diversification into home care enhance asset quality, margins, and revenue resilience.

- Rising labor costs, funding shortfalls, and policy uncertainty are squeezing margins and threatening Regis Healthcare's profitability, revenue sustainability, and long-term earnings stability.

Catalysts

About Regis Healthcare- Engages in the provision of residential aged care services in Australia.

- The ongoing and accelerating demographic shift toward a larger aged population in Australia is driving sustained demand for residential aged care, with a forecast need for 9,300 additional beds annually for the next 20 years, positioning Regis to benefit from higher long-term occupancy rates and revenue growth.

- Government policies and funding reform are designed to improve sector profitability-including recent and expected future uplifts in AN-ACC subsidies, higher maximum room (RAD) pricing, and the legislated introduction of RAD retention, all likely to drive continued revenue and earnings expansion.

- Ongoing portfolio expansion through targeted acquisitions and greenfield developments (e.g., Rockpool, Ti Tree, CPSM acquisitions) and significant refurbishment capex are set to increase bed numbers, enhance asset quality, and support higher average pricing, underpinning both top-line revenue and net margin improvement.

- The company's investments in technology, operational efficiencies, and workforce optimization (including AI, HR systems, and clinical platforms) are expected to mitigate margin pressures from staff cost inflation and compliance requirements, supporting long-term margin expansion.

- Expansion into home care and diversified service offerings enables Regis to tap into increased demand for complex/chronic health management in the aging population, generating new revenue streams and enhancing overall earnings resilience.

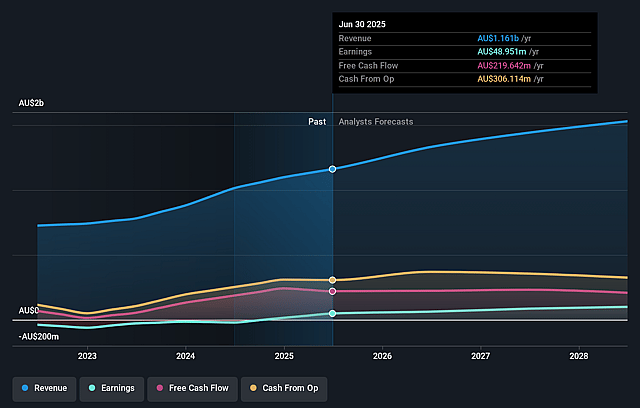

Regis Healthcare Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Regis Healthcare's revenue will grow by 9.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.2% today to 6.5% in 3 years time.

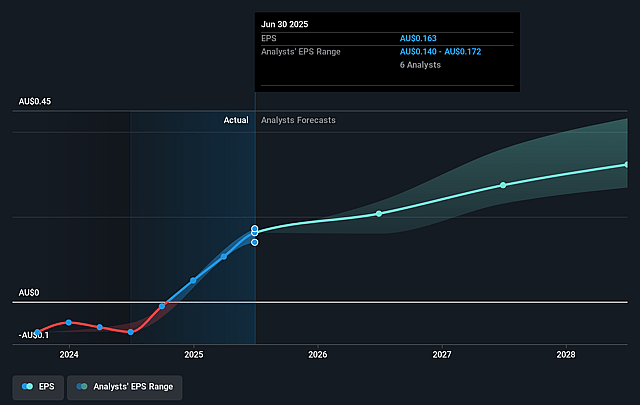

- Analysts expect earnings to reach A$99.0 million (and earnings per share of A$0.32) by about September 2028, up from A$49.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$130 million in earnings, and the most bearish expecting A$81.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 31.6x on those 2028 earnings, down from 47.1x today. This future PE is lower than the current PE for the AU Healthcare industry at 57.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.48%, as per the Simply Wall St company report.

Regis Healthcare Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing and escalating wage inflation, mandated higher care minute targets, and persistent workforce shortages could continue to increase operating costs faster than government funding increases, particularly if future AN-ACC indexation does not keep pace, compressing Regis Healthcare's net margins and putting long-term earnings growth at risk.

- Significant and ongoing losses in the everyday living and accommodation service segments-driven by government hoteling supplements and accommodation supplements that underfund the actual costs of these services-suggest a structural risk to profitability, with losses expected to persist until (and unless) future policy changes close these funding gaps, directly impacting net margins and overall revenue sustainability.

- Delays or insufficient adjustments in government policy to review and address the widening gap between concessional (government-supported) and non-concessional resident funding, combined with slow means-testing reforms for everyday living costs, could create adverse selection, compromise occupancy mix, and impair revenue growth if Regis must turn away less profitable residents or face government pressure to admit them at a loss.

- Growing workforce constraints, especially in regional areas-where labor shortages are more acute-risk not meeting mandated care minute targets; failure at a home-level could result in substantial per-resident per-day AN-ACC funding penalties from April 2026 onward, jeopardizing both revenue and net earnings, and amplifying compliance and reputational risks.

- Increasing capex requirements for facility refurbishments, sustainability compliance, and new greenfield developments-paired with rising acquisition price multiples and the potential for higher liquidity requirements under the new Aged Care Act-could strain return on invested capital and free cash flow, especially if occupancy or revenue growth under-delivers, challenging earnings resilience and limiting longer-term dividend capacity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$8.607 for Regis Healthcare based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$9.9, and the most bearish reporting a price target of just A$7.9.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$1.5 billion, earnings will come to A$99.0 million, and it would be trading on a PE ratio of 31.6x, assuming you use a discount rate of 6.5%.

- Given the current share price of A$7.65, the analyst price target of A$8.61 is 11.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.