Key Takeaways

- Recovery in tourism and ongoing property upgrades are driving higher occupancy, improved brand perception, and expanding revenue and margins.

- Strong balance sheet and operational efficiency enable flexibility for buybacks, expansion, and shareholder returns amid rising African demand.

- Geographic concentration, underperforming offshore assets, high maintenance costs, rising competition, and economic headwinds all threaten long-term revenue stability and profitability.

Catalysts

About Southern Sun- Owns, leases, and manages hotels in South Africa, Mozambique, the Seychelles, Tanzania, the United Arab Emirates, and Zambia.

- Southern Sun is benefitting from the continued recovery and growth in international and regional tourism, as seen in surging occupancy in key markets like Cape Town and upticks in conference/event demand; further route expansion, increased airline connectivity, and potential easing of local interest rates could accelerate this trend, driving sustained increases in occupancy and revenue.

- Strategic refurbishments and modernization of flagship properties are delivering strong returns, as upgrades enable higher rates and lift brand perception-continued investment in refreshing the portfolio (e.g., Sandton Towers, Paradise Sun, Newlands) is set to support future revenue growth and margin expansion.

- The company's strong focus on operational efficiency-evidenced by tight control over payroll and variable costs, as well as investments in IT systems and revenue management-positions it well to benefit from incremental demand while maintaining or improving net margins.

- The business is now largely ungeared, with minimal net debt post-COVID and significant liquidity headroom; this improved balance sheet flexibility enables potential share buybacks or select expansion, both likely catalysts for higher future earnings per share.

- Management's disciplined capital allocation and internal focus on high-return projects mean that as demand lifts-driven by rising disposable incomes, urbanization, and digitalization in Africa-Southern Sun is well-positioned to increase earnings and cash flows, while dividends and potential buybacks further improve shareholder returns.

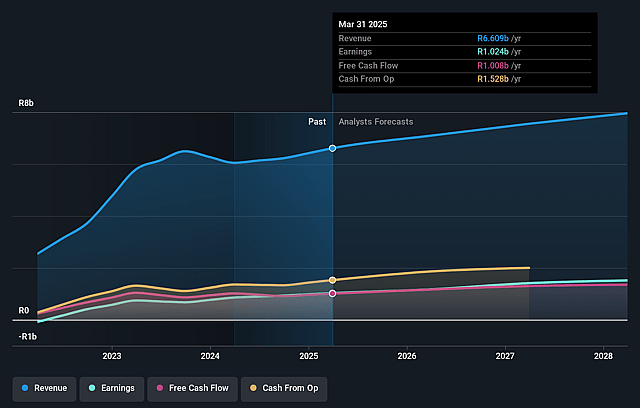

Southern Sun Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Southern Sun's revenue will grow by 6.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.5% today to 19.1% in 3 years time.

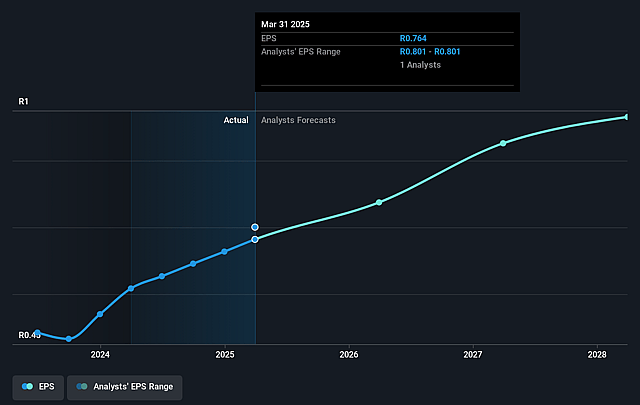

- Analysts expect earnings to reach ZAR 1.5 billion (and earnings per share of ZAR 1.13) by about September 2028, up from ZAR 1.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.7x on those 2028 earnings, up from 11.3x today. This future PE is greater than the current PE for the ZA Hospitality industry at 10.7x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.64%, as per the Simply Wall St company report.

Southern Sun Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on performance in specific regions such as Cape Town and Western Cape creates geographic concentration risk; underperformance in other key nodes like Durban and Mozambique due to political instability, event dependency, or sluggish economic conditions could drive revenue volatility and margin compression.

- Persistent underperformance and uncertain recovery in offshore assets, especially Mozambique-and limited appetite or clarity for further international diversification-can restrict non-South African growth, leaving earnings overly tied to the South African macro environment.

- Elevated and recurring maintenance and refurbishment CapEx requirements for an ageing property portfolio, combined with high construction costs for new projects, risk compressing future free cash flows or reducing long-term returns on equity, particularly if revenue growth slows or economic headwinds emerge.

- Rising competition from alternative accommodation platforms, international brands, and fragmented independent operators-especially with low-cost property developers entering the market-may pressure occupancy rates and average daily rates, threatening both top-line revenue and operating margins.

- South Africa's cyclical economy, structural constraints around government budgets, policy uncertainties, high interest rates, and the sector's overall event dependency introduce material long-term downside risks to consistent revenue, EBITDA growth, and shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ZAR10.7 for Southern Sun based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ZAR8.0 billion, earnings will come to ZAR1.5 billion, and it would be trading on a PE ratio of 16.7x, assuming you use a discount rate of 20.6%.

- Given the current share price of ZAR8.62, the analyst price target of ZAR10.7 is 19.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.