Last Update 10 Dec 25

CPK: Raised Price Outlook Will Highlight Earnings Consistency And Supportive Sector Backdrop

Analysts have raised their price target on Chesapeake Utilities to $128 from $120, citing updated group-wide utilities assumptions and a Q3 earnings preview that support a modestly higher valuation multiple despite largely unchanged fundamental forecasts.

Analyst Commentary

Bullish Takeaways

- Bullish analysts point to the higher price target as validation that the company can sustain steady earnings growth, even with minimal changes to underlying forecasts.

- The updated valuation reflects confidence that upcoming Q3 results will demonstrate consistent execution across the utilities portfolio and support a modest re rating of the shares.

- Improved group wide assumptions in the utilities sector are seen as a tailwind, potentially enhancing Chesapeake Utilities relative positioning and long term growth outlook.

- The Equal Weight stance combined with a higher target suggests limited downside near term, with risk reward viewed as balanced to slightly positive ahead of the earnings update.

Bearish Takeaways

- Bearish analysts emphasize that the rating remains neutral, signaling that upside from current levels may be constrained despite the higher price target.

- The largely unchanged fundamental forecasts imply that the new target is driven more by sector level adjustments than by company specific acceleration in growth.

- There is caution that any Q3 earnings miss or weaker guidance could quickly pressure the valuation, given the modest nature of the target increase.

- Some remain concerned that regulatory and cost inflation risks within the utilities group could cap margin expansion and limit multiple expansion over the medium term.

What's in the News

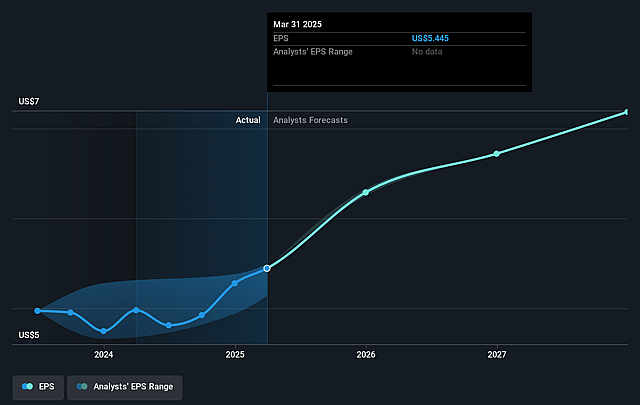

- Reaffirmed full year 2025 earnings guidance, maintaining EPS outlook of $6.15 to $6.35 per share, which underscores management confidence in the earnings trajectory (company guidance).

- The upcoming November 6, 2025 board meeting includes an agenda item to declare a quarterly cash dividend of $0.685 per share on common stock. This signals a continued commitment to shareholder returns (board meeting notice).

Valuation Changes

- Fair Value: Unchanged at $147.50, indicating no revision to the long term intrinsic value estimate.

- Discount Rate: Edged down slightly to 6.96 percent from 6.96 percent, a negligible shift in the company specific risk assessment.

- Revenue Growth: Essentially flat at about 3.92 percent, reflecting a stable medium term growth outlook.

- Net Profit Margin: Remained effectively unchanged at roughly 19.10 percent, signaling no material alteration in expected profitability.

- Future P/E: Steady at about 23.75x, suggesting no meaningful change in the valuation multiple applied to forward earnings.

Key Takeaways

- Modernizing energy infrastructure and expanding into high-growth regions positions Chesapeake Utilities for sustained revenue and margin growth.

- Strategic diversification into alternative fuels, along with regulatory successes and operational efficiencies, enhances earnings stability and long-term profitability.

- Heavy capital spending and geographic concentration, coupled with regulatory and decarbonization risks, threaten future margin expansion and expose the company to operational and financial vulnerability.

Catalysts

About Chesapeake Utilities- Operates as an energy delivery company in the United States.

- Substantial capital investment in energy infrastructure modernization (~$213M in first half 2025 and increased annual guidance to $375M–$425M) positions Chesapeake Utilities to capture growing demand and supports durable future rate base growth, directly boosting long-term revenue and earnings potential.

- Accelerating customer and population growth in high-expansion regions such as Florida and the Delmarva Peninsula (Q2 2025 residential customer growth of 4.2% in Delmarva, 3% in Florida) increases natural gas demand and enables incremental margin growth from customer additions, supporting revenue and net margin expansion.

- Strategic pipeline and RNG/alternative fuels projects (e.g., data center-related pipeline in Ohio, three new RNG transportation projects) broaden service offerings and tap into decarbonization trends, allowing for new revenue streams and improved margin mix over time.

- Favorable regulatory outcomes and constructive relationships (recent rate case approvals in Maryland, Delaware, Florida; successful interim FERC approvals for major projects) reduce earnings volatility and enable timely recovery of infrastructure investments, supporting steady net income and improved cash flow visibility.

- Ongoing business process improvements and ERP/IT upgrades drive operational efficiencies and cost management, amplifying the positive impact of revenue growth on adjusted net income and supporting higher future margins.

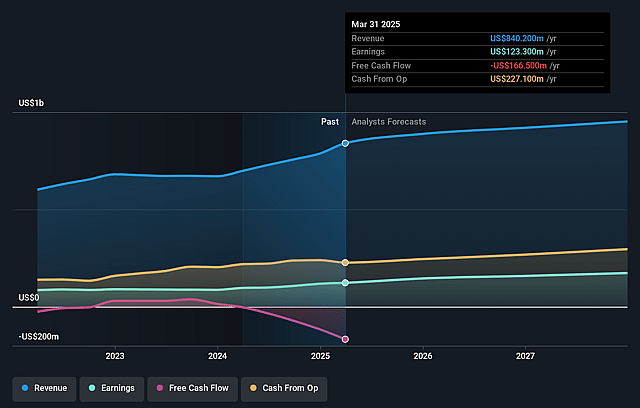

Chesapeake Utilities Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Chesapeake Utilities's revenue will grow by 4.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.9% today to 19.3% in 3 years time.

- Analysts expect earnings to reach $189.1 million (and earnings per share of $7.58) by about September 2028, up from $129.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.9x on those 2028 earnings, down from 22.7x today. This future PE is greater than the current PE for the US Gas Utilities industry at 17.6x.

- Analysts expect the number of shares outstanding to grow by 3.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Chesapeake Utilities Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Elevated capital spending requirements-such as the projected $1.5–$1.8 billion 5-year capital plan and recent $50 million increase in annual CapEx guidance-may necessitate higher debt and equity issuance, increasing financial leverage and diluting returns, which could compress net margins and earnings.

- Continued dependence on growth in specific service regions (Delmarva, Florida) and heavy investment in infrastructure for natural gas delivery may expose Chesapeake Utilities to geographic concentration risk, leaving revenue and customer growth vulnerable to adverse regulatory actions or demographic/economic shifts in these areas.

- Sustained margin growth assumptions rely on customer adoption of natural gas for new developments, but accelerating secular decarbonization and electrification trends (e.g., public policies or shifts toward all-electric construction) could reduce long-term demand, jeopardizing future revenues and project returns.

- A successful outcome in the Florida City Gas depreciation study is assumed in 2025 full-year EPS guidance; failure to secure this regulatory approval, or regulatory pushback elsewhere, could result in higher ongoing depreciation expense and reduced net income, impacting earnings targets.

- Partial offset of strong transmission/distribution margins by rising O&M, depreciation, and financing expenses-as highlighted by cost overruns in projects (e.g., the LNG storage facility)-suggests operational or construction execution risk, which could erode projected margin/earnings growth if costs continue to rise or if regulatory cost recovery is delayed or denied.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $136.2 for Chesapeake Utilities based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $148.0, and the most bearish reporting a price target of just $120.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $978.1 million, earnings will come to $189.1 million, and it would be trading on a PE ratio of 21.9x, assuming you use a discount rate of 6.8%.

- Given the current share price of $124.24, the analyst price target of $136.2 is 8.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Chesapeake Utilities?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.