Key Takeaways

- DTE Energy's $30 billion investment aims to boost grid reliability and cleaner energy, supporting future revenue and earnings growth.

- Potential data center demand in Michigan and 45Z tax credits could enhance financial flexibility, boosting revenue and earnings.

- Regulatory and legislative challenges could delay capital allocation and increase expenditures, straining financial resources and impacting revenue, net margins, and earnings.

Catalysts

About DTE Energy- Engages in the energy-related businesses and services.

- DTE Energy plans to make a significant investment of $30 billion over the next 5 years, primarily to improve grid reliability and transition to cleaner energy generation. This sizable capital investment is expected to support future revenue growth as it enhances service quality and meets regulatory requirements for cleaner energy.

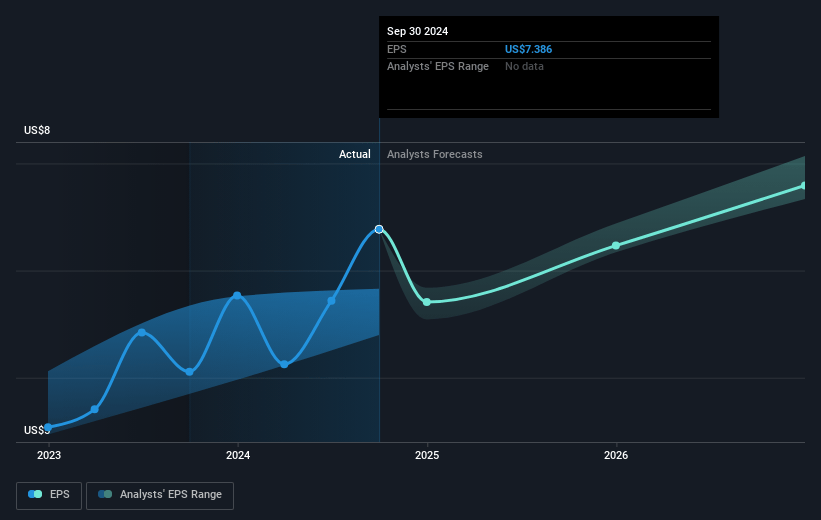

- The company is targeting a 6% to 8% operating EPS growth rate through 2029, with an emphasis on reaching the higher end of this range from 2025 to 2027. This expectation is underpinned by a constructive regulatory environment and the strategic capital investments which should result in improved earnings.

- Incremental investment opportunities may arise from potential demand growth, particularly within the data center sector in Michigan, which are not yet fully included in the current 5-year capital plan. This could further boost future revenue and earnings.

- DTE Energy has a strong commitment to affordability, maintaining low customer bill increases compared to peers, which may enhance customer satisfaction and retain market share, contributing to stable revenue streams.

- The utilization of 45Z tax credits provides additional financial flexibility and strength, allowing DTE to strategically position for growth within the outlined guidance period, potentially improving net margins as these credits offset investment costs.

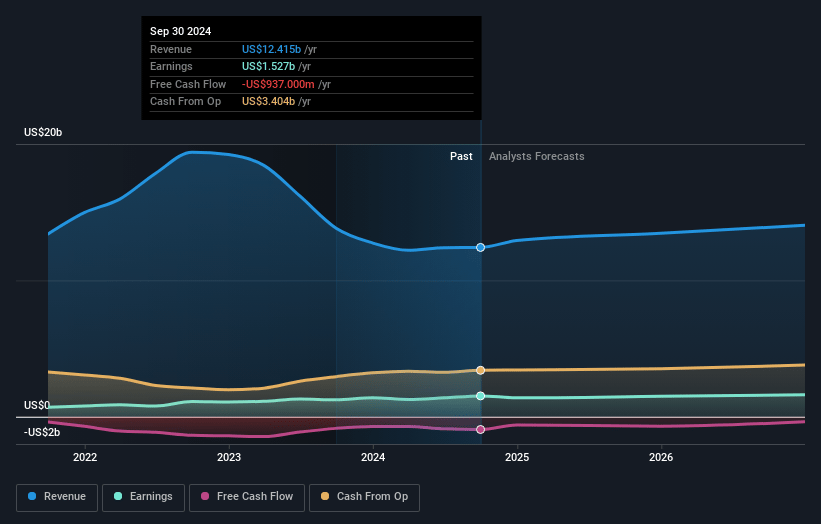

DTE Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming DTE Energy's revenue will grow by 4.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.2% today to 12.3% in 3 years time.

- Analysts expect earnings to reach $1.7 billion (and earnings per share of $8.34) by about April 2028, up from $1.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.0x on those 2028 earnings, down from 20.1x today. This future PE is lower than the current PE for the US Integrated Utilities industry at 22.4x.

- Analysts expect the number of shares outstanding to grow by 0.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

DTE Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Regulatory challenges and required alignments for expanding investment mechanisms like IRM (Infrastructure Recovery Mechanism) may delay or complicate capital allocation, potentially affecting revenue and cost recovery.

- An increase in DTE Electric's capital expenditures on distribution and renewable infrastructure could result in higher rate case frequency and the need for supportive regulatory orders, which may not always match the company's expectations, potentially impacting net margins and earnings.

- Changes in environmental legislation or infrastructure requirements could lead to unforeseen capital expenditure increases, straining financial resources and affecting net income and overall return on investment.

- Data center development, while providing potential upside, may take longer to convert from term sheet agreements to definitive agreements, which could delay its positive impact on revenue and load growth expectations.

- The reliance on tax credits such as the 45Z for renewable natural gas during 2025-2027 could be at risk if policy shifts occur, impacting future revenue projections and confidence in reaching the high end of EPS growth targets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $139.841 for DTE Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $148.0, and the most bearish reporting a price target of just $124.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $14.1 billion, earnings will come to $1.7 billion, and it would be trading on a PE ratio of 20.0x, assuming you use a discount rate of 6.2%.

- Given the current share price of $135.8, the analyst price target of $139.84 is 2.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.