Last Update 05 Nov 25

Fair value Increased 0.69%FHN: Shares Will Benefit From $1.2 Billion Repurchase Plan and M&A Flexibility

The analyst price target for First Horizon has increased modestly from $24.32 to $24.49. Analysts cite improved profit margins and steady revenue growth, though these are offset by tempered expectations around merger activity and company strategic direction.

Analyst Commentary

Analysts remain divided on the direction of First Horizon, balancing improved operational results and strategic ambiguity. Recent earnings and management commentary prompted both target adjustments and more cautious outlooks. While some see ongoing franchise value and strategic flexibility, others highlight increased uncertainty and limited near-term upside catalysts. Below, the core analyst perspectives are summarized.

Bullish Takeaways- Some analysts highlight First Horizon's fundamental strength, calling its franchise one of the most attractive in the group and noting a resilient business model despite market pressures.

- There is a belief that the recent pullback in the share price is overdone, creating an attractive entry point for long-term investors due to elevated scarcity value and positive risk-reward skew.

- Management’s willingness to keep strategic options open, including potential M&A activity, is seen as providing flexibility in uncertain deal-making environments.

- Organic growth opportunities, such as deepening existing client relationships, are expected to drive steady revenue growth and improved margins moving forward.

- Bearish analysts cite a lack of meaningful upside catalysts over the next 12 months and consider the current valuation fair, following the management’s comments on possible bank acquisitions as a buyer.

- There is concern that much of the merger and acquisition premium has been removed from the stock, yet not fully de-risked. This introduces caution into near-term forecasts.

- Some investors were caught off guard by management’s openness to M&A as a buyer. This creates a perception of strategic drift and tempers expectations for a potential sale in the near future.

- Valuation remains a sticking point for some, with shares trading at a notable premium to regional peers. A neutral stance has been adopted until a clearer execution path emerges.

What's in the News

- The Board of Directors unanimously approved an amendment to Section 3.2 of the Bylaws and increased the number of directors from thirteen to fourteen, effective immediately (Key Developments).

- First Horizon Corporation launched a share repurchase program that authorizes up to $1.2 billion in common stock buybacks through January 31, 2027 (Key Developments).

- From October 1 to October 27, 2025, the company repurchased more than 6 million shares for $131.89 million. This brings the total repurchases under this program to 39 million shares and $820 million (Key Developments).

- The company reported net charge-offs of $26 million for the third quarter ending September 30, 2025, which is slightly higher than the $24 million reported a year earlier (Key Developments).

- First Horizon maintained its revenue guidance for 2025 and expects revenue to be flat or rise up to 4% this year (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has risen slightly from $24.32 to $24.49, reflecting a modest increase in perceived fair value.

- Discount Rate has fallen marginally, decreasing from 7.01% to 6.93%. This suggests a mildly lower cost of capital or risk perception.

- Revenue Growth expectation is virtually unchanged, moving from 5.54% to 5.55%. This indicates stable future top-line growth projections.

- Net Profit Margin has improved slightly, up from 27.44% to 27.53%. This points to incremental progress in profitability forecasts.

- Future P/E ratio shows a minimal increase from 12.15x to 12.17x, signaling little change in anticipated valuation multiples.

Key Takeaways

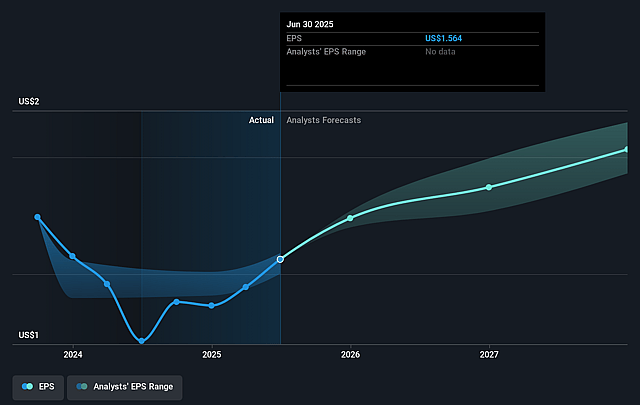

- Effective deposit cost management and strategic capital deployment could drive further net interest margin expansion and enhance earnings per share.

- The company's diversified business model and focus on cost discipline may boost earnings stability and shield against economic fluctuations.

- Economic uncertainty and credit risks may hurt First Horizon’s revenue, net interest margins, and earnings as market volatility and potential recession loom.

Catalysts

About First Horizon- Operates as the bank holding company for First Horizon Bank that provides various financial services.

- First Horizon is managing interest-bearing deposit costs effectively, with a 38 basis point reduction, which could lead to net interest margin expansion and positively impact net interest income.

- The company has opportunities for organic loan growth, particularly through its mortgage warehouse segment, which may enhance overall earnings if economic conditions or rate cuts increase demand.

- First Horizon's strategic capital deployment through a share repurchase program may lead to higher earnings per share (EPS) as outstanding shares are reduced.

- Increased focus on cost discipline and expense management can potentially improve net margins and bolster pre-provision net revenue growth.

- The diversified business model, offering countercyclical revenue support, may shield earnings from macroeconomic volatility and ensure a steady revenue stream across various interest rate environments.

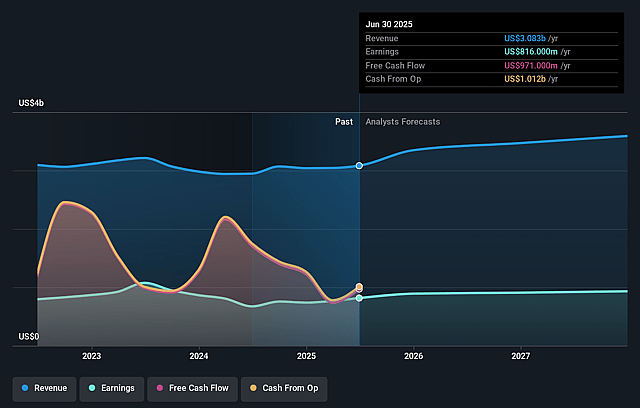

First Horizon Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming First Horizon's revenue will grow by 6.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 26.5% today to 25.8% in 3 years time.

- Analysts expect earnings to reach $965.0 million (and earnings per share of $2.03) by about September 2028, up from $816.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.9x on those 2028 earnings, down from 14.2x today. This future PE is greater than the current PE for the US Banks industry at 11.9x.

- Analysts expect the number of shares outstanding to decline by 4.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.9%, as per the Simply Wall St company report.

First Horizon Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The economic environment is currently shaped by heightened macroeconomic uncertainty due to tariffs and related policies, which could negatively impact revenue and net interest margins as market volatility persists.

- The risk of a potential recession is acknowledged, as further macroeconomic uncertainty is reflected in increased provision expenses and the potential impact on earnings and credit performance.

- The provision expense increased by $30 million, and the ACL to loans ratio increased by 2 basis points, which indicates caution over possible credit losses and may negatively affect future net margins and earnings.

- There is a decrease in fee income, excluding deferred compensation, by $5 million, and a decline in loan yields could continue to pressure revenues and profitability.

- The net charge-offs increased by $16 million, which, coupled with potential further macroeconomic challenges, could put additional stress on credit quality and earnings performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $24.641 for First Horizon based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $27.0, and the most bearish reporting a price target of just $22.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.7 billion, earnings will come to $965.0 million, and it would be trading on a PE ratio of 13.9x, assuming you use a discount rate of 6.9%.

- Given the current share price of $22.81, the analyst price target of $24.64 is 7.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.