Last Update 22 Jan 26

Fair value Increased 1.93%HLMA: Higher Fair Value Assumptions Will Likely Support Premium P/E Multiple

Halma's analyst price target has been lifted by £0.72 to £38.05, with analysts pointing to updated assumptions around fair value, revenue growth, profit margins and future P/E levels as key drivers behind the change.

Analyst Commentary

Bullish Takeaways

- Bullish analysts see the higher £38.05 target as better reflecting their updated fair value work, which now builds in revised assumptions around revenue, margins and the P/E they are prepared to apply.

- The uplift of £0.72 is being interpreted as a signal that, under these revised assumptions, Halma’s current share price leaves some room for upside to what analysts view as fair value.

- By raising their target in absolute terms, bullish analysts are effectively expressing more confidence in the company’s ability to support the earnings profile implied by their new valuation framework.

- Analysts pointing to more constructive fair value assumptions suggest that, for investors who agree with these inputs, Halma’s risk or reward skew screens as more attractive than it did before the revision.

Bearish Takeaways

- Bearish analysts caution that the higher target relies on specific assumptions for revenue trends, profit margins and future P/E levels, so any disappointment on execution could leave the shares exposed to a reset in those inputs.

- The new target, while higher, may also imply that a meaningful portion of the expected value is already reflected in the shares, which could limit upside if earnings or margins track only in line with existing expectations.

- Some cautious voices highlight that the fair value work is sensitive to the chosen P/E multiple, so if market appetite for paying up for Halma’s earnings profile moderates, the justified valuation could move lower.

- There is also a view that repeated reworking of valuation assumptions, without a clear change in fundamental information, can introduce more uncertainty around how robust the £38.05 target really is for long term holders.

Valuation Changes

- Fair Value: updated from £37.33 to £38.05, a small uplift in the central valuation anchor.

- Discount Rate: adjusted slightly from 8.85% to 8.86%, indicating only a minimal change in the required return used in the model.

- Revenue Growth: revised from 7.72% to 9.59%, pointing to a higher assumed top line expansion in the updated assumptions.

- Profit Margin: moved from 15.44% to 15.73%, reflecting a modestly higher expected level of profitability.

- Future P/E: reset from 39.01x to 37.07x, suggesting the new target builds in a somewhat lower valuation multiple on future earnings.

Key Takeaways

- Strong cash generation and balance sheet support significant R&D and acquisition investments, ensuring sustainable growth and increased future revenues and earnings.

- Focus on niche markets and talent investment boosts high margins and long-term growth potential, enhancing future profit margins and earnings.

- Geopolitical instability, currency impact, and reliance on M&A and niche markets may challenge Halma's revenue, profit margins, and financial flexibility.

Catalysts

About Halma- Together its subsidiaries, provides technology solutions in the safety, health, and environmental markets in the United States, Mainland Europe, the United Kingdom, the Asia Pacific, Africa, the Middle East, and internationally.

- Continued strong cash generation and a healthy balance sheet have enabled substantial investments in R&D and acquisitions, ensuring sustainable future growth, which is likely to drive up revenues and earnings.

- Acquisitions and a robust M&A pipeline spanning all sectors are contributing to EBIT growth and are expected to enhance future profit margins and earnings growth.

- Organic revenue growth supported by price increases and strong demand ensures maintained high gross margins and potentially improved earnings.

- Investment in talent and collaborative culture across a diverse portfolio positions Halma for consistent growth, enhancing long-term earnings potential.

- Focus on high-value niche markets with strong, long-term growth drivers supports high margins and returns on invested capital, suggesting an increase in future net margins and earnings.

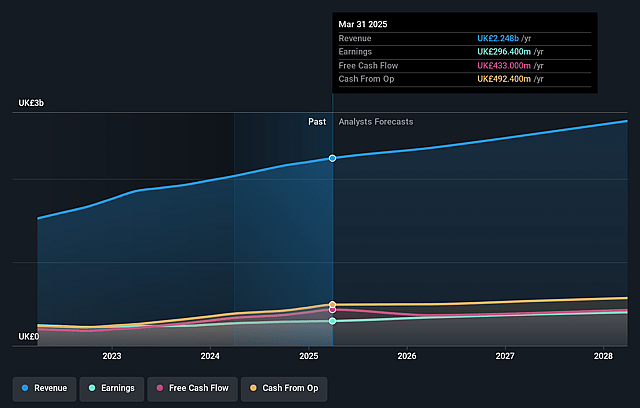

Halma Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Halma's revenue will grow by 6.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.2% today to 14.7% in 3 years time.

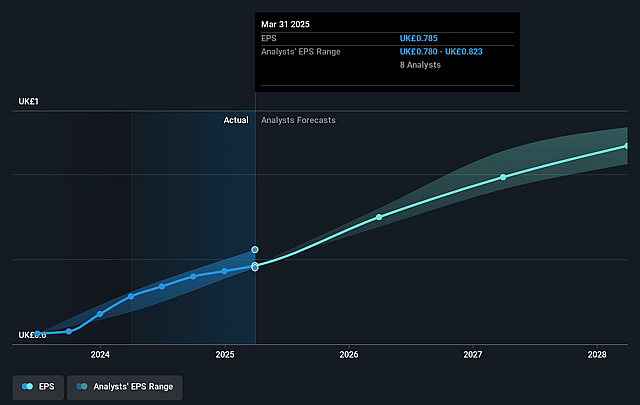

- Analysts expect earnings to reach £397.1 million (and earnings per share of £1.07) by about September 2028, up from £296.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 39.2x on those 2028 earnings, down from 41.1x today. This future PE is greater than the current PE for the GB Electronic industry at 29.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.45%, as per the Simply Wall St company report.

Halma Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing geopolitical and economic volatility, along with an adverse currency movement impacting revenue growth, presents a risk that could limit Halma's financial performance. This currency drag, specifically the strengthening of sterling, has been noted as a headwind (revenue impact).

- The decline in the Healthcare sector, notably in eye health therapeutics due to delays in OEM product launches and destocking, offsets growth in other areas and could strain profit margins if not rectified promptly (net margin and revenue impact).

- The strategy of continuous M&A could present risks, especially if integration challenges arise or if acquired companies underperform. Recently acquired businesses, despite contributing to growth, sometimes require additional investment, affecting short-term profitability (earnings impact).

- The reliance on high-margin niche markets and regulated industries means any shifts in regulatory policies or changes in market conditions could impact revenue streams and the overall margin performance, particularly if robustness in sustainability diminishes (net margins and revenue impact).

- While current cash generation and dividend growth are strong, any shift in interest rates or economic conditions affecting cash conversion rates could challenge Halma's financial flexibility and ability to sustain high reinvestment and acquisition activities (cash flow and earnings impact).

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £32.388 for Halma based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £37.4, and the most bearish reporting a price target of just £24.9.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £2.7 billion, earnings will come to £397.1 million, and it would be trading on a PE ratio of 39.2x, assuming you use a discount rate of 8.4%.

- Given the current share price of £32.28, the analyst price target of £32.39 is 0.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Halma?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.