Key Takeaways

- Modernizing energy infrastructure and expanding into high-growth regions positions Chesapeake Utilities for sustained revenue and margin growth.

- Strategic diversification into alternative fuels, along with regulatory successes and operational efficiencies, enhances earnings stability and long-term profitability.

- Heavy capital spending and geographic concentration, coupled with regulatory and decarbonization risks, threaten future margin expansion and expose the company to operational and financial vulnerability.

Catalysts

About Chesapeake Utilities- Operates as an energy delivery company in the United States.

- Substantial capital investment in energy infrastructure modernization (~$213M in first half 2025 and increased annual guidance to $375M–$425M) positions Chesapeake Utilities to capture growing demand and supports durable future rate base growth, directly boosting long-term revenue and earnings potential.

- Accelerating customer and population growth in high-expansion regions such as Florida and the Delmarva Peninsula (Q2 2025 residential customer growth of 4.2% in Delmarva, 3% in Florida) increases natural gas demand and enables incremental margin growth from customer additions, supporting revenue and net margin expansion.

- Strategic pipeline and RNG/alternative fuels projects (e.g., data center-related pipeline in Ohio, three new RNG transportation projects) broaden service offerings and tap into decarbonization trends, allowing for new revenue streams and improved margin mix over time.

- Favorable regulatory outcomes and constructive relationships (recent rate case approvals in Maryland, Delaware, Florida; successful interim FERC approvals for major projects) reduce earnings volatility and enable timely recovery of infrastructure investments, supporting steady net income and improved cash flow visibility.

- Ongoing business process improvements and ERP/IT upgrades drive operational efficiencies and cost management, amplifying the positive impact of revenue growth on adjusted net income and supporting higher future margins.

Chesapeake Utilities Future Earnings and Revenue Growth

Assumptions

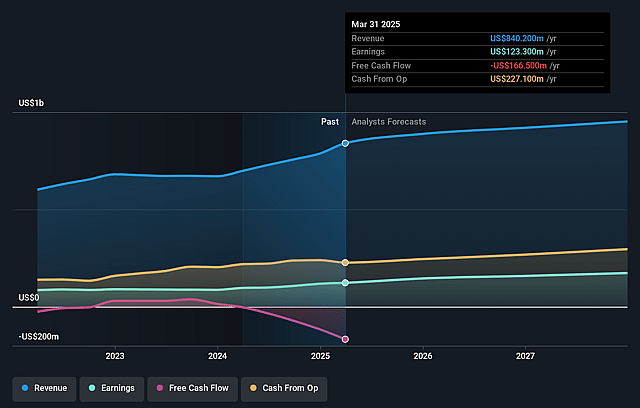

How have these above catalysts been quantified?- Analysts are assuming Chesapeake Utilities's revenue will grow by 3.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.9% today to 19.5% in 3 years time.

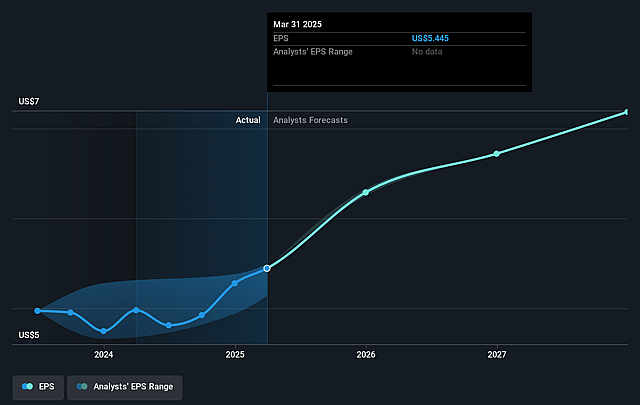

- Analysts expect earnings to reach $189.1 million (and earnings per share of $7.58) by about August 2028, up from $129.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.6x on those 2028 earnings, up from 23.0x today. This future PE is greater than the current PE for the US Gas Utilities industry at 18.1x.

- Analysts expect the number of shares outstanding to grow by 4.88% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Chesapeake Utilities Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Elevated capital spending requirements-such as the projected $1.5–$1.8 billion 5-year capital plan and recent $50 million increase in annual CapEx guidance-may necessitate higher debt and equity issuance, increasing financial leverage and diluting returns, which could compress net margins and earnings.

- Continued dependence on growth in specific service regions (Delmarva, Florida) and heavy investment in infrastructure for natural gas delivery may expose Chesapeake Utilities to geographic concentration risk, leaving revenue and customer growth vulnerable to adverse regulatory actions or demographic/economic shifts in these areas.

- Sustained margin growth assumptions rely on customer adoption of natural gas for new developments, but accelerating secular decarbonization and electrification trends (e.g., public policies or shifts toward all-electric construction) could reduce long-term demand, jeopardizing future revenues and project returns.

- A successful outcome in the Florida City Gas depreciation study is assumed in 2025 full-year EPS guidance; failure to secure this regulatory approval, or regulatory pushback elsewhere, could result in higher ongoing depreciation expense and reduced net income, impacting earnings targets.

- Partial offset of strong transmission/distribution margins by rising O&M, depreciation, and financing expenses-as highlighted by cost overruns in projects (e.g., the LNG storage facility)-suggests operational or construction execution risk, which could erode projected margin/earnings growth if costs continue to rise or if regulatory cost recovery is delayed or denied.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $136.0 for Chesapeake Utilities based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $148.0, and the most bearish reporting a price target of just $120.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $970.0 million, earnings will come to $189.1 million, and it would be trading on a PE ratio of 23.6x, assuming you use a discount rate of 6.8%.

- Given the current share price of $125.96, the analyst price target of $136.0 is 7.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.