Narratives are currently in beta

Key Takeaways

- The Manufacturing and Plastics segments face demand headwinds and pricing pressures, risking revenue, profit margins, and earnings growth adversely.

- Legal liabilities, capital-intensive projects, and execution risks in renewable energy and infrastructure investments pose potential challenges to financial health and future earnings.

- Otter Tail shows strong growth potential in Electric and Plastics segments, underpinned by strategic investments and a robust balance sheet supporting sustainable earnings.

Catalysts

About Otter Tail- Engages in electric utility, manufacturing, and plastic pipe businesses in the United States.

- Otter Tail's Manufacturing segment is facing significant demand-related headwinds across key end markets, such as recreational vehicle, agriculture, construction, and lawn and garden. This decreased demand is likely contributing to a negative outlook on sales volumes and could impact overall revenue and profit margins adversely in the near term.

- The company's Plastics segment is experiencing a decline in PVC pipe prices, which are expected to continue falling over time despite current demand moderating the rate of decline. This trend could compress profit margins and affect overall earnings growth.

- The ongoing class action lawsuits against pipe manufacturers, including Otter Tail, could present legal liabilities and uncertainties, potentially leading to unexpected costs that may affect net margins and future earnings.

- The Electric segment is embarking on a sizable 5-year capital spending plan, including investments in renewable generation and transmission. While this plan aims to support long-term growth, the significant upfront costs and regulatory challenges could impact financial health if anticipated benefits do not materialize, potentially affecting both net margins and earnings.

- Otter Tail’s focus on wind repowering projects and advanced metering infrastructure, while positioned as investments for future growth, involve substantial capital outlay and carry execution risks which could stress cash flows and earnings if not effectively managed or if expected returns are delayed.

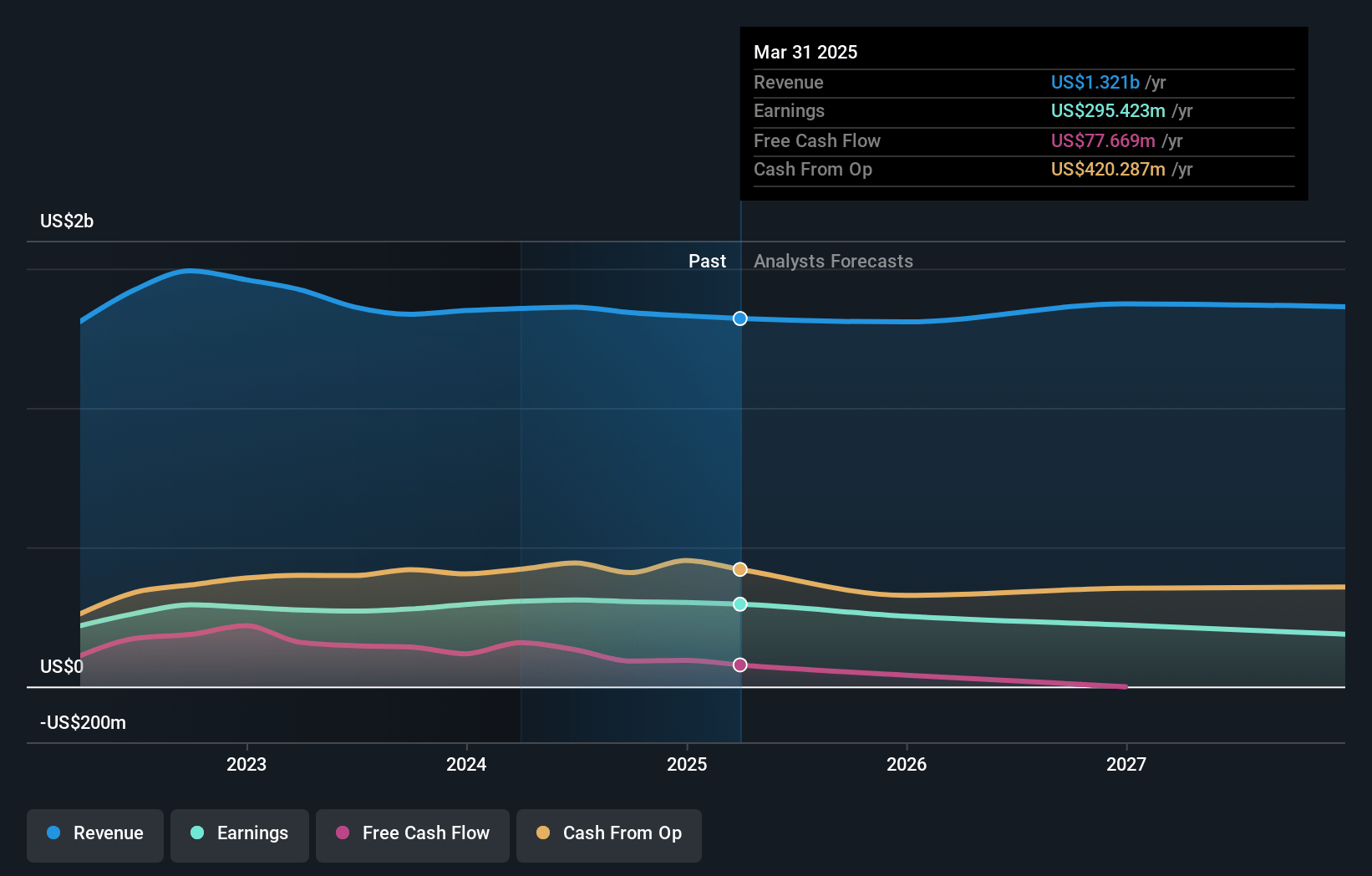

Otter Tail Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Otter Tail's revenue will grow by 1.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 22.7% today to 11.6% in 3 years time.

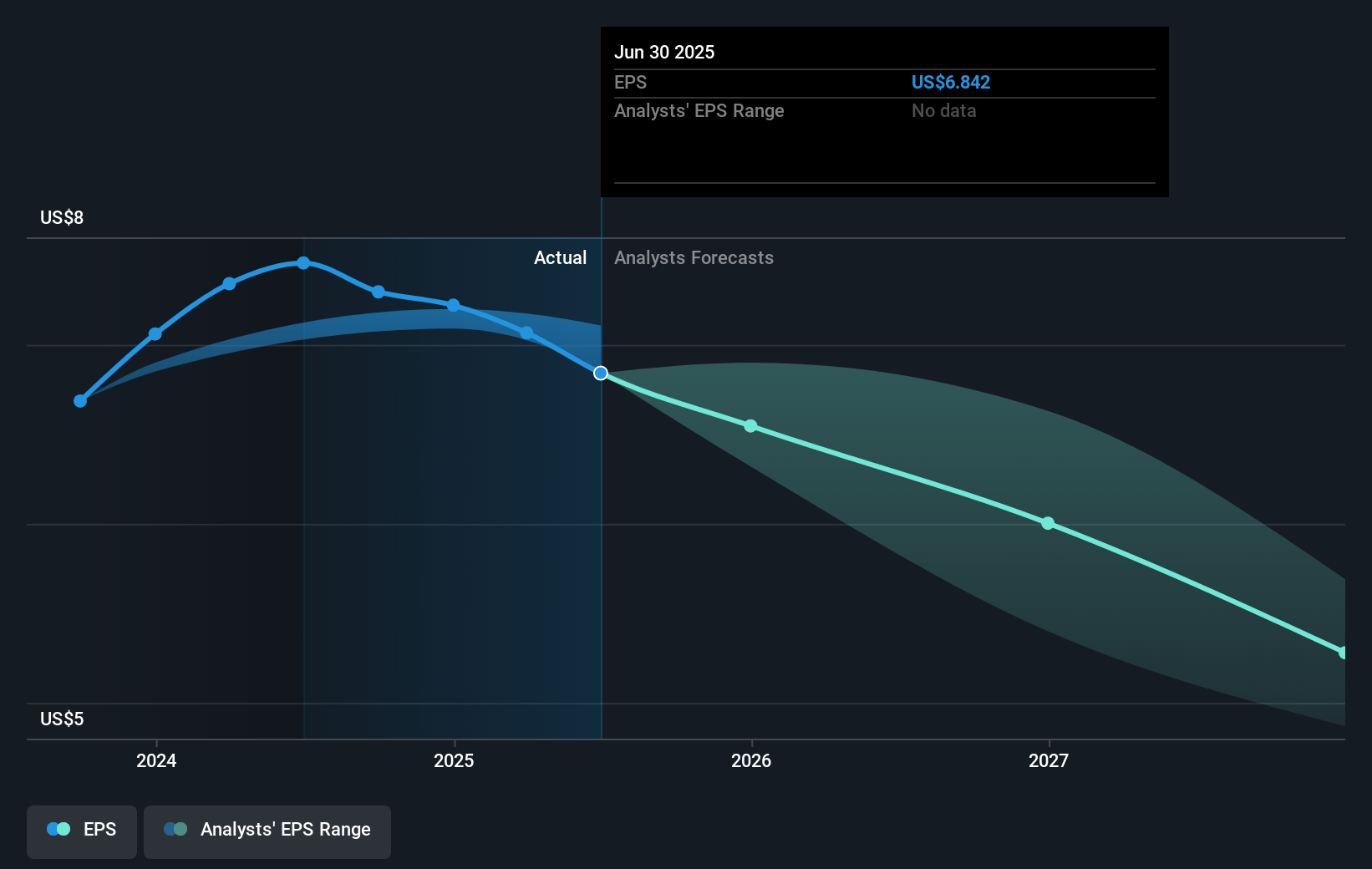

- Analysts expect earnings to reach $164.9 million (and earnings per share of $4.23) by about November 2027, down from $304.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.8x on those 2027 earnings, up from 11.0x today. This future PE is greater than the current PE for the US Electric Utilities industry at 20.8x.

- Analysts expect the number of shares outstanding to decline by 2.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Otter Tail Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The Electric segment is experiencing significant growth, with earnings increasing by 16%, driven by factors such as interim rates in North Dakota and favorable transmission return on equity rulings, which could boost overall earnings.

- Otter Tail is projecting a potentially record year in annual earnings, demonstrating strong financial performance, especially within the Plastics segment, which is anticipated to perform better than expected, impacting net margins positively.

- The company's strategic capital spending plan focuses on renewable generation and transmission investments, expected to produce a rate base growth of 7.7%, indicating potential for revenue growth in the Electric segment.

- Despite declines in sales prices for PVC pipes, the Plastics segment performance has exceeded expectations due to customer volume growth and demand improvements, suggesting resilience in revenue generation and potential for sustaining higher-than-anticipated earnings.

- The company's strong balance sheet, with significant liquidity and a high return on equity (over 20%), positions it well to execute long-term growth plans without equity needs, supporting stable profit margins and financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $81.0 for Otter Tail based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.4 billion, earnings will come to $164.9 million, and it would be trading on a PE ratio of 22.8x, assuming you use a discount rate of 5.9%.

- Given the current share price of $80.31, the analyst's price target of $81.0 is 0.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives