Last Update 09 Nov 25

Fair value Decreased 0.27%DUK: Upgraded Balance Sheet and Southeast Demand Will Support Stable Returns Ahead

Duke Energy's analyst price target was modestly reduced to $137.24 from $137.60, as analysts point to ongoing improvements in revenue growth and profit margins. This was partially offset by a higher discount rate and recalibrated future valuation multiples.

Analyst Commentary

Recent analyst updates for Duke Energy reflect a mix of optimism and caution surrounding the company's growth trajectory, execution, and current valuation levels. These perspectives offer insight into both the opportunities and risks facing the utility giant.

Bullish Takeaways- Bullish analysts highlight Duke Energy's improved balance sheet and strengthened regulatory frameworks, which are viewed as supportive of long-term growth and more predictable returns for investors.

- Several recent coverage initiations and price target increases point to confidence in Duke's ability to capitalize on the Southeast's robust demand for electricity, especially given the region's rapid data center and population growth.

- The company's significant capital expenditure plans benefit from constructive regulatory environments. These environments enable efficient cost recovery and reduce regulatory lag.

- Persistent upward revisions in price targets signal expectations that Duke Energy will continue to deliver steady earnings growth and meet its guidance targets for the coming years.

- Some bearish analysts express concern that Duke Energy's stock is trading at a premium to peers, indicating limited headroom for further valuation expansion without additional catalysts.

- There is cautious sentiment regarding the absence of immediate, significant catalysts that could drive near-term outperformance in the stock price.

- Despite recent portfolio improvements, a segment of analysts believes much of the company’s solid execution is already reflected in the current valuation, reducing the potential for material upside.

- Elevated discount rates and recalibrated valuation multiples remain ongoing headwinds. These factors could weigh on future price target adjustments if broader market conditions deteriorate.

What's in the News

- Duke Energy selected three properties in Southwest Ohio and Northern Kentucky for its 2025 Site Readiness Program. The initiative aims to boost economic development by preparing these sites for future business and industrial investment. Since 2010, the program has brought over $2 billion in capital investments and created 5,400 new jobs in Ohio and Kentucky, with companies such as Coca-Cola, Carvana, Shape Corp., and Niagara Bottling participating. (Key Developments)

- The company has submitted the final license application to the Federal Energy Regulatory Commission (FERC) for the Bad Creek Pumped Storage Hydroelectric Station in South Carolina. If approved, this would extend the plant's operations by 50 years and further solidify its role in Duke's generation portfolio. (Key Developments)

- Duke Energy recently completed upgrades at the Bad Creek pumped storage facility. The improvements added 320 megawatts of carbon-free energy, increasing total capacity to 1,680 megawatts. These enhancements support grid reliability and the company's clean energy goals. (Key Developments)

Valuation Changes

- Consensus Analyst Price Target: Slightly reduced from $137.60 to $137.24, reflecting updated valuation assumptions.

- Discount Rate: Increased from 6.78% to 6.96%. This indicates a modest rise in perceived risk or cost of capital.

- Revenue Growth: Edged up from 4.83% to 4.90%, suggesting a marginally more optimistic outlook for sales expansion.

- Net Profit Margin: Improved from 16.65% to 16.80%. This points to stronger forecast profitability.

- Future P/E: Decreased from 22.44x to 22.00x, implying a slightly lower valuation multiple for future earnings.

Key Takeaways

- Strong regional economic activity and supportive legislation are expected to drive sustained growth in revenues, earnings stability, and operational efficiency.

- Investment in grid modernization, renewables, and nuclear enhances financial flexibility and positions Duke favorably for the ongoing energy transition.

- Accelerating distributed energy adoption, regulatory risks, capital needs, and fossil fuel reliance threaten Duke Energy's revenue growth, margins, and financial flexibility amid the energy transition.

Catalysts

About Duke Energy- Through its subsidiaries, operates as an energy company in the United States.

- Major economic development wins (e.g., AWS's $10B data center in North Carolina), paired with accelerated migration and manufacturing demand in Duke's service territory, are expected to drive robust, multi-year load and volume growth, supporting higher revenues and long-term EPS growth.

- Supportive state and federal legislation-such as the Power Bill Reduction Act in NC and the Energy Security Act in SC-streamlines cost recovery for new generation and grid investments, reducing regulatory lag and improving cash flow and earnings stability over the next decade.

- Significant infrastructure and grid modernization investment (e.g., over $4 billion incremental CapEx in Florida) is positioned to capitalize on growing needs for digitalization and grid resilience, enabling Duke to enhance operational efficiency and reliability, which benefits both net margins and future rate base growth.

- Proceeds from recent asset sales and the minority stake sale (e.g., Brookfield in Florida) are being used to strengthen the balance sheet and de-risk future equity needs, improving the company's financial flexibility and lowering funding costs, which in turn should protect or expand net margins and earnings.

- Duke's large-scale commitment to nuclear and renewables (operating the nation's largest regulated nuclear fleet, plus long-term renewables investment pipeline) aligns with the ongoing clean energy transition, securing regulatory support and capturing production tax credits-directly boosting earnings and reducing exposure to commodity price volatility.

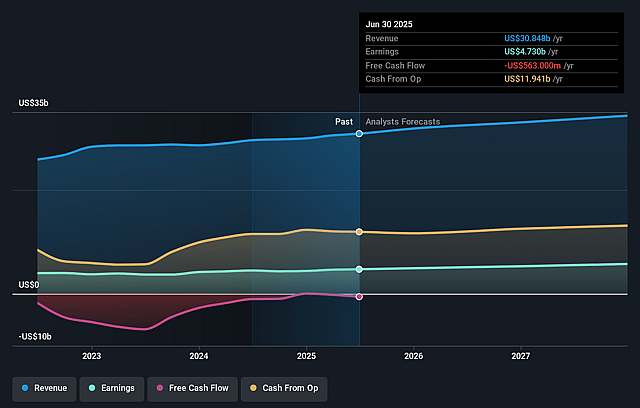

Duke Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Duke Energy's revenue will grow by 4.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.3% today to 17.2% in 3 years time.

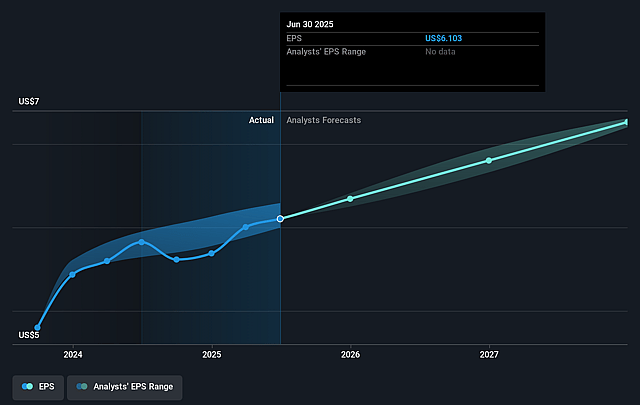

- Analysts expect earnings to reach $6.1 billion (and earnings per share of $7.65) by about September 2028, up from $4.7 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.0x on those 2028 earnings, up from 19.8x today. This future PE is greater than the current PE for the US Electric Utilities industry at 19.9x.

- Analysts expect the number of shares outstanding to grow by 0.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Duke Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating distributed energy adoption, such as solar and batteries by customers and businesses, could reduce long-term demand for Duke Energy's centralized grid services and utility-provided electricity, leading to potential stagnation or decline in sales and ultimately pressuring long-term revenue growth.

- Heavy reliance on natural gas and legacy coal infrastructure complicates Duke's transition to renewables, which could result in higher capital expenditures, increased compliance costs, and exposure to stranded asset risk as decarbonization policies accelerate-negatively impacting net margins and future earnings.

- Significant increases in capital needs for grid modernization, generation investments, and new project developments-especially to serve large customers like data centers-raise Duke Energy's dependence on external financing, amplifying vulnerability to persistent inflation and higher interest rates that can compress returns and elevate interest expense, thereby reducing net income.

- While recent legislative and regulatory outcomes have been supportive, any future unfavourable regulatory changes (such as potential shifts to performance-based ratemaking or customer rate resistance) could introduce earnings variability, limit guaranteed returns, or constrain rate base growth, all of which may adversely affect regulated revenue and EPS trajectory.

- Elevated balance sheet leverage and large deferred equity issuance plans heighten refinancing and credit downgrade risks, particularly if capital markets tighten or operational execution falters, which could increase borrowing costs, reduce financial flexibility, and ultimately negatively impact net income and shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $132.0 for Duke Energy based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $35.4 billion, earnings will come to $6.1 billion, and it would be trading on a PE ratio of 21.0x, assuming you use a discount rate of 6.8%.

- Given the current share price of $120.38, the analyst price target of $132.0 is 8.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.