Last Update 24 Sep 25

Fair value Increased 1.25%The consensus price target for JSE saw a slight upward revision as analysts raised their revenue growth forecasts, while profit margin expectations remained stable, resulting in a new fair value of ZAR154.50.

Valuation Changes

Summary of Valuation Changes for JSE

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from ZAR152.60 to ZAR154.50.

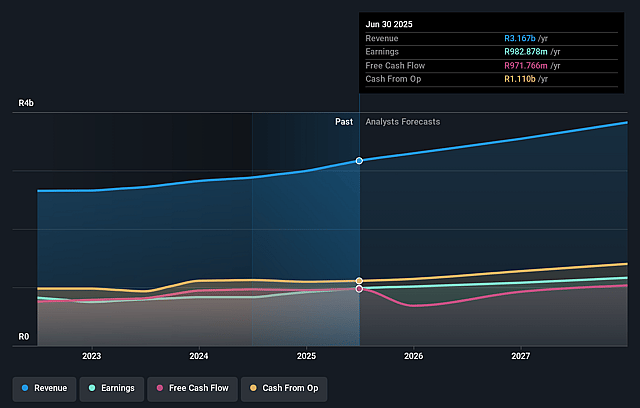

- The Consensus Revenue Growth forecasts for JSE has risen from 7.4% per annum to 8.1% per annum.

- The Net Profit Margin for JSE remained effectively unchanged, moving only marginally from 29.01% to 28.44%.

Key Takeaways

- Expansion of digital infrastructure and innovative product offerings are expected to boost operational efficiency, market participation, and earnings growth.

- Increased focus on sustainable investing and diversification into high-margin recurring revenues position JSE for stronger long-term performance.

- Weak economic fundamentals, rising competition, technology investment risks, and uncertain nontrading income growth threaten JSE's revenue stability, earnings potential, and margin resilience.

Catalysts

About JSE- Operates as a multi-asset class stock exchange in South Africa.

- Continued expansion and modernization of JSE's digital infrastructure-including the large-scale migration of post-trade systems to cloud-native, scalable platforms, rollout of new data products, and ongoing automation-are expected to drive long-term cost efficiencies, operational resilience, and higher net margins.

- JSE's growing focus on product innovation (launching new ETFs, derivatives, sustainability-linked instruments, and advanced analytics tools) supports increased market participation and trading activity, which should translate into higher transaction-based revenues and earnings growth.

- Increased wealth, financial inclusion, and a rising retail investor base across Africa is leading to sustained growth in trading volumes and demand for investment products, providing a strong outlook for higher core revenues.

- The global shift toward sustainable investing is likely to direct more capital to South African listed vehicles, boosting liquidity, demand for ESG-linked products and indices, and associated recurring fee income.

- Diversification into high-margin, recurring revenue streams (e.g., market data, post-trade, and information services), combined with the JSE's regional positioning as a leading African exchange, creates the potential for sustained earnings growth and future net margin expansion.

JSE Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming JSE's revenue will grow by 7.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 31.0% today to 29.0% in 3 years time.

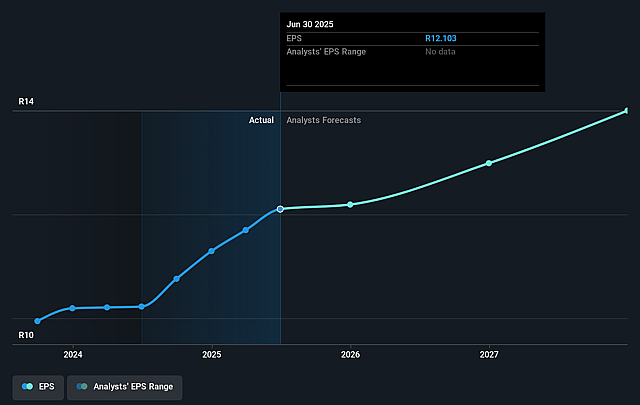

- Analysts expect earnings to reach ZAR 1.1 billion (and earnings per share of ZAR 13.42) by about September 2028, up from ZAR 982.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.1x on those 2028 earnings, up from 10.4x today. This future PE is greater than the current PE for the ZA Capital Markets industry at 7.4x.

- Analysts expect the number of shares outstanding to decline by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.06%, as per the Simply Wall St company report.

JSE Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent structural challenges in South Africa's economy, such as high unemployment, low GDP growth, and slow infrastructure investment, have yet to show meaningful translation to sustainable economic expansion, which over time could limit new listings, constrain trading activity, and negatively impact both JSE's revenue growth and long-term earnings.

- The recent surge in trading volumes, market volatility, and JSE share outperformance was partly driven by short-term external factors (e.g. global geopolitical tensions, currency volatility, event-driven portfolio rebalancing), which may not be sustainable, suggesting future trading activity and fee revenues could normalize or decline, impacting earnings growth.

- Competition risk is increasing, as highlighted by the emergence of rivals like A2X and alternative investment platforms, as well as the global shift toward private markets and alternative asset classes, potentially diverting liquidity and fee income away from the JSE and putting pressure on both revenue base and margins.

- Ongoing technology modernization and digital transformation projects, including migration of the core BDA system and investments in cloud infrastructure, require significant and rising personnel and technology spending; if project complexity, budget overruns, or delayed execution occur, these investments may outpace revenue growth and compress net margins.

- JSE's growing focus on diversifying income streams (e.g. information services, data products, post-trade services) delivers resilience but is not immune to cyclical or currency risks (e.g. dollar weakness, softer demand, once-off gains not repeating), and subdued or volatile nontrading income growth could undermine the stability and predictability of future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ZAR152.595 for JSE based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ZAR3.9 billion, earnings will come to ZAR1.1 billion, and it would be trading on a PE ratio of 18.1x, assuming you use a discount rate of 19.1%.

- Given the current share price of ZAR125.35, the analyst price target of ZAR152.6 is 17.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.