Key Takeaways

- Dynamic market conditions and reduced pricing power are expected to challenge growth in the Manufacturing and Plastics segments, impacting future revenue and earnings.

- Significant capital investments and regulatory uncertainties could strain financials and impact margins if costs are not fully recovered through rates.

- Otter Tail's strategic expansion in utilities and clean energy, bolstered by a stable financial position, positions it for sustained growth and shareholder returns.

Catalysts

About Otter Tail- Engages in electric utility, manufacturing, and plastic pipe businesses in the United States.

- The expectation of continued challenges in the Manufacturing and Plastics segments due to dynamic market conditions, including lower sales volumes and reduced pricing power, could put pressure on future revenue and earnings growth.

- Revenue growth could be impacted by the anticipation that plastic segment earnings will decline through 2027, with a normalized level not expected until 2028 due to declining PVC pipe prices and increasing raw material costs.

- The execution of the significant capital investment in solar and transmission projects, while promising future growth, carries risks regarding regulatory approvals and execution efficiency, which could affect anticipated earnings and net margins.

- The planned $1.4 billion capital spending for Otter Tail Power, aimed at long-term rate base growth but partially dependent on regulatory recovery, could strain financials and impact net margins if costs are not fully recovered through existing rates.

- The uncertainty in securing new large load agreements could result in underutilized capacity, potentially affecting revenue growth prospects if anticipated large customers do not materialize as expected.

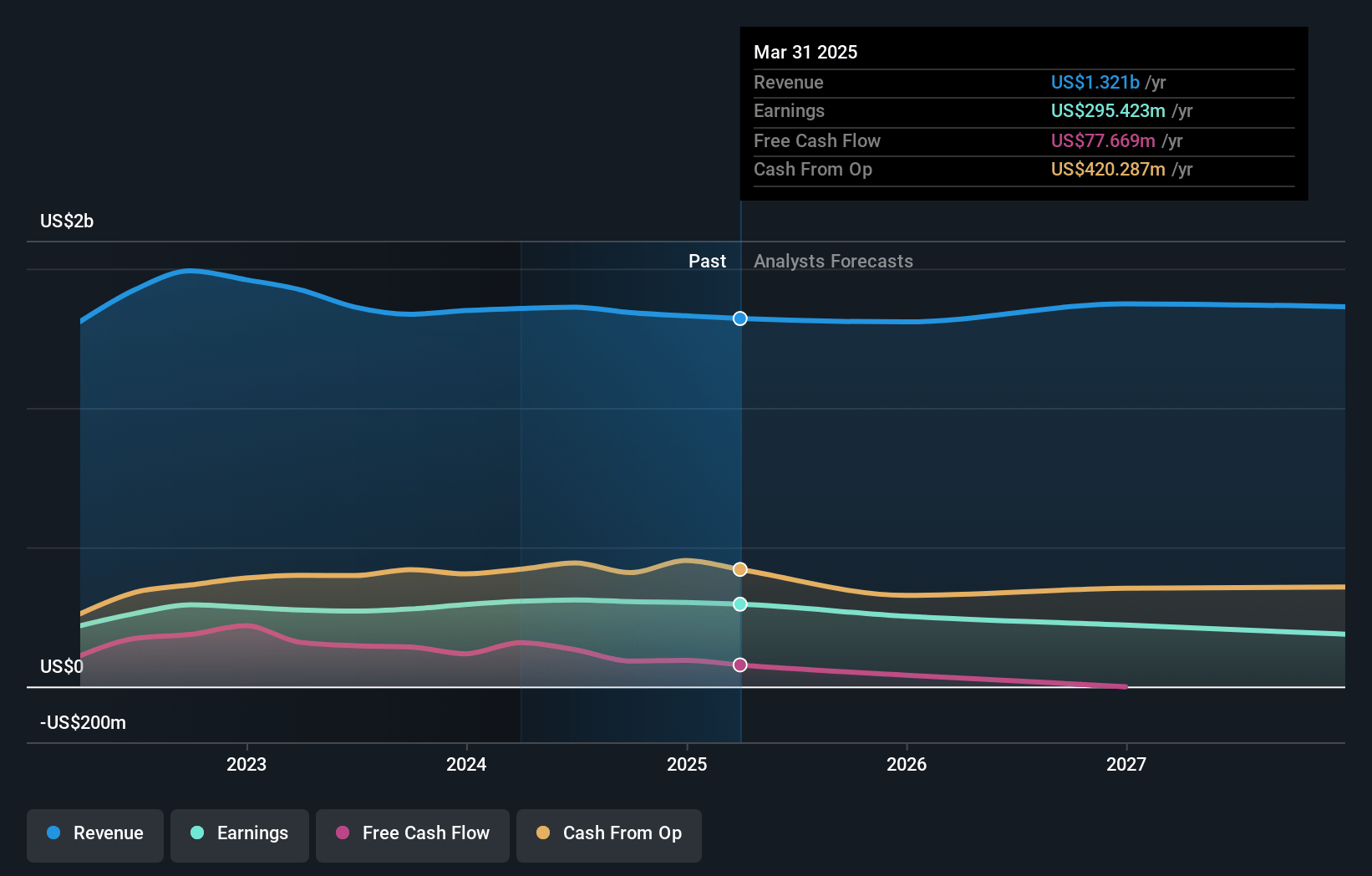

Otter Tail Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Otter Tail's revenue will decrease by 0.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 22.7% today to 13.8% in 3 years time.

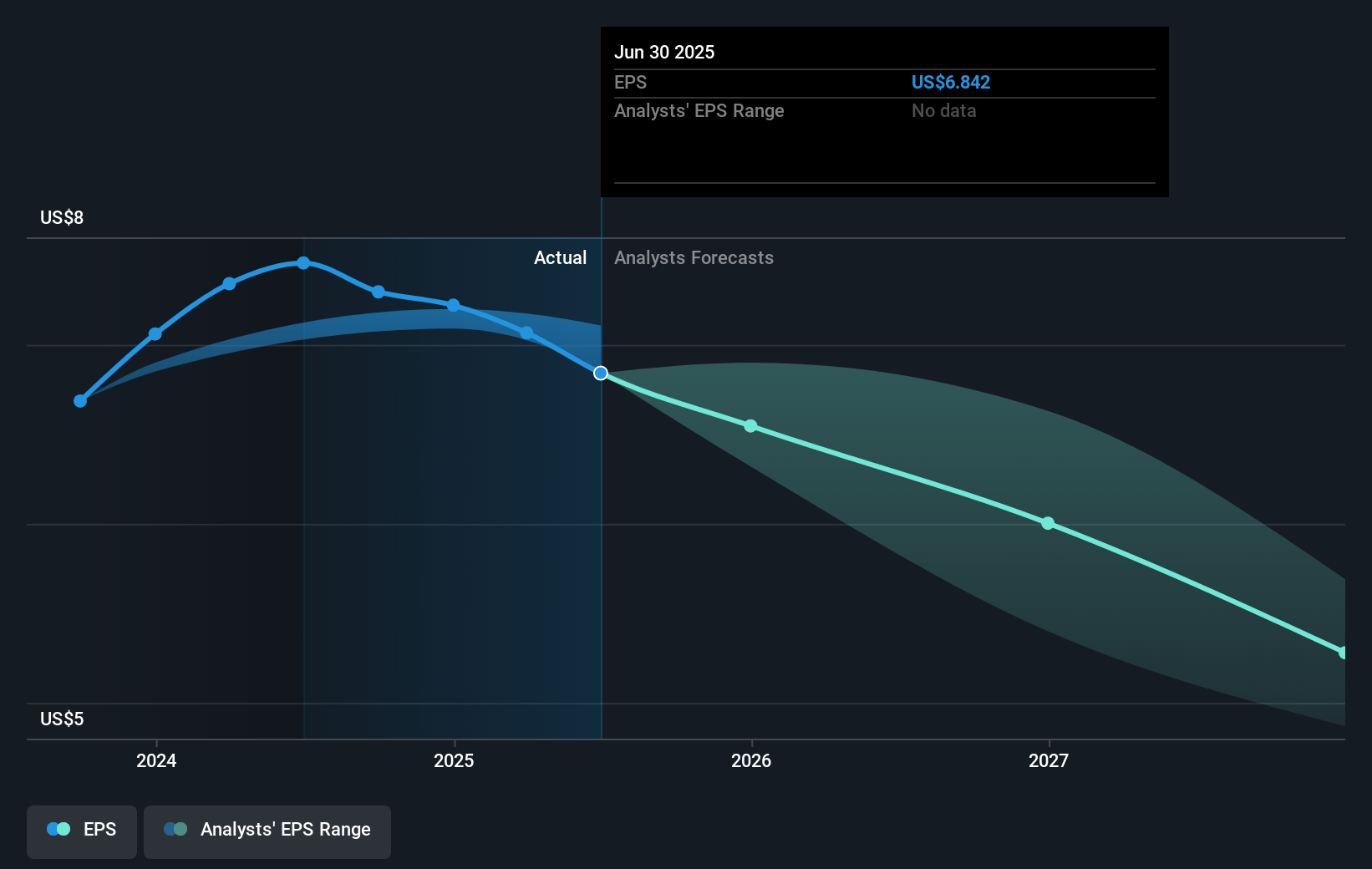

- Analysts expect earnings to reach $188.0 million (and earnings per share of $5.08) by about April 2028, down from $301.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.4x on those 2028 earnings, up from 10.9x today. This future PE is greater than the current PE for the US Electric Utilities industry at 20.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Otter Tail Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Otter Tail Corporation has announced a 5-year capital spending plan of $1.4 billion for Otter Tail Power, which is an increase of 9% over the previous plan, demonstrating strong financial commitment and potentially supporting robust earnings growth. This increased investment in utilities could positively impact the company's revenue and net margins.

- With an increased long-term earnings per share growth target of 6% to 8%, Otter Tail Corporation shows confidence in its ability to sustain and grow earnings, potentially contradicting expectations of a share price decrease due to solid projected financial performance.

- The approval of a $13.1 million net annual revenue requirement increase from the North Dakota general rate case creates an opportunity for increased revenue and positively impacts the financial stability and earnings of Otter Tail Power by maintaining lower regulatory lag and efficient cost recovery.

- The company's strategic initiatives, including the expansion into solar and wind energy projects, are likely to harness government incentives and tax credits while positioning the company as a leader in clean energy, potentially boosting long-term revenue and maintaining affordable rates.

- Otter Tail's strong balance sheet, with no expected need for equity issuances in the next 5 years, combined with a track record of 86 consecutive years of dividend payments, indicates a stable financial position and potential for consistent shareholder returns, contradicting the belief of a future share price decrease.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $82.0 for Otter Tail based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $188.0 million, and it would be trading on a PE ratio of 21.4x, assuming you use a discount rate of 6.2%.

- Given the current share price of $78.53, the analyst price target of $82.0 is 4.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.