Key Takeaways

- Strategic focus on African expansion and private banking offers potential for revenue growth through capturing regional market opportunities.

- Cost efficiency post-Liberty transaction and hedging in South Africa aim to enhance margins and sustain net interest income amid interest rate changes.

- Weaker currencies, high taxes, volatile credit environments, and geopolitical tensions pose significant risks to growth, margins, and revenue across African markets.

Catalysts

About Standard Bank Group- Provides financial products and services in South Africa and internationally.

- The group expects that the substantial currency devaluation impacts experienced in 2024 will not repeat in 2025, which should allow for stronger constant currency growth and favorable conversion into rand earnings, potentially boosting headline earnings. This would likely improve net margins and revenue growth.

- The integration and capital efficiency improvements following the Liberty transaction have provided cost synergies and capital distributions, which can lead to enhanced future earnings in the Insurance and Asset Management business. This success positions the group to achieve improved net margins and greater return on equity (ROE).

- The group's emphasis on capturing Africa's growth opportunities, through expansion in energy and infrastructure finance, along with a strategic focus on private banking growth, presents a significant opportunity to drive revenue growth and enhance earnings through emerging markets in Africa.

- Standard Bank's hedging program, particularly in the South African market, aims to mitigate the impact of declining interest rates on net interest income (NII). This positions the group to preserve NII and manage net margins despite external interest rate pressures.

- The group's commitment to optimizing its portfolio and making strategic exits where capital deployment can be more efficiently utilized suggests a disciplined approach that could enhance overall group returns. This strategy supports the group's efforts to achieve targets of higher ROE and cost-to-income ratio efficiency, contributing to improved earnings growth.

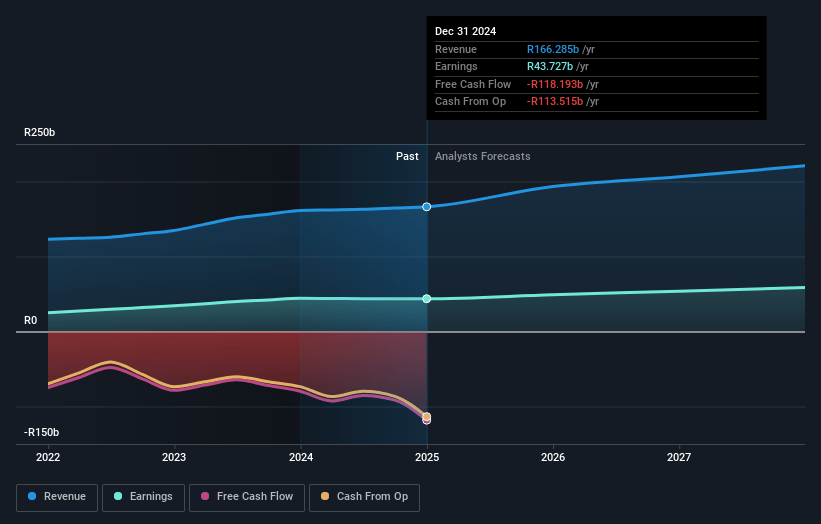

Standard Bank Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Standard Bank Group's revenue will grow by 7.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 26.3% today to 27.9% in 3 years time.

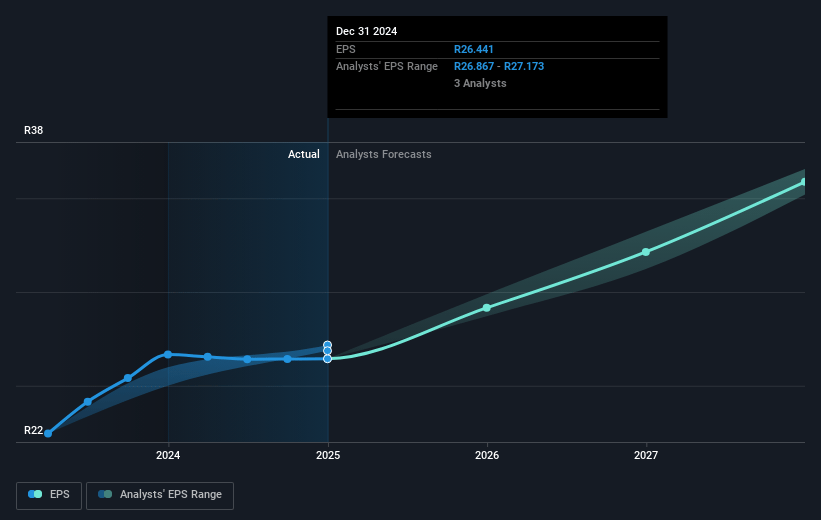

- Analysts expect earnings to reach ZAR 57.7 billion (and earnings per share of ZAR 35.14) by about July 2028, up from ZAR 43.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.2x on those 2028 earnings, up from 8.6x today. This future PE is greater than the current PE for the ZA Banks industry at 7.6x.

- Analysts expect the number of shares outstanding to decline by 0.73% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 18.78%, as per the Simply Wall St company report.

Standard Bank Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Weaker African currencies, particularly the Nigerian naira and Angolan kwanza, reduced rand earnings by 9%, which could continue to impact future revenue growth if currency devaluation persists.

- Slower loan growth influenced by subdued client demand due to sustained high interest rates could lead to lower-than-expected net interest income and impact revenue.

- Bespoke credit environments remain volatile, with specific sovereign credit risks in markets like Mozambique and Malawi, potentially impacting credit loss ratios and earnings.

- Rising tax burdens from increased withholding taxes, a windfall tax levy in Nigeria, and global minimum tax introduced in South Africa may adversely affect net profit margins.

- The potential global economic impact of trade wars and geopolitical tensions could unpredictably alter macroeconomic conditions, posing risks to revenue and margins by reducing investment confidence across Africa.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ZAR262.086 for Standard Bank Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ZAR206.8 billion, earnings will come to ZAR57.7 billion, and it would be trading on a PE ratio of 12.2x, assuming you use a discount rate of 18.8%.

- Given the current share price of ZAR229.5, the analyst price target of ZAR262.09 is 12.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.