Investors Don't See Light At End Of Kingsoft Cloud Holdings Limited's (NASDAQ:KC) Tunnel

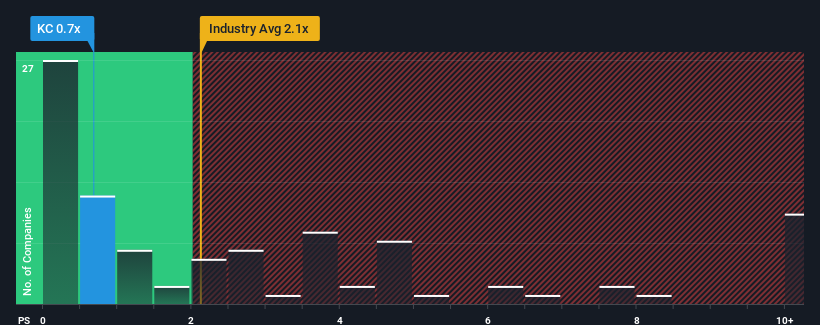

When close to half the companies operating in the IT industry in the United States have price-to-sales ratios (or "P/S") above 2.1x, you may consider Kingsoft Cloud Holdings Limited (NASDAQ:KC) as an attractive investment with its 0.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Kingsoft Cloud Holdings

How Has Kingsoft Cloud Holdings Performed Recently?

Kingsoft Cloud Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Kingsoft Cloud Holdings.How Is Kingsoft Cloud Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Kingsoft Cloud Holdings would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 14%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 28% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 4.6% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 13% per annum, which is noticeably more attractive.

With this information, we can see why Kingsoft Cloud Holdings is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of Kingsoft Cloud Holdings' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

It is also worth noting that we have found 1 warning sign for Kingsoft Cloud Holdings that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

가치 평가는 복잡하지만, 저희는 이를 단순화하고자 합니다.

공정가치 추정치, 잠재적 위험, 배당금, 내부자 거래 및 재무 상태를 포함한 자세한 분석을 통해 Kingsoft Cloud Holdings 의 저평가 또는 고평가 여부를 알아보세요.

무료 분석에 액세스Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

This article has been translated from its original English version, which you can find here.