Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Steel Connect, Inc. (NASDAQ:STCN) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Steel Connect

What Is Steel Connect's Debt?

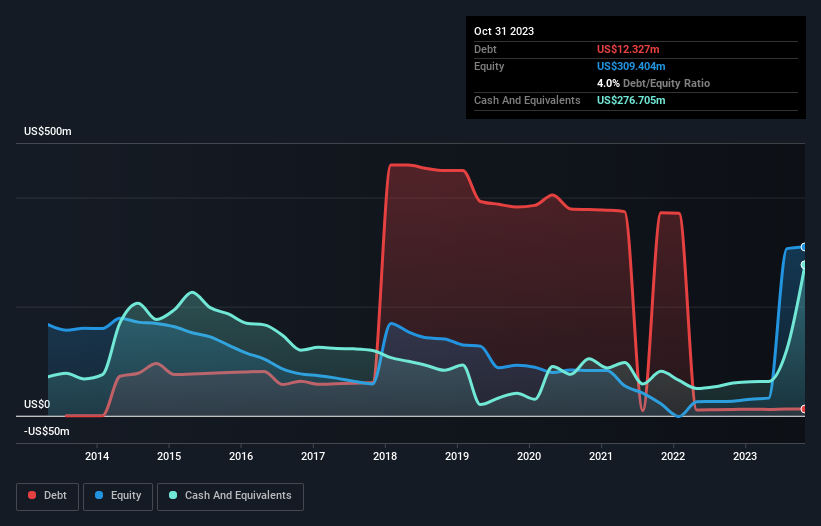

You can click the graphic below for the historical numbers, but it shows that as of October 2023 Steel Connect had US$12.3m of debt, an increase on US$11.6m, over one year. However, its balance sheet shows it holds US$276.7m in cash, so it actually has US$264.4m net cash.

A Look At Steel Connect's Liabilities

The latest balance sheet data shows that Steel Connect had liabilities of US$77.9m due within a year, and liabilities of US$23.3m falling due after that. Offsetting these obligations, it had cash of US$276.7m as well as receivables valued at US$28.4m due within 12 months. So it actually has US$204.0m more liquid assets than total liabilities.

This luscious liquidity implies that Steel Connect's balance sheet is sturdy like a giant sequoia tree. Having regard to this fact, we think its balance sheet is as strong as an ox. Simply put, the fact that Steel Connect has more cash than debt is arguably a good indication that it can manage its debt safely.

The good news is that Steel Connect has increased its EBIT by 6.5% over twelve months, which should ease any concerns about debt repayment. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Steel Connect's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. Steel Connect may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last two years, Steel Connect actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing Up

While we empathize with investors who find debt concerning, the bottom line is that Steel Connect has net cash of US$264.4m and plenty of liquid assets. The cherry on top was that in converted 170% of that EBIT to free cash flow, bringing in US$14m. When it comes to Steel Connect's debt, we sufficiently relaxed that our mind turns to the jacuzzi. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that Steel Connect is showing 2 warning signs in our investment analysis , you should know about...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

가치 평가는 복잡하지만, 저희는 이를 단순화하고자 합니다.

공정가치 추정치, 잠재적 위험, 배당금, 내부자 거래 및 재무 상태를 포함한 자세한 분석을 통해 Steel Connect 의 저평가 또는 고평가 여부를 알아보세요.

무료 분석에 액세스Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

This article has been translated from its original English version, which you can find here.