Key Takeaways

- NextEra's scale, advanced storage, and unique asset repositioning could lead to outperformance in revenue, margins, and market share as energy demand accelerates.

- Aggressive investments in nuclear, grid digitalization, and all-source solutions position NextEra for sustained growth and premium pricing in a rapidly electrifying economy.

- Higher interest rates, regulatory uncertainty, industry competition, shifting energy trends, and geographic climate risks threaten long-term earnings growth and pressure margins.

Catalysts

About NextEra Energy- Through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America.

- Analyst consensus acknowledges strong backlog and storage growth, but they may understate NextEra's competitive positioning; in reality, NextEra's aggressive pre-2029 safe harbor strategy and unmatched supply chain scale could enable them to win a disproportionate share of accelerated demand pull-forward, leading to above-consensus revenue and earnings growth from 2027 through 2029.

- Analysts broadly agree on cost and pricing advantages from in-house battery sourcing and grid investments, but this may actually underplay NextEra's long-term margin expansion-continued acceleration in advanced energy storage and grid digitalization could drive structural net margin increases well into the next decade as costs fall and operational efficiencies compound.

- Few recognize the full financial impact of NextEra's unique position to recontract legacy renewable assets into a structurally tighter, higher-price power market, providing latent earnings upside and margin expansion as long-term contracts roll off into a supply-constrained environment.

- NextEra's active multi-pronged nuclear development (including SMRs and brownfield restarts like Duane Arnold) and capacity to deliver all-of-the-above energy solutions positions the company to monetize secular growth in power demand from tech/data centers, electrified transport, and industrial reshoring-supporting sustained, outsized growth in both regulated and merchant revenues.

- The rapid electrification of the U.S. economy and the acute shortfall of new generation build capability among smaller competitors create an extraordinary, underappreciated opportunity for NextEra to gain market share and premium pricing rights, implying durable, above-trend operating cash flow and return on capital through the next decade.

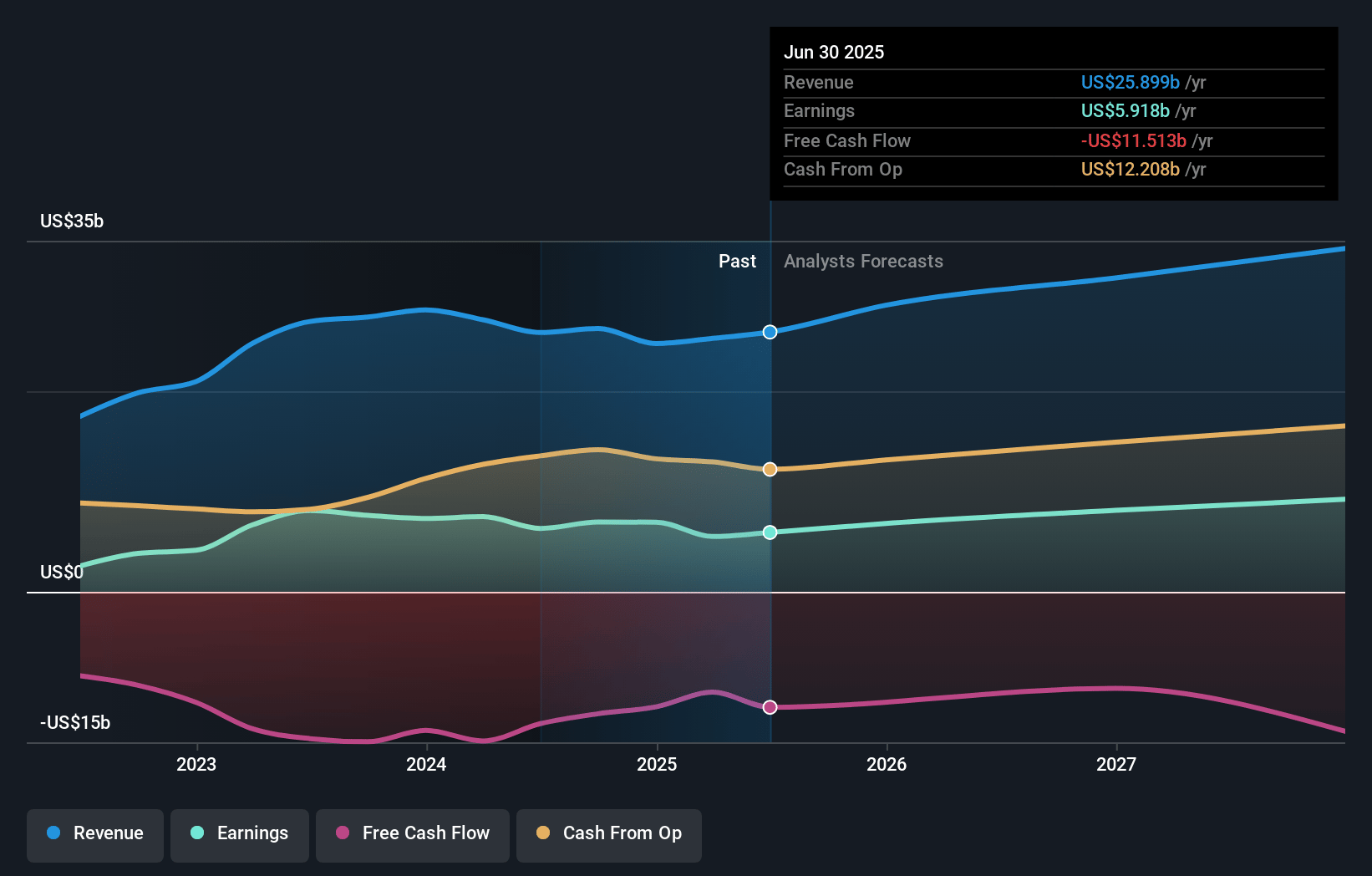

NextEra Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on NextEra Energy compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming NextEra Energy's revenue will grow by 16.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 21.8% today to 26.4% in 3 years time.

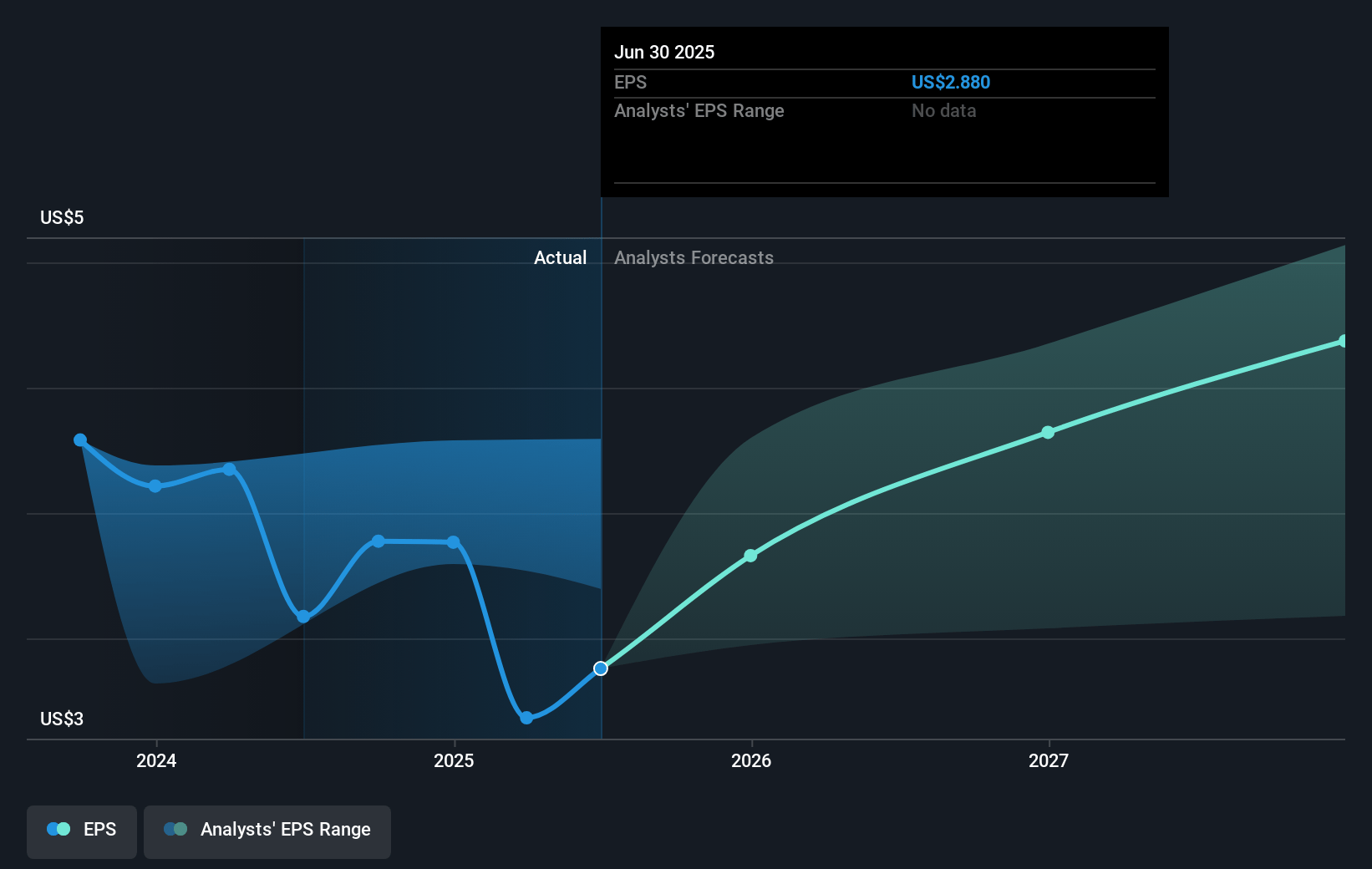

- The bullish analysts expect earnings to reach $10.6 billion (and earnings per share of $4.9) by about July 2028, up from $5.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 24.3x on those 2028 earnings, down from 29.0x today. This future PE is greater than the current PE for the US Electric Utilities industry at 22.0x.

- Analysts expect the number of shares outstanding to grow by 0.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

NextEra Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising interest rates and higher borrowing costs were already cited as reducing per-share earnings due to increased interest expense, highlighting the risk that further sustained rate increases could pressure net margins and slow earnings growth, especially given the company's large, ongoing capital expenditure requirements.

- Political and regulatory uncertainty around renewable incentives was acknowledged as an ongoing challenge, with rules like the OBBB undergoing further executive actions and complicating the long-term visibility of tax credits, which introduces risk to future project returns and could negatively impact both earnings and revenue growth beyond 2029.

- Despite currently strong electricity demand, advances in distributed energy resources and consumer grid independence could accelerate, reducing reliance on utility-scale generation over the long-term and, in turn, eroding NextEra's future revenue streams and pressuring margins.

- Intensifying industry competition, particularly in renewables from smaller developers and new entrants, could result in rationalized pricing and shrinking market share, especially as tax credits phase out and development skills become more widely dispersed, potentially slowing revenue growth and squeezing net margins.

- The company's geographic concentration of assets in Florida, a region exposed to hurricanes and climate events, increases vulnerability to severe weather-related damages and elevated operational costs, which may pressure net earnings and add volatility to results.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for NextEra Energy is $103.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of NextEra Energy's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $103.0, and the most bearish reporting a price target of just $52.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $39.9 billion, earnings will come to $10.6 billion, and it would be trading on a PE ratio of 24.3x, assuming you use a discount rate of 6.4%.

- Given the current share price of $77.54, the bullish analyst price target of $103.0 is 24.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.