Narratives are currently in beta

Key Takeaways

- Streamlining management and rationalizing SKUs are expected to enhance revenue growth and improve net margins.

- Investments in technology and manufacturing aim to optimize costs and capture market share in Southern Africa.

- Heavy reliance on South Africa and cost-cutting strategies may hinder revenue growth, with risks in operational challenges, cash flow management, and competition affecting profitability.

Catalysts

About Tiger Brands- Engages in the manufacture and sale of fast-moving consumer goods in South Africa and internationally.

- Tiger Brands is focusing on evolving its operating model by streamlining management, which is expected to increase efficiencies and potentially improve net margins.

- Strategic sales of non-core brands and SKU rationalization efforts may lead to a more streamlined and profitable portfolio, enhancing revenue growth and optimizing earnings.

- The company is increasing investments in technology, such as SAP for better supply chain management and AI capabilities for improved demand forecasting, aiming to optimize stock levels and reduce costs, supporting net margin improvements.

- Tiger Brands is intensifying its focus in Southern Africa, particularly in high-growth segments like e-commerce and general trade markets, to drive revenue growth and capture market share.

- Investments in competitive manufacturing and the development of super bakeries are expected to substantially lower conversion costs, potentially improving net margins and earnings over time.

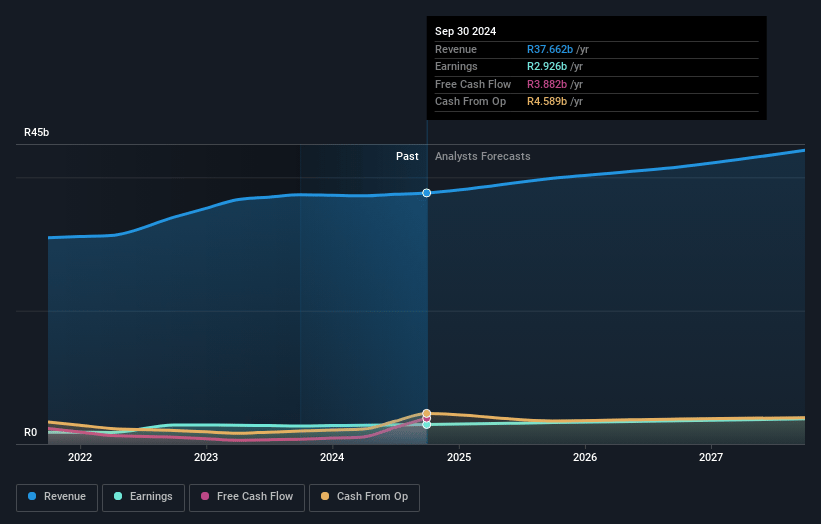

Tiger Brands Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tiger Brands's revenue will grow by 5.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.8% today to 8.6% in 3 years time.

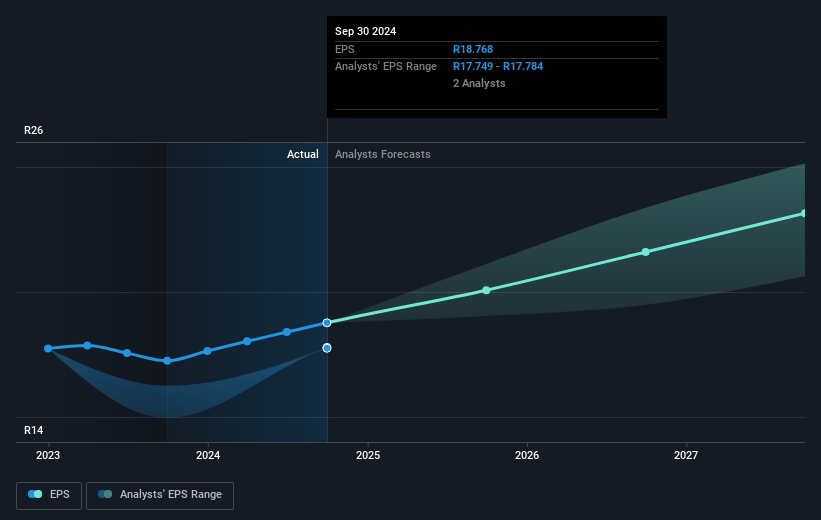

- Analysts expect earnings to reach ZAR 3.8 billion (and earnings per share of ZAR 24.41) by about January 2028, up from ZAR 2.9 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.7x on those 2028 earnings, up from 14.8x today. This future PE is lower than the current PE for the ZA Food industry at 20.0x.

- Analysts expect the number of shares outstanding to decline by 0.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.94%, as per the Simply Wall St company report.

Tiger Brands Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The reliance on South Africa for 81% of its revenue, in an environment with significant economic challenges such as food inflation and unemployment, could impact future revenues and growth potential.

- With ongoing issues in the general trade due to food safety concerns and operational challenges, there could be a delay in sales mix improvements, which would affect revenue growth in that segment.

- The strategy to focus on cost leadership and execution, while necessary, indicates potential risks in maintaining product quality. This could impact net margins if cost-cutting negatively affects the brand value.

- Having major CapEx commitments, including the launch of Super Bakeries, while discussing the need for potential share buybacks and dividends, highlights the risk of overextension which could affect cash flow and net earnings.

- The risk associated with private label competition that offers similar products at a lower price can pressure Tiger Brands to cut margins to maintain volumes, which could adversely affect profitability and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ZAR310.33 for Tiger Brands based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ZAR 44.1 billion, earnings will come to ZAR 3.8 billion, and it would be trading on a PE ratio of 19.7x, assuming you use a discount rate of 15.9%.

- Given the current share price of ZAR278.0, the analyst's price target of ZAR310.33 is 10.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives