Last Update 18 Oct 25

Fair value Increased 0.81%Lower Inflation And Political Stability Will Stimulate Credit Growth Opportunities

Narrative Update on FirstRand: Analyst Price Target Revision

Analysts have raised their fair value estimate for FirstRand from R93.14 to R93.89. This change reflects modest improvements in revenue growth assumptions and a slightly higher projected discount rate.

Valuation Changes

- The Fair Value Estimate has increased slightly from ZAR 93.14 to ZAR 93.89.

- The Discount Rate has risen marginally from 18.41% to 18.43%.

- The Revenue Growth projection has improved from 11.77% to 11.88%.

- The Net Profit Margin estimate has decreased slightly from 31.28% to 31.19%.

- The future P/E ratio has moved up modestly from 14.79x to 14.92x.

Key Takeaways

- Improved affordability and economic recovery could drive increased consumer and corporate credit demand, positively impacting revenue growth.

- Strategic focus on SME lending and non-interest revenue growth is set to boost earnings and diversify income sources.

- Geopolitical and economic challenges, including high inflation and competition, could impact FirstRand's revenue, margins, and increase operating expenses.

Catalysts

About FirstRand- Provides transactional, lending, investment, and insurance products and services in South Africa, rest of Africa, the United Kingdom, and internationally.

- The potential for improved affordability due to a rate-cutting cycle and lower inflation could lead to increased consumer credit demand and revenue growth, as consumer spending power is expected to rise.

- Early signs of economic recovery and increased business confidence in South Africa, attributed to political stability and reforms, may catalyze the expansion of corporate and commercial credit growth, impacting revenue positively.

- The strategic focus on increased lending to SMEs, supported by data and digital underwriting enhancements, is expected to capture growth opportunities arising from economic reforms, potentially boosting earnings and margins.

- The implementation of the ALM strategy, which optimizes shareholder returns across interest rate cycles through active management, suggests an anticipated stabilization of net interest margins (NIM) despite interest rate fluctuations.

- Growth in non-interest revenue (NIR), driven by FNB's expanding customer base, insurance business contributions, and RMB's fees from private equity and advisory services, is expected to enhance earnings and diversify income sources.

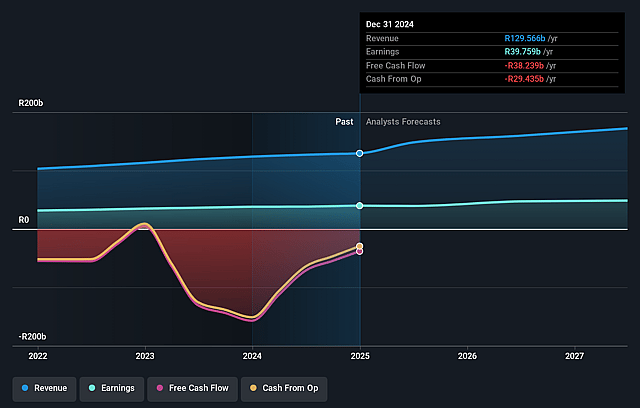

FirstRand Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming FirstRand's revenue will grow by 12.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 30.7% today to 28.7% in 3 years time.

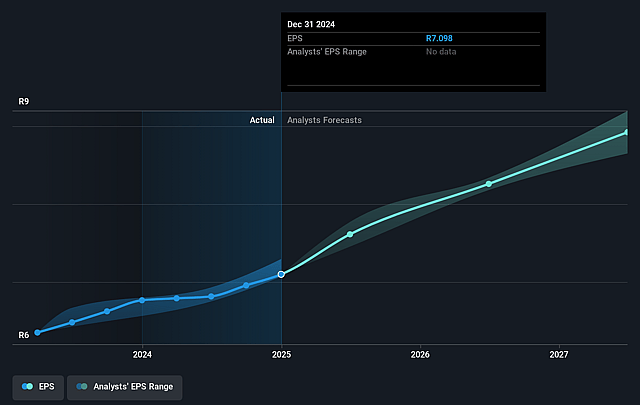

- Analysts expect earnings to reach ZAR 52.6 billion (and earnings per share of ZAR 8.92) by about September 2028, up from ZAR 39.8 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.7x on those 2028 earnings, up from 10.2x today. This future PE is greater than the current PE for the ZA Diversified Financial industry at 10.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 18.7%, as per the Simply Wall St company report.

FirstRand Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Geopolitical headwinds and uncertainty may impact FirstRand's revenue and profits as global growth slows, particularly in China and the euro area.

- High inflation and fiscal challenges in African countries like Nigeria, Zambia, and Ghana could result in subdued economic activity, impacting FirstRand's revenue growth prospects in those areas.

- Weak South African domestic demand and market competition might affect net interest income (NII) and margin pressures in certain lending sectors.

- Legal challenges in the U.K., specifically the potential negative outcomes from the supreme court appeal regarding motor commission matters, could necessitate further provisioning and impact earnings.

- Reinvestment requirements in technology to support business growth may increase operating expenses, impacting net margins if not managed effectively.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ZAR88.488 for FirstRand based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ZAR95.0, and the most bearish reporting a price target of just ZAR77.08.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ZAR183.1 billion, earnings will come to ZAR52.6 billion, and it would be trading on a PE ratio of 15.7x, assuming you use a discount rate of 18.7%.

- Given the current share price of ZAR72.51, the analyst price target of ZAR88.49 is 18.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.