Key Takeaways

- Lower feed costs, rising poultry demand, and expanded production position Astral for margin recovery, increased sales volumes, and earnings growth.

- Operational efficiencies, technological upgrades, and sector consolidation support improved productivity, cost competitiveness, and enhanced price realization.

- Persistent cost pressures, operational risks, and macroeconomic challenges threaten profitability and earnings growth amid limited pricing power and heightened exposure to external shocks.

Catalysts

About Astral Foods- Operates as an integrated poultry producer in South Africa and internationally.

- The recovery of South African maize and soy crops, with expectations for improved local harvests and stable global soy prices, should reduce feed input costs going forward, directly supporting a rebound in poultry division margins and group operating profit.

- Persistent growth in local poultry demand, supported by population growth and urbanization trends, positions Astral to benefit from increased sales volumes as consumer preferences tilt toward affordable protein – which boosts topline revenue potential.

- Capacity increases, such as ramping up weekly broiler slaughter to nearly 6 million birds and planned capex on refrigeration, allow Astral to capture additional market share amid competitor difficulties and potential import restrictions, driving volume expansion and operating leverage to lift earnings.

- Sector consolidation, ongoing retail engagement to recover selling prices, and stabilized inventory positions give Astral a platform for improved price realization in the second half, with higher prices translating to net margin recovery.

- Continued focus on operational efficiencies, improved feed conversion, and investment in technology across farming and processing will enhance productivity, sustain cost competitiveness, and support longer-term margin improvement.

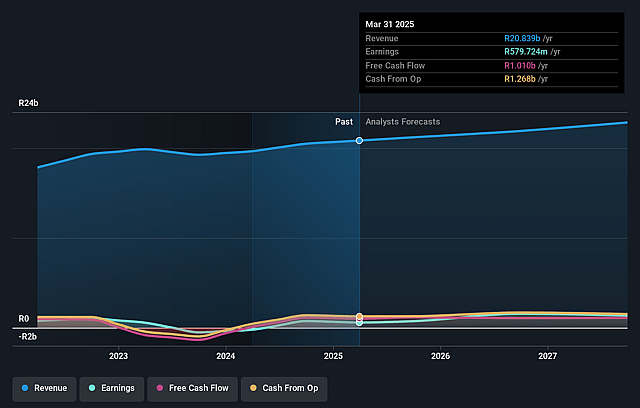

Astral Foods Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Astral Foods's revenue will grow by 3.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.8% today to 8.5% in 3 years time.

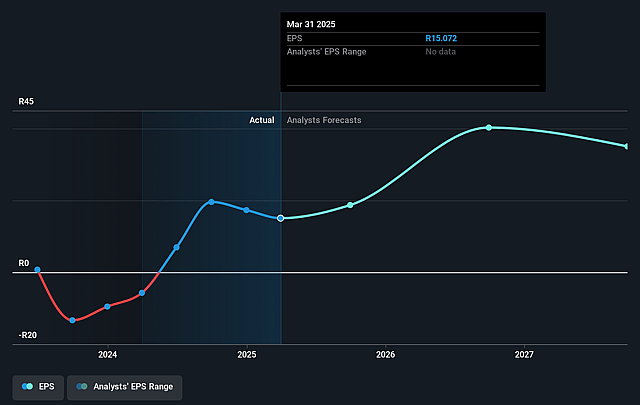

- Analysts expect earnings to reach ZAR 2.0 billion (and earnings per share of ZAR 35.04) by about August 2028, up from ZAR 579.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.2x on those 2028 earnings, down from 12.9x today. This future PE is lower than the current PE for the ZA Food industry at 10.0x.

- Analysts expect the number of shares outstanding to grow by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.74%, as per the Simply Wall St company report.

Astral Foods Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent margin pressure in the Poultry Division due to inability to fully pass through rising feed and input costs (primarily from volatile maize prices) to customers, which threatens ongoing profitability and net margins over time.

- Chronic embedded costs from unreliable utilities (power and water supply disruptions requiring expensive diesel and alternative water sources) increase Astral's operational expenses and undermine long-term operating margins.

- Continued exposure to significant biological risks-such as avian influenza-with delays in vaccination rollout, absence of government compensation, and lack of insurance, all of which increase the likelihood of production shutdowns and culling, directly impacting both revenue and earnings.

- Weak South African macroeconomic environment, characterized by high unemployment, depressed consumer spending, and uncertain political conditions, limits demand growth and keeps poultry selling prices under deflationary pressure, putting Astral's revenue and earnings growth at risk.

- Currency volatility and ongoing global trade uncertainties (potential loss of AGOA preferential access, regional trade frictions) drive further input cost unpredictability and raise risks to revenue and net margins through both higher costs and limited access to export or import-managed markets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ZAR233.0 for Astral Foods based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ZAR23.2 billion, earnings will come to ZAR2.0 billion, and it would be trading on a PE ratio of 7.2x, assuming you use a discount rate of 16.7%.

- Given the current share price of ZAR193.59, the analyst price target of ZAR233.0 is 16.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.