Narratives are currently in beta

Key Takeaways

- CenterPoint's infrastructure and grid enhancements aim to improve reliability, customer satisfaction, and revenue, while stabilizing earnings through reduced outages.

- Strategic expansions and regulatory strategies are designed to boost service reliability, revenue, and net margins by aligning ROE and efficiently managing costs.

- Substantial investments and regulatory dependencies could pressure margins and earnings, with potential equity issuance causing share dilution.

Catalysts

About CenterPoint Energy- Operates as a public utility holding company in the United States.

- The Greater Houston Resiliency Initiative (GHRI) aims to enhance the resiliency and reliability of CenterPoint Energy's grid by accelerating investments in the distribution system, which could lead to fewer outages and improved customer satisfaction, thereby potentially increasing future revenue and stabilizing earnings.

- Significant infrastructure investments, including converting 69 kV transmission lines to 138 kV, upgrading transmission structures, and improving substation flood risk management, are expected to reduce regulatory lag and lead to improved regulatory outcomes, supporting future earnings growth.

- Strong organic growth in the Houston Electric Service Territory, driven by a fast-increasing customer base and demand from industries like hydrogen and data centers, is poised to boost revenue substantially, as population and industrial electrification grow.

- CenterPoint's proactive regulatory strategy, including anticipated filings to recover recent investment costs, aims to improve earned return on equity (ROE) closer to the allowed level, thereby positively impacting net margins and earnings.

- Strategic expansion plans to further automate the grid with intelligent grid switching devices and trip savers are expected to enhance service reliability, reduce downtime, and attract and retain more customers, which could lead to increased revenue and improved net margins.

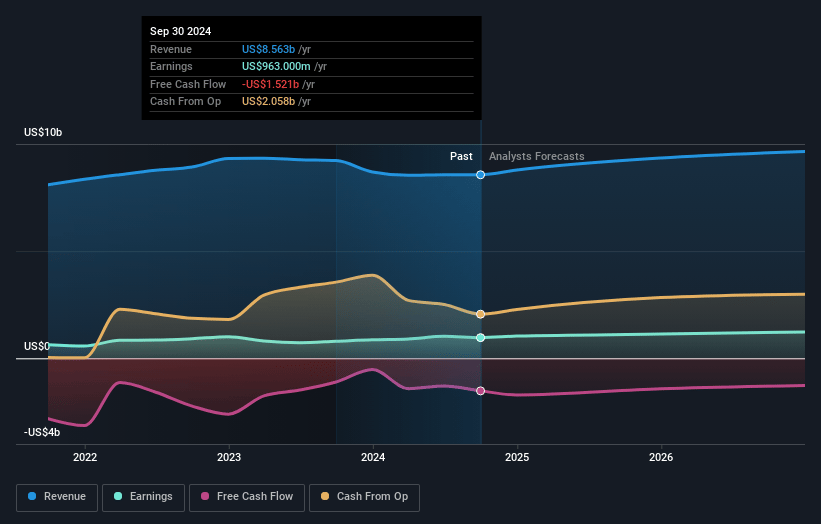

CenterPoint Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CenterPoint Energy's revenue will grow by 5.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.2% today to 13.1% in 3 years time.

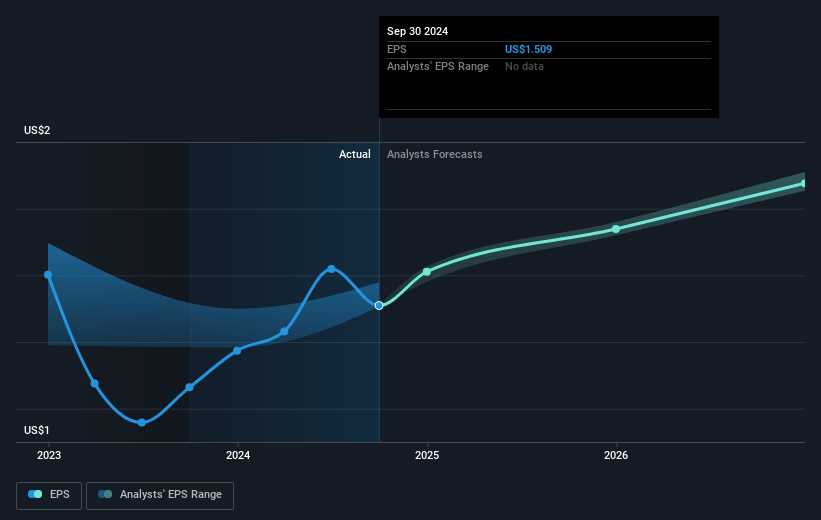

- Analysts expect earnings to reach $1.3 billion (and earnings per share of $1.99) by about November 2027, up from $963.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.4x on those 2027 earnings, down from 20.6x today. This future PE is lower than the current PE for the US Integrated Utilities industry at 20.3x.

- Analysts expect the number of shares outstanding to grow by 0.77% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

CenterPoint Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The substantial investment in storm restoration ($1.6 billion) and additional $5 billion in resiliency investments may result in increased expenses that potentially impact net margins if costs cannot be fully recovered or if there is regulatory lag.

- The withdrawal of the Houston Electric rate case filing could create uncertainty and delay in revenue recovery, possibly affecting future earnings and financial stability.

- Increased operational expenses (O&M) due to the accelerated Greater Houston Resiliency Initiative may pressure short-term earnings, especially if these costs are not recoverable, impacting net profits.

- There is a significant dependency on favorable regulatory outcomes and securitization approvals to maintain revenue and earnings growth, presenting a risk to future financial performance if these outcomes are less positive than anticipated.

- Future equity issuance (additional $1.25 billion through 2030) to support increased capital investment could result in share dilution, potentially impacting earnings per share growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $30.9 for CenterPoint Energy based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $10.1 billion, earnings will come to $1.3 billion, and it would be trading on a PE ratio of 18.4x, assuming you use a discount rate of 5.9%.

- Given the current share price of $30.41, the analyst's price target of $30.9 is 1.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives