Key Takeaways

- Oncor's proactive rate review and capital investments align with Texas's economic growth, poised to boost revenue and earnings through increased demand.

- Sempra's substantial capital plan and infrastructure investments aim for long-term growth, supported by lucrative LNG projects enhancing future earnings.

- Sempra faces financial pressure from lower EPS guidance, interest rate uncertainties, and regulatory decisions impacting margins, alongside challenges in capital investment returns and shareholder dilution.

Catalysts

About Sempra- Operates as an energy infrastructure company in the United States and internationally.

- Oncor is preparing to file a comprehensive base rate review earlier than initially planned, which may set the stage for higher revenue and improved earnings by aligning its cost structure with current economic conditions and increased demand. This will likely boost future earnings growth.

- Texas is experiencing robust economic growth with forecasted electricity demand nearly doubling, which supports Oncor's increased capital investments. This growth is expected to significantly enhance Oncor's revenue and overall earnings.

- Sempra has announced a new record $56 billion capital plan for 2025 to 2029, which marks a 16% increase over the previous plan. A large portion of these investments are directed towards infrastructure projects that are expected to drive substantial rate base growth and contribute to long-term revenue and earnings increases.

- Oncor has plans for potentially $12 billion in additional capital projects beyond its base plan, including key transmission projects, which represent future growth opportunities that should positively influence future revenues and earnings.

- Sempra Infrastructure's dual-basin LNG strategy, focusing on LNG projects with significant long-term contracts, is poised to bring substantial cash flows upon project completion, including ECA LNG Phase 1 and Port Arthur LNG Phase 1, projected to enhance earnings from 2026 onwards.

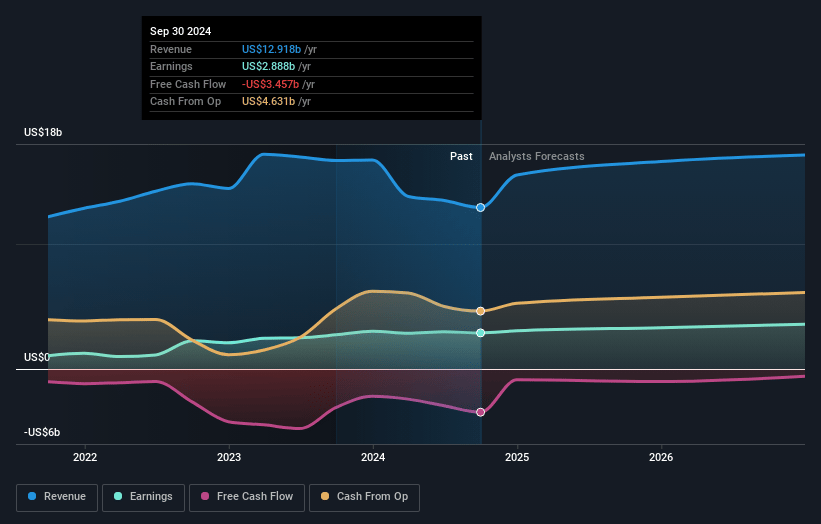

Sempra Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sempra's revenue will grow by 11.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 21.4% today to 20.2% in 3 years time.

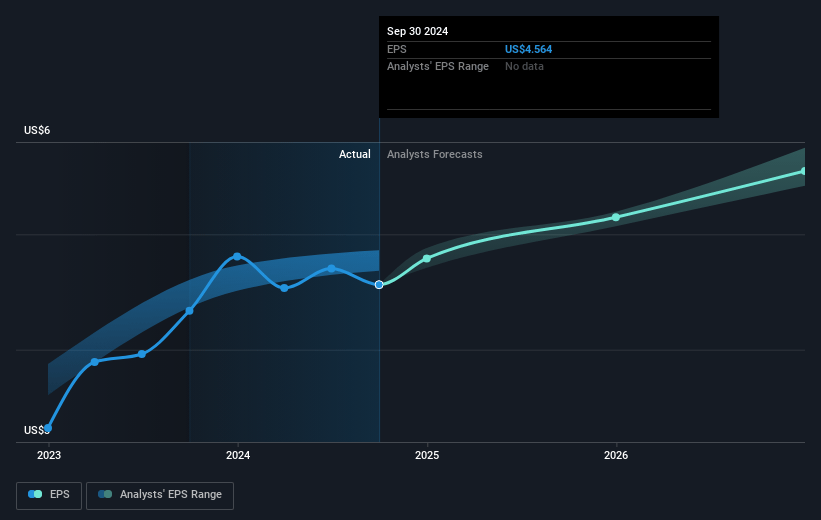

- Analysts expect earnings to reach $3.7 billion (and earnings per share of $5.58) by about March 2028, up from $2.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.7x on those 2028 earnings, up from 16.0x today. This future PE is lower than the current PE for the US Integrated Utilities industry at 21.9x.

- Analysts expect the number of shares outstanding to grow by 2.94% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Sempra Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The revision of Sempra's 2025 EPS guidance to $4.30 to $4.70, which is below prior expectations, reflects pressures and challenges impacting Sempra's near-term earnings potential. (Impact: Earnings)

- California's general rate case final decision came in lower than expected, coupled with a 42 basis point decrease in return on equity, which negatively impacts Sempra California's financial outlook. (Impact: Net Margins)

- Assumptions regarding interest rates, which have been updated, suggest potential increases that could substantially increase Sempra's cost structure and impact net income. (Impact: Net Margins/Earnings)

- The potential for Oncor's challenging growth cycles, particularly if assumptions related to rate cases or capital investment returns do not fully materialize as expected, adds uncertainty to Sempra's earnings projections. (Impact: Revenue/Earnings)

- Higher interest expenses and the need for issuing new hybrid securities to finance capital investments could result in tensions on Sempra's balance sheet, potentially diluting shareholder returns. (Impact: Net Margins/Earnings)

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $82.225 for Sempra based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $96.0, and the most bearish reporting a price target of just $72.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $18.5 billion, earnings will come to $3.7 billion, and it would be trading on a PE ratio of 18.7x, assuming you use a discount rate of 6.2%.

- Given the current share price of $69.3, the analyst price target of $82.22 is 15.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.