Narratives are currently in beta

Key Takeaways

- Optimization of supply chains and strategic realignment aim to reduce costs and increase net margins and earnings.

- Focus on e-commerce and private label growth is expected to boost market penetration and drive revenue growth.

- Over-reliance on South Africa and challenges in adjusting sales and supply chains pose risks to revenue growth and market stability.

Catalysts

About Tiger Brands- Engages in the manufacture and sale of fast-moving consumer goods in South Africa and internationally.

- Tiger Brands is focusing on improving its operational model by optimizing supply chains, centralizing procurement, and realigning head office and business unit structures. This is expected to drive down costs and potentially increase net margins and earnings.

- The company has successfully sold off non-core brands and is optimizing its product portfolio, which indicates an alignment of capital and resources towards higher-margin and growth areas, potentially impacting future earnings positively.

- Tiger Brands is emphasizing growth in e-commerce, which has already seen a 54% increase. This shift towards digital sales channels is likely to positively impact revenue and increase market penetration.

- The introduction of new technologies, such as advanced SAP systems and logistics control towers for better supply chain management, is expected to improve efficiency and reduce costs, positively affecting net margins.

- Strategic adjustments like focusing on Southern Africa and increasing competitiveness in the private label and affordable segments are anticipated to drive revenue growth and volume recovery in core markets.

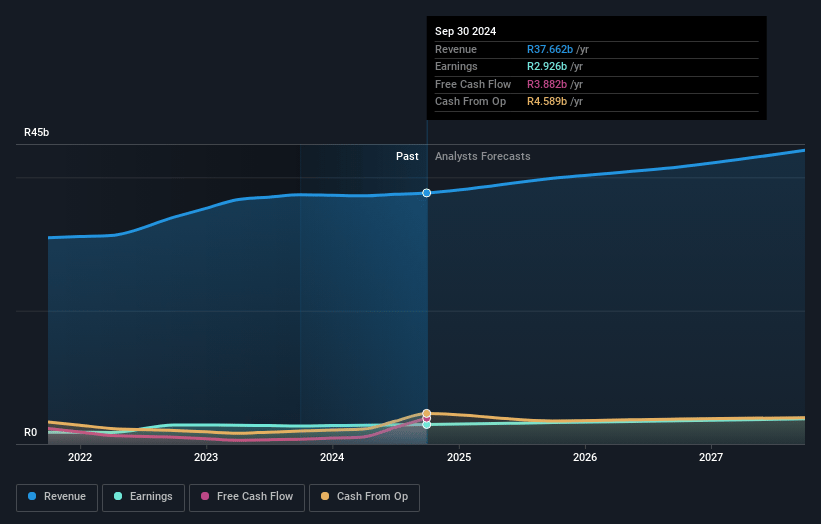

Tiger Brands Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tiger Brands's revenue will grow by 5.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.8% today to 8.6% in 3 years time.

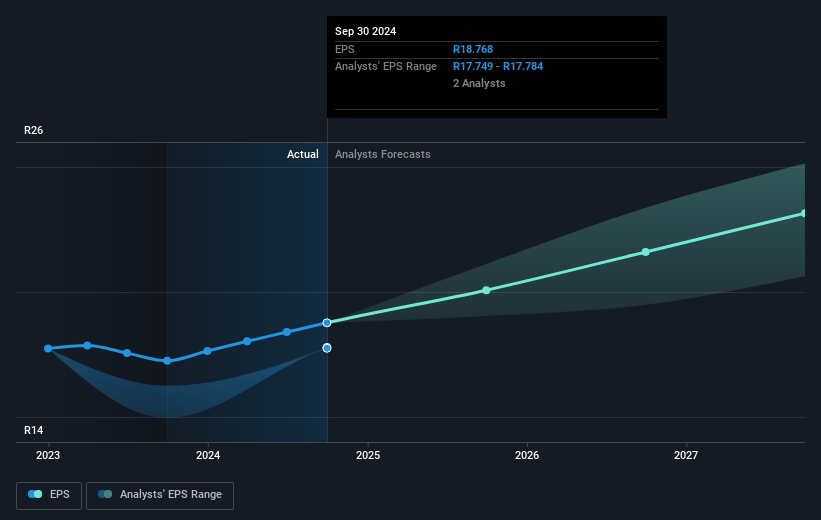

- Analysts expect earnings to reach ZAR 3.8 billion (and earnings per share of ZAR 24.41) by about January 2028, up from ZAR 2.9 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.7x on those 2028 earnings, up from 14.8x today. This future PE is lower than the current PE for the ZA Food industry at 20.0x.

- Analysts expect the number of shares outstanding to decline by 0.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.94%, as per the Simply Wall St company report.

Tiger Brands Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Tiger Brands faces challenges in adjusting its sales mix in the general trade, which could impact its ability to boost revenue and market presence in that segment.

- The need to invest significantly in new baking technologies and super bakeries may strain cash flows and capital expenditure, affecting net margins if efficiencies are not realized quickly.

- Intense competition from private label brands poses risks to Tiger Brands' pricing power and brand loyalty, potentially impacting revenues if not managed effectively.

- The reliance on the South African market, which constitutes 81% of the business, exposes the company to economic and consumer confidence fluctuations in South Africa, affecting sales volumes and earnings stability.

- Vulnerabilities in agricultural sourcing and supply chain inefficiencies could lead to cost pressures or supply disruptions, potentially impacting earnings and profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ZAR310.33 for Tiger Brands based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ZAR 44.1 billion, earnings will come to ZAR 3.8 billion, and it would be trading on a PE ratio of 19.7x, assuming you use a discount rate of 15.9%.

- Given the current share price of ZAR278.0, the analyst's price target of ZAR310.33 is 10.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives