Narratives are currently in beta

Key Takeaways

- Grid-hardening investments and multiyear rate plans could reduce outages, stabilize future revenue, and enhance earnings outlook.

- Capital investments in gas, renewables, and tax credit monetization may improve margins, boost cash flow, and support earnings growth.

- Severe weather disruptions, rising expenses, and regulatory uncertainty are straining Duke Energy's margins and posing challenges to future earnings and financial stability.

Catalysts

About Duke Energy- Operates as an energy company in the United States.

- Duke Energy's grid-hardening investments, including targeted undergrounding and advanced self-healing technology, are expected to reduce outages and improve system reliability, potentially leading to stabilized future revenue by minimizing storm-related losses.

- The company's multiyear rate plans in various jurisdictions, which provide for timely recovery of grid and renewable investments, could enhance revenue visibility and contribute to a higher earnings outlook.

- Significant economic development activities, including signed agreements for large data centers, suggest robust future load growth, which is anticipated to contribute to revenue growth and a potential upward revision to earnings projections.

- Duke Energy's plans for incremental capital investments, including the development of natural gas, renewables, and battery storage, are expected to diversify its generation mix, potentially improving net margins and supporting long-term earnings growth.

- The monetization of tax credits, particularly through nuclear and solar projects, is anticipated to significantly enhance cash flow, supporting the balance sheet and possibly leading to increased earnings per share through reinvestments and reduced financing costs.

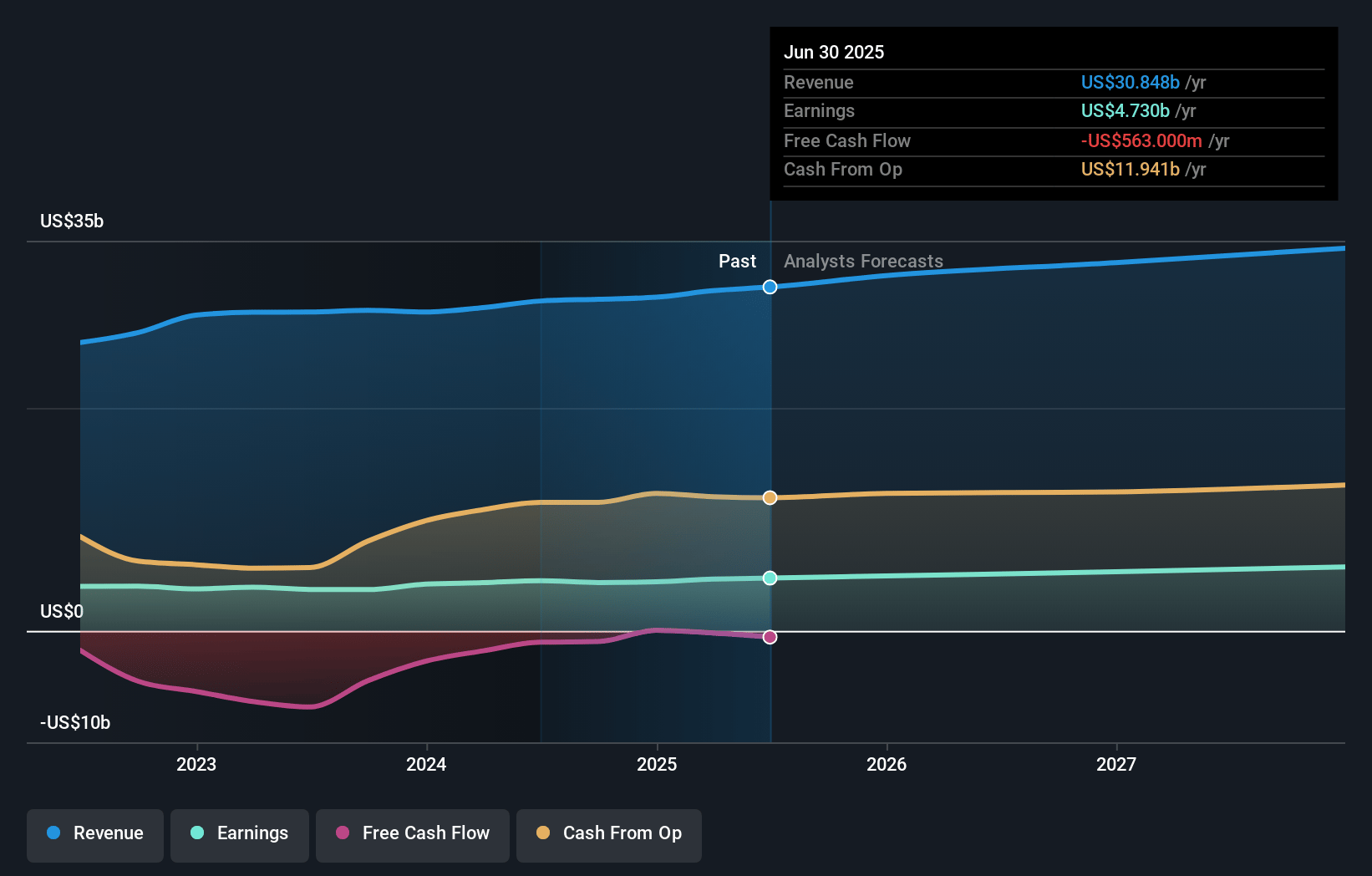

Duke Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Duke Energy's revenue will grow by 3.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.5% today to 17.2% in 3 years time.

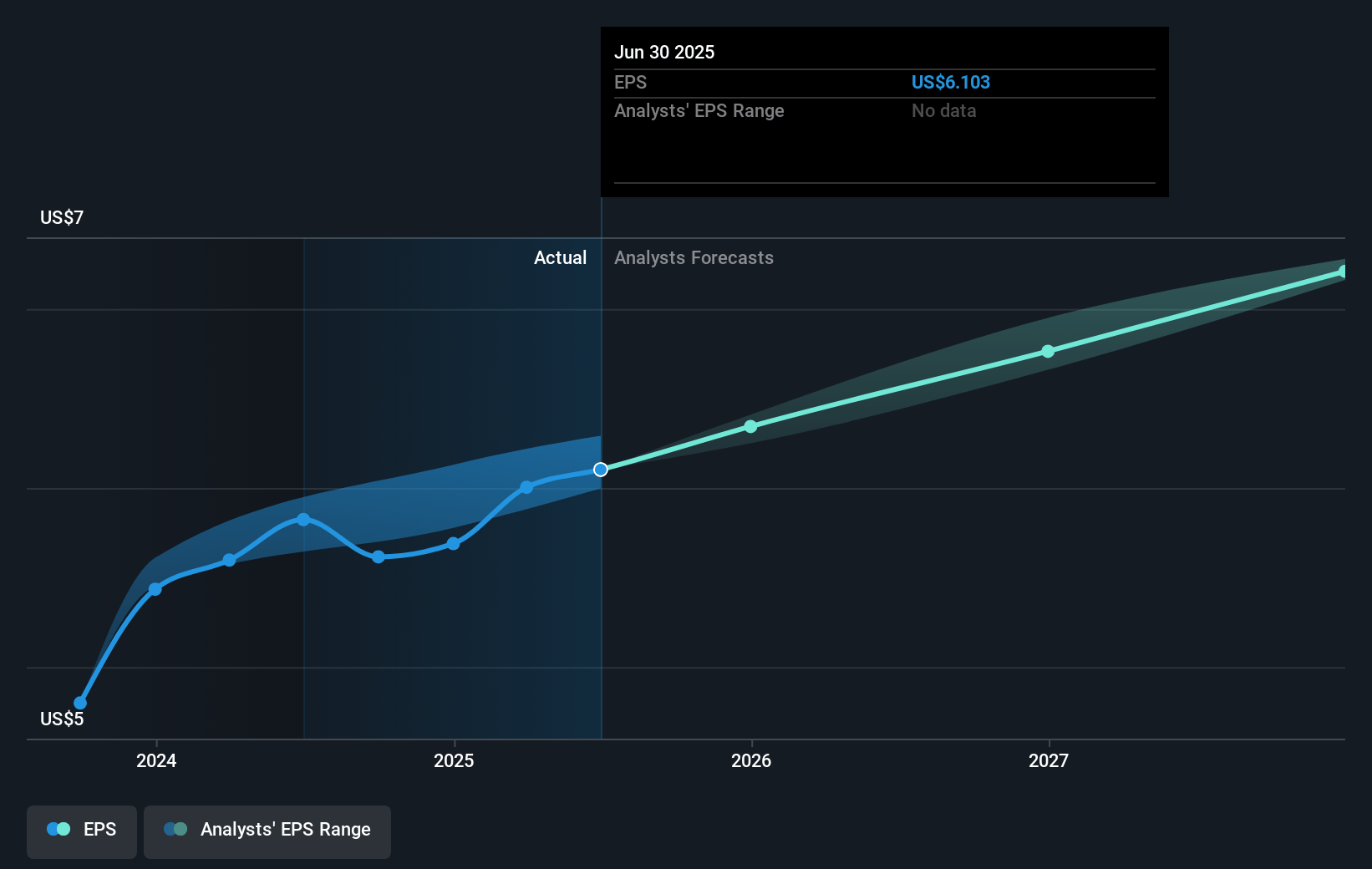

- Analysts expect earnings to reach $5.6 billion (and earnings per share of $7.13) by about November 2027, up from $4.3 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.6x on those 2027 earnings, up from 20.0x today. This future PE is lower than the current PE for the US Electric Utilities industry at 20.9x.

- Analysts expect the number of shares outstanding to grow by 0.65% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Duke Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The impact of an extraordinary hurricane season has caused significant disruptions, resulting in deferred or capitalized costs and lost revenues from outages, which could affect Duke Energy's net margins and earnings.

- The company is tracking towards the lower half of its 2024 earnings guidance range due to storm impacts and ongoing restoration costs, indicating potential challenges in meeting profit expectations.

- Increased interest expenses and depreciation on a growing asset base in both electric and gas segments have negatively affected earnings, suggesting potential pressures on net margins.

- The costs of hurricane restoration and lost revenue combined with the expectation of higher capital expenditure could strain financial resources, potentially impacting future earnings and balance sheet health.

- There is ongoing regulatory uncertainty, especially concerning the approval of new infrastructure projects and generation resources, which could affect future revenues and result in additional financial burdens.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $123.83 for Duke Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $139.0, and the most bearish reporting a price target of just $113.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $32.7 billion, earnings will come to $5.6 billion, and it would be trading on a PE ratio of 20.6x, assuming you use a discount rate of 5.9%.

- Given the current share price of $111.88, the analyst's price target of $123.83 is 9.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives