Narratives are currently in beta

Key Takeaways

- Investments in reliability, clean generation, and grid modernization will drive revenue growth, improve efficiencies, and enhance net margins.

- Expanding renewable programs and strategic projects promise incremental revenue and future earnings increase.

- Regulatory proceedings, ambitious infrastructure goals, and execution risks could strain DTE Energy's financials, impacting earnings growth and necessitating equity or debt increases.

Catalysts

About DTE Energy- Engages in the utility operations.

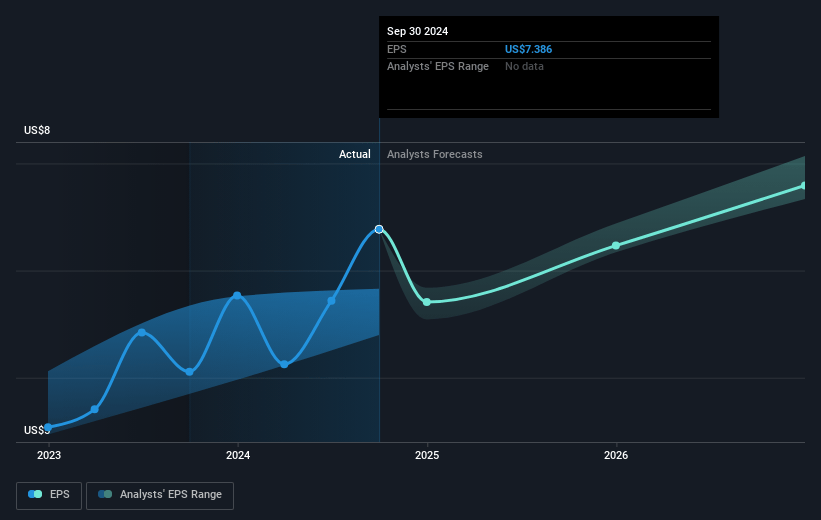

- DTE Energy's long-term capital investment plans in reliability and clean generation, supported by regulatory proceedings and legislative pushes toward decarbonization, are expected to drive their targeted EPS growth rate of 6% to 8%. This will significantly impact future revenue and earnings.

- The independent audit of DTE's electric distribution system confirmed the need for strategic investment, particularly in their grid modernization plan, which aims to reduce power outages by 30% and cut outage time by half by 2029. These grid investments are likely to improve operating efficiencies and ultimately drive net margins.

- DTE's voluntary renewable energy program is rapidly expanding, having filled a 2,500 MW subscription target sooner than anticipated, suggesting incremental revenue growth from potential new investments in renewable capacities.

- New storm resilience and smart grid technologies are already showing tangible benefits, such as the improved storm response speeds. Continued investments in these areas could result in reduced operating costs and enhanced service reliability, contributing positively to net margins.

- DTE Vantage's projects, such as the Ford Motor Company energy solution and RNG projects, are nearing full operation. These projects, supported by long-term contracts and investment tax credits, have the potential to boost earnings in the future.

DTE Energy Future Earnings and Revenue Growth

Assumptions

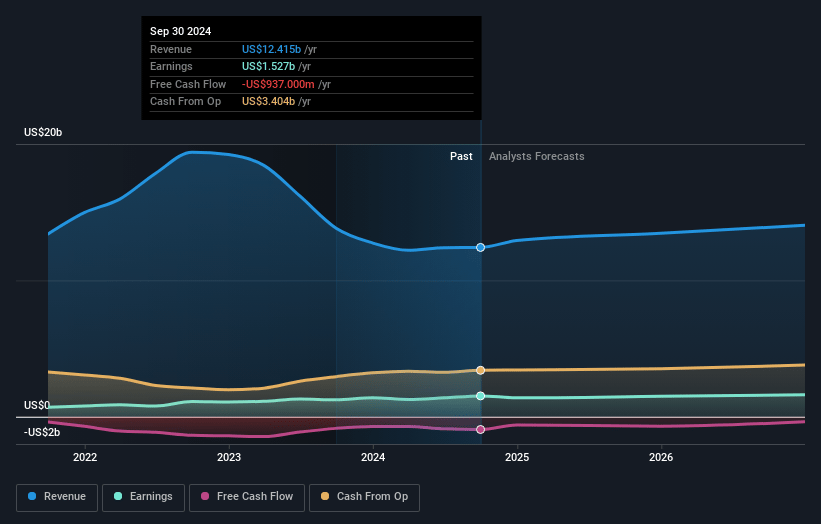

How have these above catalysts been quantified?- Analysts are assuming DTE Energy's revenue will grow by 5.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 12.3% today to 11.6% in 3 years time.

- Analysts expect earnings to reach $1.7 billion (and earnings per share of $8.22) by about November 2027, up from $1.5 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.6x on those 2027 earnings, up from 16.1x today. This future PE is lower than the current PE for the US Integrated Utilities industry at 20.3x.

- Analysts expect the number of shares outstanding to decline by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

DTE Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The regulatory environment is a significant factor, with multiple proceedings ongoing, including rate cases for both DTE Gas and Electric. Rate case outcomes in November and January could add pressure to near-term capital plans, potentially impacting planned earnings growth.

- Despite plans to reduce power outages by 30% and outage times by half by 2029, achieving these ambitious goals may require additional spending. The independent audit calls for potential increases in certain areas, which could strain capital resources and affect net margins if customer affordability isn't maintained.

- The company's assumption of flat demand growth over the next five years might be optimistic, especially in the context of other companies seeing upticks in demand expectations. Unexpectedly flat or reduced demand could lead to lower revenues than projected.

- Capital investments required for expansions in grid reliability and renewable energy might surpass the currently planned $25 billion in CapEx, potentially leading to an increased need for equity issuances or debt that could impact the balance sheet's health and future earnings.

- Execution risks related to the DTE Vantage projects and their impact on financials stand as a potential concern. Delays or cost overruns in energy solutions, RNG, and carbon capture projects could suppress revenue and earnings growth if they fail to come online as scheduled.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $135.9 for DTE Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $145.0, and the most bearish reporting a price target of just $122.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $14.6 billion, earnings will come to $1.7 billion, and it would be trading on a PE ratio of 19.6x, assuming you use a discount rate of 5.9%.

- Given the current share price of $118.62, the analyst's price target of $135.9 is 12.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives