Key Takeaways

- Capital investments in distribution and e-commerce could enhance operational efficiency and inventory management, driving revenue growth through faster order fulfillment and better sales.

- Focus on credit management, customer acquisition, and sustainability may improve trade receivables, customer engagement, and attract investors, boosting long-term earnings and stock performance.

- Economic pressures, supply chain issues, and rising competition may challenge Truworths' revenue growth, profitability, and market share retention.

Catalysts

About Truworths International- An investment holding and management company, engages in the retail of fashion apparel and accessories.

- Capital investments in a new distribution center and expanded e-commerce platform could significantly enhance operational efficiencies and sales, potentially driving revenue growth as the infrastructure supports better inventory management and faster order fulfillment.

- The integration of design centers and local manufacturing capabilities is likely to reduce lead times and improve responsiveness to fashion trends, which could enhance product offerings and boost sales and net margins by aligning closely with consumer demand.

- Truworths' modernization of stores and the rollout of new retail concepts, along with the expansion of its Office London brand, may drive higher in-store foot traffic and revenue, supporting an increase in future sales and profitability.

- The strategic focus on enhancing credit management systems and new customer acquisition could result in healthier trade receivables and improved customer engagement, potentially boosting future earnings as new scoring systems allow more targeted rehabilitation of delinquent accounts.

- Continued emphasis on sustainability and ESG performance, alongside high return metrics on investments, may attract socially conscious investors, potentially improving the company's cost of equity and supporting stock performance and earnings growth in the long term.

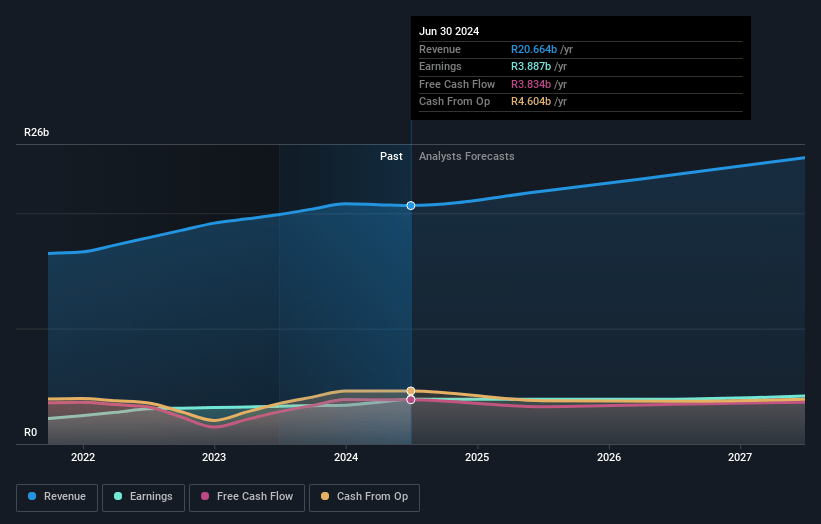

Truworths International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Truworths International's revenue will grow by 6.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 18.8% today to 16.7% in 3 years time.

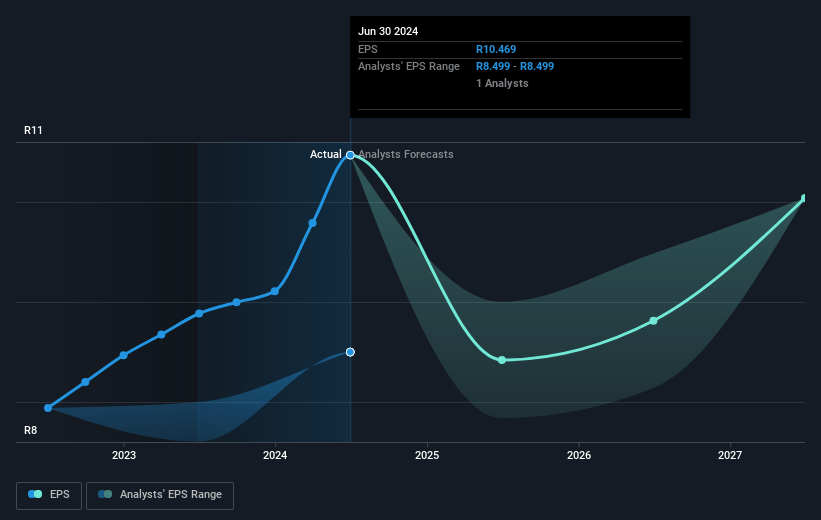

- Analysts expect earnings to reach ZAR 4.2 billion (and earnings per share of ZAR 9.59) by about February 2028, up from ZAR 3.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.1x on those 2028 earnings, up from 7.7x today. This future PE is greater than the current PE for the ZA Specialty Retail industry at 10.0x.

- Analysts expect the number of shares outstanding to grow by 0.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 18.29%, as per the Simply Wall St company report.

Truworths International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued pressure on disposable income and lower consumer confidence in South Africa and the U.K. could negatively affect sales growth and overall revenue performance.

- Global supply chain disruptions and port congestion have historically led to merchandise delays, impacting sales and potentially pressuring margins through increased promotional activities to clear stock.

- A decline in return on equity and return on capital due to factors like impairment reversals and share buyback programs indicates challenges in maintaining profitability levels.

- High-interest rates and credit environment pressures could continue to affect credit sales and trade receivables, which are critical to Truworths' revenue, given its significant reliance on in-store credit.

- Increasing competition from fast-fashion online stores like Shein and Temu could pressure both offline and online sales, impacting market share and revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ZAR108.186 for Truworths International based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ZAR24.9 billion, earnings will come to ZAR4.2 billion, and it would be trading on a PE ratio of 16.1x, assuming you use a discount rate of 18.3%.

- Given the current share price of ZAR80.35, the analyst price target of ZAR108.19 is 25.7% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives