Last Update 07 Dec 25

Fair value Increased 0.93%SBK: Easing Macro Headwinds Will Support Stable Returns And Fair Value Ahead

Analysts have nudged their fair value estimate for Standard Bank Group higher, lifting the price target from ZAR 285.39 to about ZAR 288.06 as easing macro headwinds and an improving near term growth outlook support slightly stronger revenue growth assumptions, despite modestly lower margin expectations.

Analyst Commentary

Bullish analysts point to a healthier macro backdrop for South African banks and a more supportive growth outlook as key reasons the fair value estimate for Standard Bank Group can drift higher, even without a material re-rating of the sector.

Recent initiation coverage and updated models suggest that earnings visibility is improving, but that much of the prospective upside remains contingent on disciplined execution against growth and capital allocation targets.

Bullish Takeaways

- Bullish analysts highlight that South African banks are at a significant inflection point, with easing macro headwinds expected to translate into steadier loan growth and more predictable credit costs, which supports a higher fair value range.

- The new coverage with a price target moderately below the latest fair value estimate is seen as validating the current valuation framework, implying that the stock is reasonably valued with scope for upside if execution on growth initiatives outpaces base case assumptions.

- Improving near term growth prospects, underpinned by more robust activity in corporate and retail banking, are viewed as supportive of mid single digit to high single digit earnings growth, helping to sustain a premium to book value.

- Analysts also note that a more benign macro environment can reduce earnings volatility, potentially justifying a slightly higher multiple if management continues to deliver on cost control and risk management.

Bearish Takeaways

- Bearish analysts emphasize that, despite the constructive macro narrative, the initiation rating at Neutral signals that much of the near term improvement may already be reflected in the share price, limiting immediate re-rating potential.

- There is caution that moderating margin expectations could cap earnings leverage from higher volumes, making it harder for Standard Bank Group to materially outperform peers on profitability metrics.

- Uncertainty around the durability of the macro recovery, including potential policy and power supply constraints in South Africa, is seen as a risk to the growth trajectory embedded in current valuation models.

- Some analysts are wary that investors may demand a greater margin of safety in emerging market financials, which could restrain multiple expansion even if earnings trends remain broadly positive.

What's in the News

- Reaffirmed full year 2025 guidance, targeting mid to high single digit banking revenue growth, revenue growth at or above operating expense growth to keep the cost to income ratio flat to lower year on year, and group ROE anchored in the 17% to 20% target range (Key Developments).

- Hosted an Analyst and Investor Day, providing detailed updates on strategic priorities, growth initiatives, and capital allocation plans for the medium term (Key Developments).

Valuation Changes

- The Fair Value Estimate has risen slightly from ZAR 285.39 to ZAR 288.06, reflecting modestly stronger underlying assumptions.

- The Discount Rate has edged down marginally from 19.06 percent to 19.06 percent, signaling a slightly lower perceived risk profile in the valuation model.

- Revenue Growth has increased moderately from about 8.59 percent to about 8.81 percent, indicating a more constructive outlook for top line expansion.

- The Net Profit Margin has slipped slightly from about 27.04 percent to about 26.91 percent, suggesting a small offset from somewhat softer profitability expectations.

- The Future P/E has moved up marginally from 12.53x to 12.64x, implying a modestly higher valuation multiple applied to projected earnings.

Key Takeaways

- Accelerated digital transformation and focus on scalable, fee-driven channels are enhancing margins, cost efficiency, and revenue mix across diverse African markets.

- Strategic expansion in high-growth sectors and local currency lending, along with increased wealth offerings, is driving resilient earnings and improved profitability.

- Prolonged economic, currency, and regulatory headwinds may constrain Standard Bank's revenue growth and margins, while digital competition and rising costs threaten profitability and market position.

Catalysts

About Standard Bank Group- Provides financial products and services in South Africa and internationally.

- Accelerating digital adoption across Africa and Standard Bank's sustained investment in digital channels, cloud migration, and AI-driven client solutions enable the group to cost-effectively reach and serve the underbanked while driving increasing fee income, transaction volumes, and improved cost-to-income ratios, supporting higher margins and scalable growth.

- The bank's expanding presence in high-growth African markets-underpinned by rapid urbanization, a rising middle class, and ongoing geographic diversification-continues to drive robust loan and deposit growth, especially in Africa Regions where lending margins are structurally higher, bolstering revenue and overall earnings resilience.

- Standard Bank's strategy to lead the continent's infrastructure and trade finance, including sustainable/green finance, positions it to capitalize on continent-wide demand for project and trade funding, supporting strong deal origination, fee growth, and outperformance in higher-ROE corporate and investment banking segments.

- The expansion of wealth management and insurance offerings, coupled with digital and broker-led distribution, is accelerating cross-sell of capital-light, higher margin products (e.g., insurance new business value up 11%, assets under management up 10%), steadily improving revenue mix, fee income, and group ROE.

- The shift in loan book composition toward faster-growing, higher-margin local currency lending in Africa, as well as strategic growth in the unsecured lending segment, enhances net interest margin potential and positions the group for stronger NII and earnings growth as credit appetite is increased and credit loss ratios remain within target.

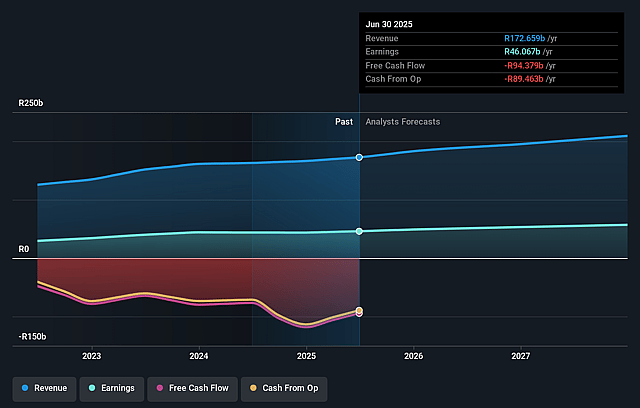

Standard Bank Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Standard Bank Group's revenue will grow by 8.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 26.7% today to 27.5% in 3 years time.

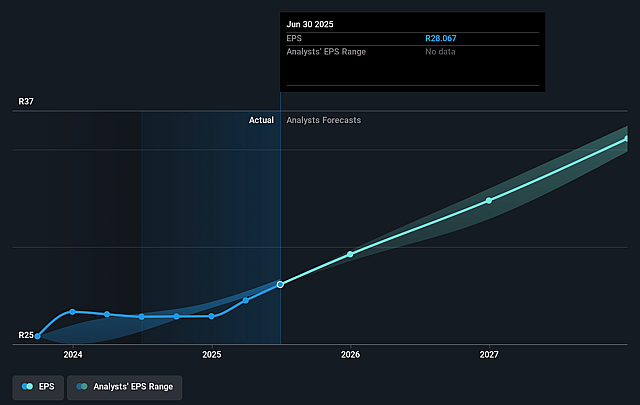

- Analysts expect earnings to reach ZAR 59.7 billion (and earnings per share of ZAR 35.55) by about September 2028, up from ZAR 46.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.1x on those 2028 earnings, up from 8.4x today. This future PE is greater than the current PE for the ZA Banks industry at 7.6x.

- Analysts expect the number of shares outstanding to decline by 1.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.31%, as per the Simply Wall St company report.

Standard Bank Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Slow or volatile economic growth in key African markets, especially South Africa, poses a risk to Standard Bank's loan demand, credit quality, and fee income, and may constrain long-term revenue and earnings growth as GDP forecasts remain subdued and political uncertainties persist.

- Continued margin compression, due to lower interest rates (NIM declines in both South Africa and Africa Regions) and competitive pricing pressure in core lending businesses, could hinder net interest income growth and weigh on future net margins and profitability.

- Although digital adoption remains strong, risks of being outpaced by more agile fintech, digital-first competitors, or mobile money operators could erode Standard Bank's fee income, accelerate disintermediation in transaction banking, and increase customer acquisition costs, impacting revenue growth and net margins.

- High and growing exposure to volatile African currencies introduces persistent FX translation risks, currency devaluation, and potential earnings volatility, with adverse effects on consolidated group revenues and net earnings reported in ZAR.

- Rising operational, technology, and regulatory compliance costs-including ongoing digital transformation, cybersecurity investments, compliance with tightened capital buffers, and evolving regulatory demands-could put pressure on cost-to-income ratios and undermine long-term operating leverage and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ZAR274.45 for Standard Bank Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ZAR304.21, and the most bearish reporting a price target of just ZAR255.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ZAR217.3 billion, earnings will come to ZAR59.7 billion, and it would be trading on a PE ratio of 12.1x, assuming you use a discount rate of 19.3%.

- Given the current share price of ZAR239.92, the analyst price target of ZAR274.45 is 12.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Standard Bank Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.