Key Takeaways

- Innovation in environmental sensors and strategic acquisitions are driving expansion into new applications, supporting higher margins and recurring revenue streams.

- Strong market position in regulatory-driven HVAC sensors and targeted Asian growth ensure resilience and above-market revenue growth amid global sustainability trends.

- Heavy reliance on short-term industrial growth drivers and vulnerability to currency, policy, and regional demand shifts threaten future revenue stability and diversification.

Catalysts

About Sensirion Holding- Engages in the development, production, sale, and servicing of sensor systems, modules, and components in the Asia Pacific, Europe, the Middle East, Africa, and the Americas.

- Sensirion's ongoing commercialization of innovative CO₂ chip-level sensors is expected to unlock new applications and markets in environmental monitoring and building controls, positioning the company to benefit from increasing global emphasis on sustainability and decarbonization-this should drive revenue growth and support higher margins as adoption broadens.

- The market leadership in A2L refrigerant leakage sensors for HVAC systems directly addresses new U.S. and international regulations around climate-friendly, low-global-warming-potential refrigerants, setting up sustained demand as regulatory frameworks tighten-supporting stable to rising topline and margin resilience.

- Expansion into high-growth Asian markets and the ability to leverage Chinese stimulus efforts through diversified sales channels strengthens regional diversification and aligns with the broader proliferation of IoT and sensor-driven smart devices, which should underpin above-market revenue CAGR.

- Strategic acquisition of Kuva Systems and continued R&D investment point toward Sensirion's intent to move up the value chain with data-driven solutions and environmental sensing for industrial and energy applications, creating potential for higher-margin, recurring revenue streams.

- Ongoing operational leverage from productivity gains, capacity utilization improvements, and disciplined OpEx management are expected to enable incremental EBITDA and net margin expansion as sales volumes grow, amplifying earnings potential over the medium term.

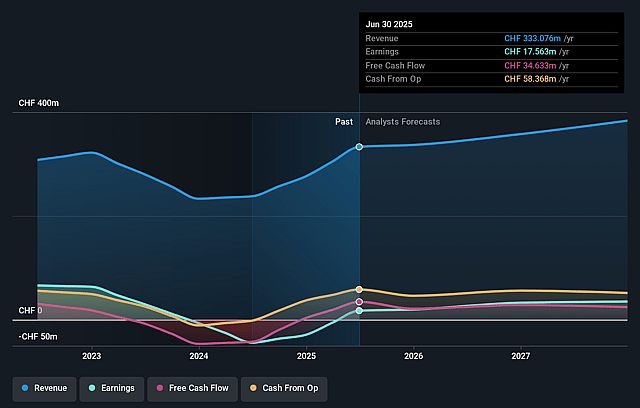

Sensirion Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sensirion Holding's revenue will grow by 6.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.3% today to 10.9% in 3 years time.

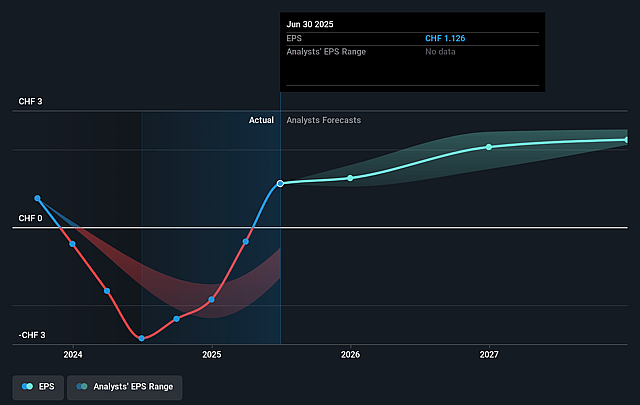

- Analysts expect earnings to reach CHF 44.2 million (and earnings per share of CHF 2.25) by about September 2028, up from CHF 17.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.2x on those 2028 earnings, down from 57.3x today. This future PE is greater than the current PE for the CH Electronic industry at 32.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.98%, as per the Simply Wall St company report.

Sensirion Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Significant exposure to currency fluctuations, particularly Swiss franc appreciation against other major currencies like the US dollar, has already led to a negative financial impact (CHF 10 million finance loss in H1 2025) and could further erode net income and future earnings.

- Persistent and unpredictable changes in US trade policy, including tariffs, create ongoing uncertainty in key markets, which may indirectly reduce global demand and directly disrupt supply chains-both posing medium

- to long-term risks to top-line revenue growth.

- The recent spike in industrial segment growth is heavily reliant on the one-off ramp-up of A2L refrigerant leakage sensors, with management already warning of normalization and no further growth expected from this application; failure to identify similarly high-impact growth drivers in the future could stall revenue and profit momentum.

- Weakness or stagnation in the automotive sector, Sensirion's second-largest segment (21% of sales), due to limited new project rollouts and exposure to struggling Western markets (rather than high-growth Asian markets), poses structural risk to diversification and future revenue streams.

- Partial phase-out of stimulus programs in China is likely to dampen demand in consumer and appliance sensor markets, threatening sustained growth in APAC and putting pressure on consolidated revenue as regulator-driven and stimulus-driven demand wanes.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CHF87.0 for Sensirion Holding based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CHF403.7 million, earnings will come to CHF44.2 million, and it would be trading on a PE ratio of 34.2x, assuming you use a discount rate of 5.0%.

- Given the current share price of CHF64.6, the analyst price target of CHF87.0 is 25.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.