Narratives are currently in beta

Key Takeaways

- Acquisition and sustainability initiatives are expected to drive future growth by boosting revenue, brand strength, and attracting ESG-conscious investors.

- Significant investments in infrastructure and modernization plan support earnings growth and improve operational efficiency, potentially enhancing customer satisfaction and margins.

- Increased operating expenses and substantial investments could compress margins and heighten financial risk, while regulatory challenges and competition may impact future revenue growth.

Catalysts

About Unitil- A public utility holding company, engages in the distribution of electricity and natural gas.

- The acquisition of Bangor Natural Gas is expected to drive future growth through increased customer base and operating synergies, potentially boosting future revenue and earnings.

- Advanced Metering Infrastructure (AMI) project, costing approximately $40 million, aims to enhance operational efficiency and could lead to improved net margins and customer satisfaction.

- The uncontested rate case settlement with FERC for Granite State Gas Transmission allows for a $3 million annual revenue increase, directly improving future revenue streams.

- The plan to achieve a 50% reduction in greenhouse gas emissions by 2030 through sustainability initiatives may attract ESG-conscious investors, potentially driving up the stock value and affecting earnings positively by enhancing brand strength and customer loyalty.

- Increased capital expenditure planning, with significant portions aimed at electric sector modernization, indicates future rate base growth between 6.5% to 8.5%, which is expected to support earnings growth of 5% to 7%.

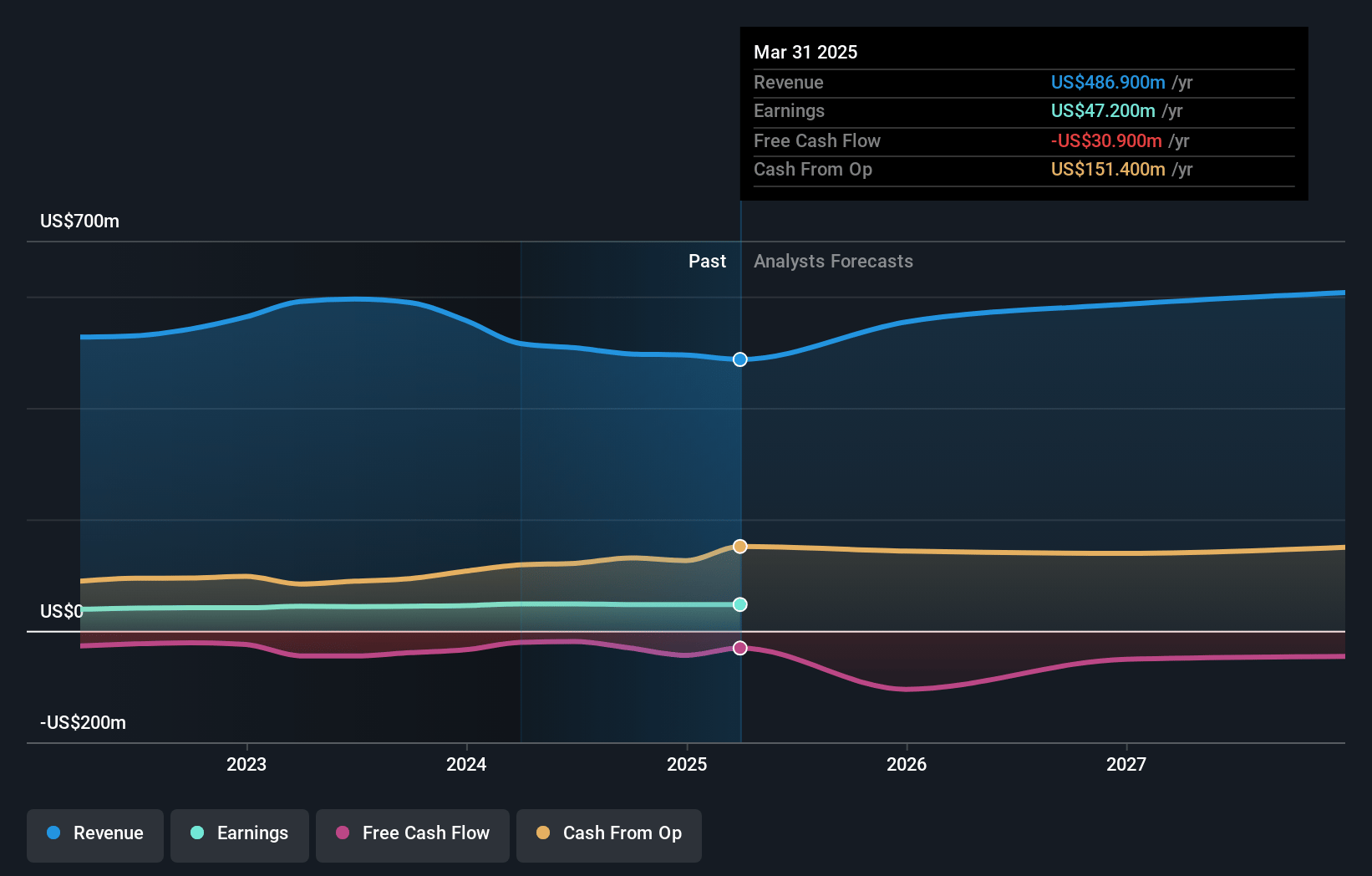

Unitil Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Unitil's revenue will grow by 8.4% annually over the next 3 years.

- Analysts are assuming Unitil's profit margins will remain the same at 9.5% over the next 3 years.

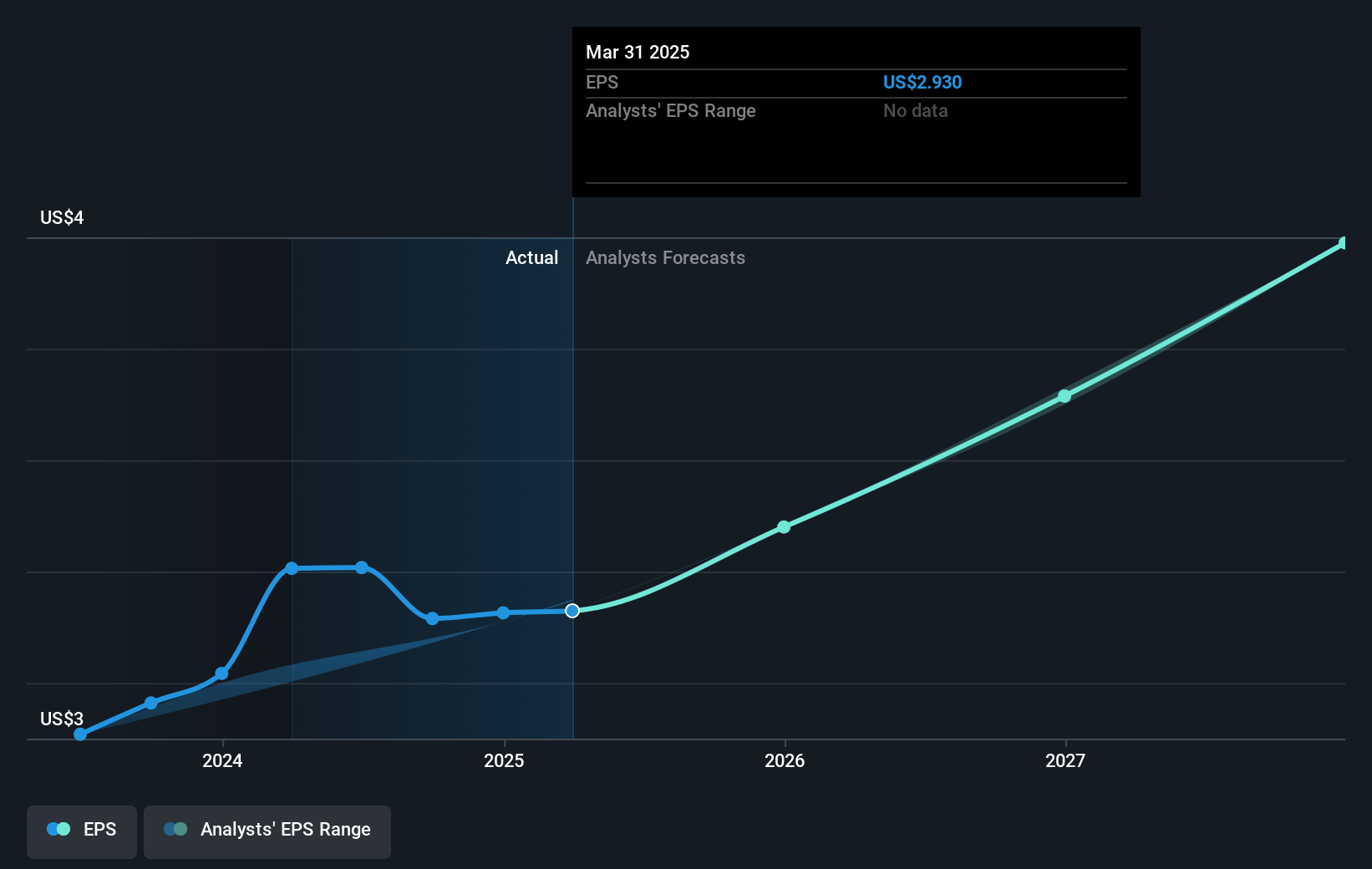

- Analysts expect earnings to reach $60.1 million (and earnings per share of $3.46) by about November 2027, up from $47.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.5x on those 2027 earnings, down from 20.3x today. This future PE is lower than the current PE for the US Integrated Utilities industry at 20.3x.

- Analysts expect the number of shares outstanding to grow by 2.42% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Unitil Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company reported breakeven financial results for the third quarter, indicating limited profitability which could impact net margins and earnings.

- There is an increase in operating expenses, including labor and utility costs, which might compress margins despite revenue growth.

- Future investments, such as the $40 million AMI project, require substantial capital spending that may impact cash flow and increase financial risk.

- Regulatory proceedings and dependency on favorable outcomes, like for the Bangor Natural Gas acquisition, carry uncertainty that might affect revenue projections.

- Increasing competition between electric and gas investments in response to state policy shifts could alter expected revenue growth and affect rate base growth targets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $58.0 for Unitil based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $632.3 million, earnings will come to $60.1 million, and it would be trading on a PE ratio of 19.5x, assuming you use a discount rate of 5.9%.

- Given the current share price of $58.93, the analyst's price target of $58.0 is 1.6% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives