Last Update 11 Dec 25

WTRG: Modest Merger Premium Will Shape Long Term Upside Potential

Analysts have lowered their price targets on Essential Utilities by a few dollars into the low to mid $40s. This reflects a more cautious stance on the announced all stock merger with American Water and its relatively modest implied premium.

Analyst Commentary

Research coverage has turned more balanced following the merger announcement, with the stock now framed as a steady but less differentiated way to gain exposure to regulated water utilities.

Targets in the low to mid $40s imply more limited upside from current levels, as investors weigh modest deal economics against the potential for longer term scale benefits.

Bullish Takeaways

- Bullish analysts view Essential as a preferred vehicle for water sector exposure, highlighting the stability of regulated earnings and defensive cash flows.

- Some see room for earnings growth toward the high end of the 5% to 7% targeted range, which could support a re rating if execution on capital plans and integration remains disciplined.

- Improving balance sheet metrics and an expectation of continued credit strengthening are cited as key supports for the current valuation and dividend sustainability.

- At recent prices, valuation is considered attractive versus historical utility multiples, assuming the company can deliver on its longer term growth and synergy objectives.

Bearish Takeaways

- Bearish analysts highlight that the roughly 10% headline deal premium is low relative to precedent transactions, which limits the immediate value creation case for existing shareholders.

- The shift from Buy to more neutral stances reflects concern that execution risk around a large, multi year integration could cap near term multiple expansion.

- Extended timing to a targeted closing in early 2027 introduces regulatory and macro uncertainty, which some investors may discount into the valuation.

- With most price targets clustered just a few dollars above recent trading levels, skeptics argue the risk reward profile is now more balanced than compelling, particularly if growth underperforms the high end of management guidance.

What's in the News

- American Water Works agrees to acquire Essential Utilities in an all stock, tax free merger valued at $12.3 billion. Essential shareholders will receive 0.305 American Water shares per Essential share, implying roughly a 10% premium and creating a combined enterprise value of about $63 billion (Key Developments).

- Post merger ownership structure will leave American Water shareholders with approximately 69% and Essential shareholders with about 31% of the combined company. The company will operate under the American Water name and remain headquartered in Camden, New Jersey, with substantial operations maintained in Pennsylvania (Key Developments).

- The combined company will have a 15 member board, including five directors selected by Essential. American Water CEO John C. Griffith will lead the combined entity, and Essential CEO Christopher H. Franklin will serve as Executive Vice Chair for two years following closing (Key Developments).

- The merger is expected to close by the end of the first quarter of 2027, subject to shareholder approvals, regulatory clearances, and other customary conditions. It is projected to be accretive to American Water’s earnings per share in the first year after close while supporting 7% to 9% EPS and dividend growth targets (Key Developments).

- Essential Utilities raises its 2025 GAAP earnings guidance and now expects earnings per share to come in above the prior $2.07 to $2.11 range due to non recurring benefits (Key Developments).

Valuation Changes

- Fair value estimate remains unchanged at approximately $43.71 per share, indicating no revision to the intrinsic value outlook.

- The discount rate is effectively flat at about 6.96%, signaling no meaningful change in the perceived risk profile or cost of capital.

- Revenue growth is steady at roughly 4.92% annually, reflecting a consistent outlook for top line expansion.

- The net profit margin is unchanged at around 27.13%, suggesting stable expectations for long term profitability.

- The future P/E ratio is essentially steady at about 22.1x, indicating no material shift in the expected valuation multiple applied to forward earnings.

Key Takeaways

- Strategic acquisitions and infrastructure investments, along with regulatory compliance, position the company for accelerated revenue and margin growth amid demographic and urbanization trends.

- Strong execution in rate cases and a robust ESG profile bolster earnings stability, investor appeal, and support for sustainable long-term growth.

- Regulatory scrutiny, slow customer growth, rising compliance costs, persistent inflation, and M&A execution risks threaten future revenue, margins, and long-term earnings growth.

Catalysts

About Essential Utilities- Through its subsidiaries, operates regulated utilities that provide water, wastewater, and natural gas services in the United States.

- Ongoing and anticipated infrastructure investment-$1.4 billion planned for 2025 and a multi-year CAGR of 6–8% in regulated rate base-positions Essential Utilities to capitalize on expanding, long-term demand for water and wastewater services due to population growth and urbanization, supporting reliable revenue and cash flow growth.

- Growing regulatory emphasis on water quality (e.g., PFAS compliance) and aging infrastructure creates acquisition opportunities as municipalities struggle to meet new standards; Essential's scale, patented PFAS solution, and capital resources should enable accelerated top-line growth and margin expansion via strategic acquisitions.

- Expansion in high-growth regions (notably Texas, with 25,000 new connections over 10 years and 90,000 in the pipeline) leverages favorable demographic and economic trends, bolstering customer growth and long-term revenue visibility.

- Strong execution in regulated rate cases (with recent approvals in Pennsylvania and Kentucky, and several major filings pending) continues to drive higher allowed returns and improved earnings stability, mitigating adverse impacts of cost inflation and regulatory lag on net margins and earnings.

- Enhanced ESG profile and consistent dividend increases (now 30+ years) position Essential Utilities to benefit from ongoing investor demand for sustainable, resilient infrastructure businesses, potentially lowering its cost of capital and supporting higher long-term earnings and payout growth.

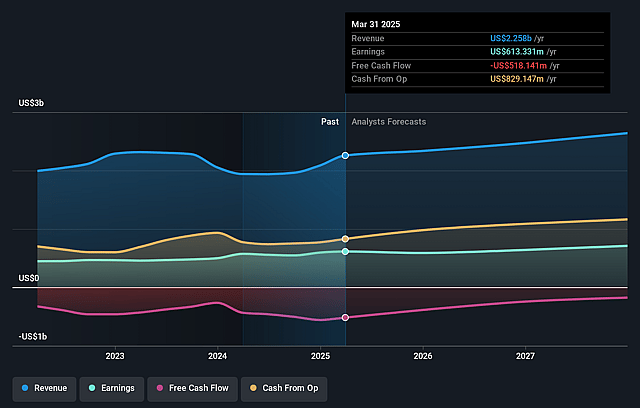

Essential Utilities Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Essential Utilities's revenue will grow by 5.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 27.6% today to 27.0% in 3 years time.

- Analysts expect earnings to reach $732.2 million (and earnings per share of $2.49) by about September 2028, up from $645.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.0x on those 2028 earnings, up from 16.6x today. This future PE is greater than the current PE for the US Water Utilities industry at 22.1x.

- Analysts expect the number of shares outstanding to grow by 2.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Essential Utilities Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising regulatory and political scrutiny on rate increases-particularly in Pennsylvania and across its multi-state footprint-may compress Essential Utilities' ability to achieve future revenue growth targets, limiting pricing power and ultimately affecting earnings.

- Slower customer growth in key service territories, as indicated by stable customer counts through 2027 and dependence on specific regional growth (e.g., Texas and potentially hyperscaler developments), could lead to stagnating top-line revenue, especially if expected expansion in fast-growing regions underperforms.

- Escalating infrastructure replacement and environmental compliance costs-including large-scale PFAS remediation, aging pipe replacement, and cybersecurity investments-risk sustained pressure on net margins as operating expenses rise faster than allowed returns.

- Elevated interest rates and inflation are already increasing O&M, depreciation, and interest expenses; continued higher cost of capital can strain Essential Utilities' ability to fund $1.4 billion annual infrastructure investments and hinder long-term earnings growth.

- Execution and integration risks related to M&A-driven growth are significant, with delays (as seen with DELCORA and other municipal acquisition opportunities), potential overpayment for assets, and regulatory or legal obstacles threatening the accretiveness of deals, thereby impacting future earnings per share.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $46.375 for Essential Utilities based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $56.0, and the most bearish reporting a price target of just $42.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.7 billion, earnings will come to $732.2 million, and it would be trading on a PE ratio of 23.0x, assuming you use a discount rate of 6.8%.

- Given the current share price of $38.28, the analyst price target of $46.38 is 17.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Essential Utilities?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.