Key Takeaways

- Expansion through acquisitions and organic growth indicates aggressive plans to boost earnings and diversify revenue by broadening Marriott's market presence.

- Investments in digital and technology aimed at improving customer experience and operational efficiency are likely to enhance margins and attract direct bookings.

- Expansion hindered by financing challenges and increased competition; reliance on digital and vulnerabilities to geopolitical or cyber issues could affect growth and trust.

Catalysts

What are the underlying business or industry changes driving this perspective?

- The robust growth in global RevPAR, driven by a balanced mix of Average Daily Rate (ADR) increases and occupancy improvements, underpins expectations of sustained revenue growth. This balanced growth stems from a diversified demand across group, leisure, and business segments, each contributing significantly to room nights and showcasing resilience and potential for future revenue expansion.

- The acquisition of MGM and the record number of new management, franchise, and license agreements in 2023, along with a significant pipeline of approximately 573,000 rooms, signal aggressive expansion plans. These moves are anticipated to catalyze future earnings by expanding Marriott's footprint, especially in key markets and segments, contributing to both top-line growth and earnings diversification.

- With over 196 million members, the loyalty program not only drives direct bookings, which are more profitable, but also enhances customer engagement through collaborations like co-branded credit cards. This strategy is expected to positively impact net margins by reducing customer acquisition costs and increasing guest spend, leading to higher revenue per available room (RevPAR) and ancillary revenues.

- Focused investments in digital channels and a multi-year technology transformation aim to improve customer experience, booking efficiency, and operational excellence. This strategic focus is likely to lead to margin enhancements by streamlining operations and attracting direct bookings, thereby reducing reliance on third-party platforms.

- Marriott’s push into the high-growth mid-scale market and further expansion of its luxury distribution signals a strategic effort to capture a wider audience. This diversification allows access to new customer segments, potentially driving revenue growth across different price points and enhancing market share in both volume-driven and high-margin segments.

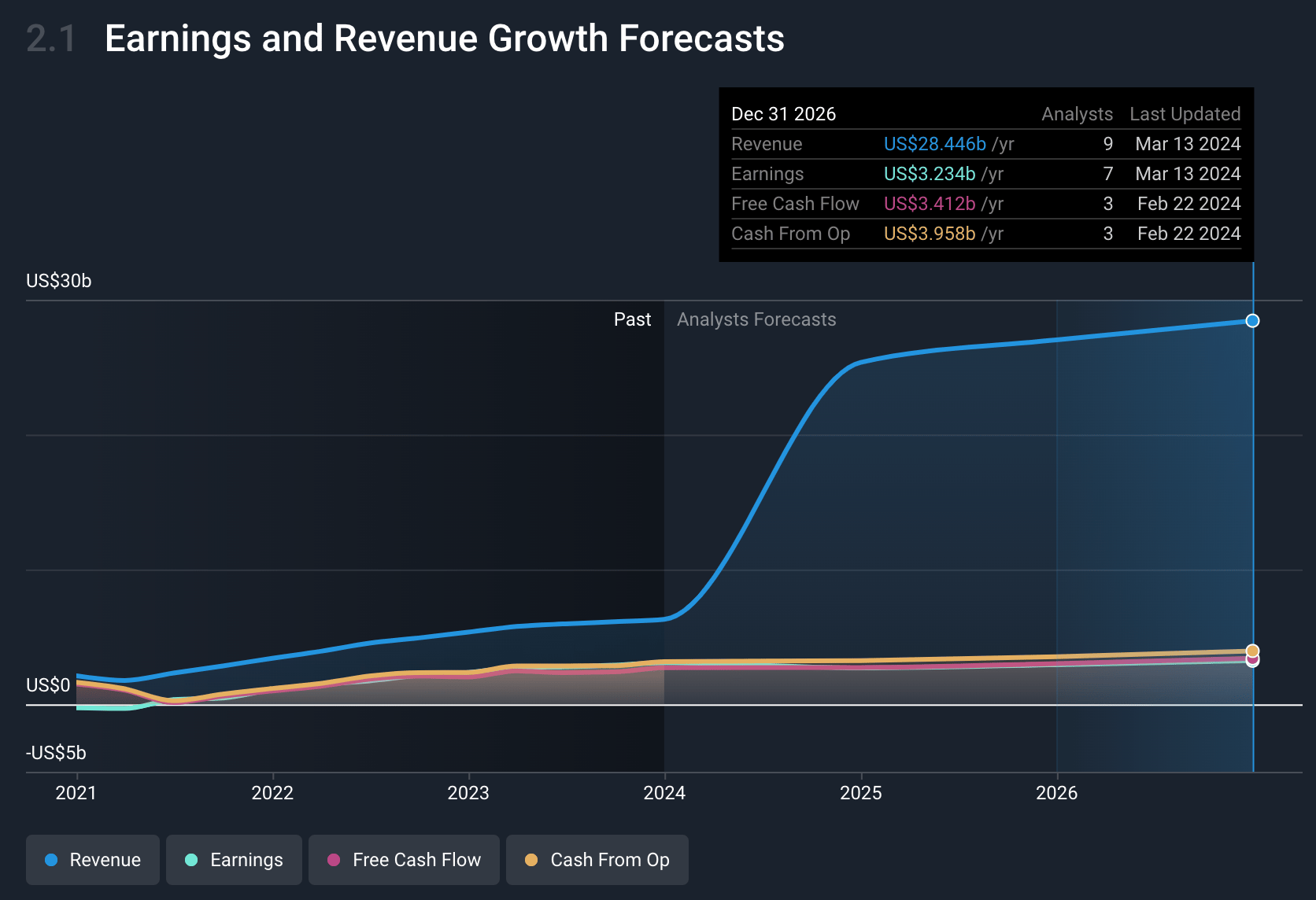

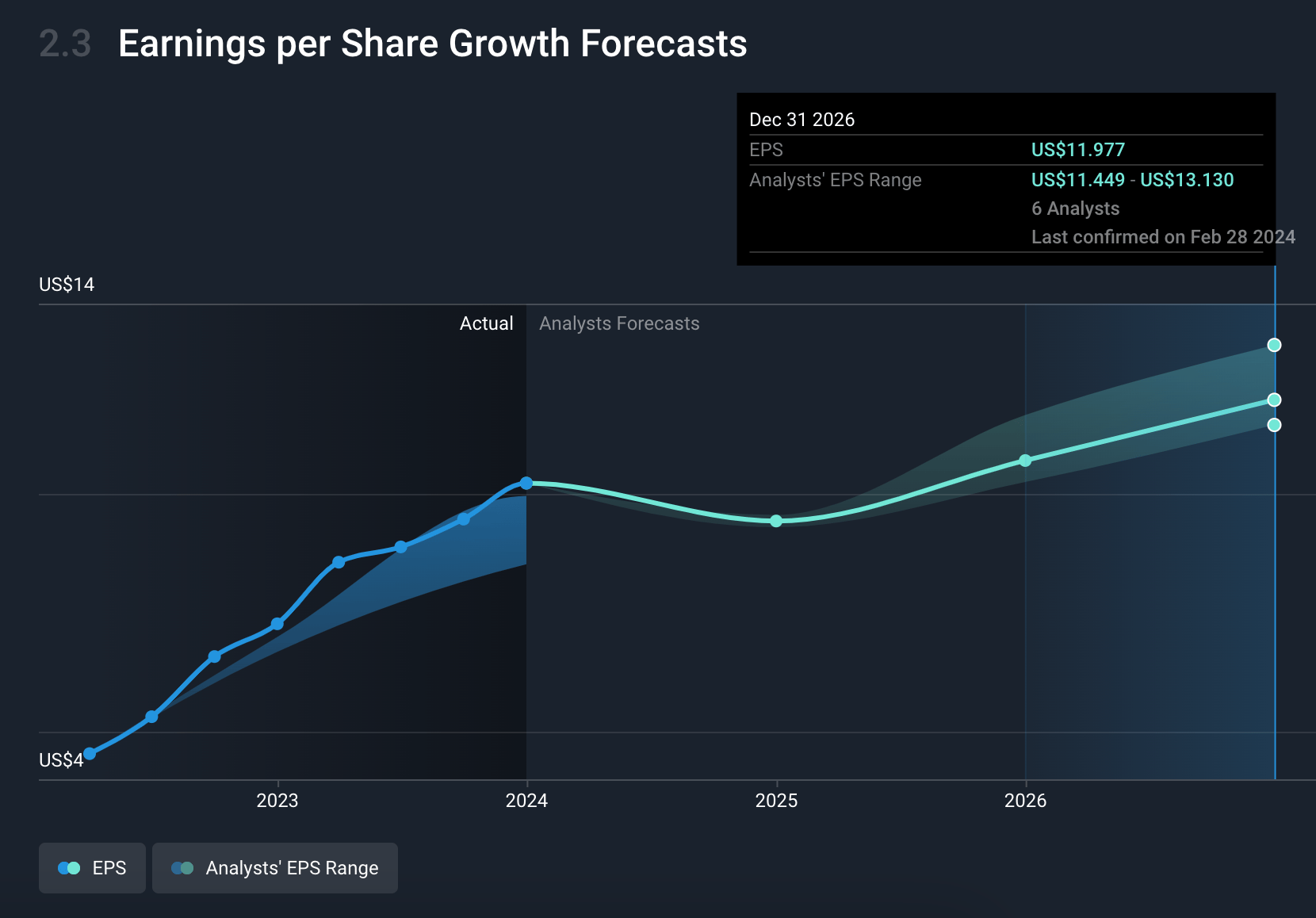

Figures in the charts may differ slightly from those mentioned in the narrative

Assumptions

How have these above catalysts been quantified?

- Analysts are assuming Marriott International's revenue will grow by 65.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 48.9% today to 11.4% in 3 years time.

- Analysts expect earnings to reach $3.2 billion (and earnings per share of $11.98) by about March 2027, up from $3.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.7x on those 2027 earnings, up from 23.3x today.

- To value all of this in today’s dollars, we will use a discount rate of 7.79%, as per the Simply Wall St company report.

Figures in the charts may differ slightly from those mentioned in the narrative

Risks

What could happen that would invalidate this narrative?

- The challenging financing environment in the U.S. and Europe might hinder the company's ability to expand and sign new development projects, potentially affecting net rooms growth and future earnings.

- Increased competition in the lodging and hospitality sectors could impact Marriott’s market share, affecting revenue growth.

- Leverage on digital channels and Marriott Bonvoy app significantly contributes to room nights and earnings, a technological failure or cybersecurity breach could negatively affect customer trust and company's earnings.

- Fluctuations in international markets, especially Asia Pacific, could result in unpredictable revenue streams due to factors like geopolitical tensions or pandemic outbreaks, impacting overall revenue and net margins.

- Potential increases in operational costs, including wage and benefit inflation, might not be fully offset by revenue growth, impacting net margins and profitability.

valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $244.61 for Marriott International based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $28.4 billion, earnings will come to $3.2 billion, and it would be trading on a PE ratio of 23.7x, assuming you use a discount rate of 7.8%.

- Given the current share price of $248.52, the analyst's price target of $244.61 is 1.6% lower. The relatively low difference between the current share price and the analyst target indicates that they believe the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.