Narratives are currently in beta

Key Takeaways

- Regulatory uncertainties may affect earnings, but infrastructure improvements and strategic moves could boost operational efficiency and net margins.

- Commitment to capital investment and increased capacity may bolster revenue, meeting demand and supporting growth targets.

- Delays in interim rates, increased wildfire insurance costs, and regulatory uncertainties could undermine NorthWestern Energy Group's financial stability and growth prospects.

Catalysts

About NorthWestern Energy Group- Provides electricity and natural gas to residential, commercial, and various industrial customers.

- The delay in Montana interim rates presents significant regulatory uncertainty, but if resolved positively, it could improve earnings by increasing approved pricing. This would likely impact revenue and net margins as the rates affect the company's ability to recover costs.

- The Yellowstone County Generating Station recently went online, adding generating capacity anticipated to bolster revenue streams and earnings by meeting customer demand more effectively.

- The $700 million GRIP grant from the Department of Energy, which includes $21 million for NorthWestern Energy, is earmarked for infrastructure improvements that could lead to increased operational efficiency and reliability, positively affecting net margins and revenue.

- Potential buyouts of power purchase agreements (PPAs) and existing agreements signify strategic moves that may reduce operating costs and improve net margins by optimizing NorthWestern Energy's energy supply portfolio.

- Capital investment plans remain unchanged despite current challenges, indicating commitment to long-term growth and a stable financial outlook, potentially enhancing earnings and supporting EPS growth targets.

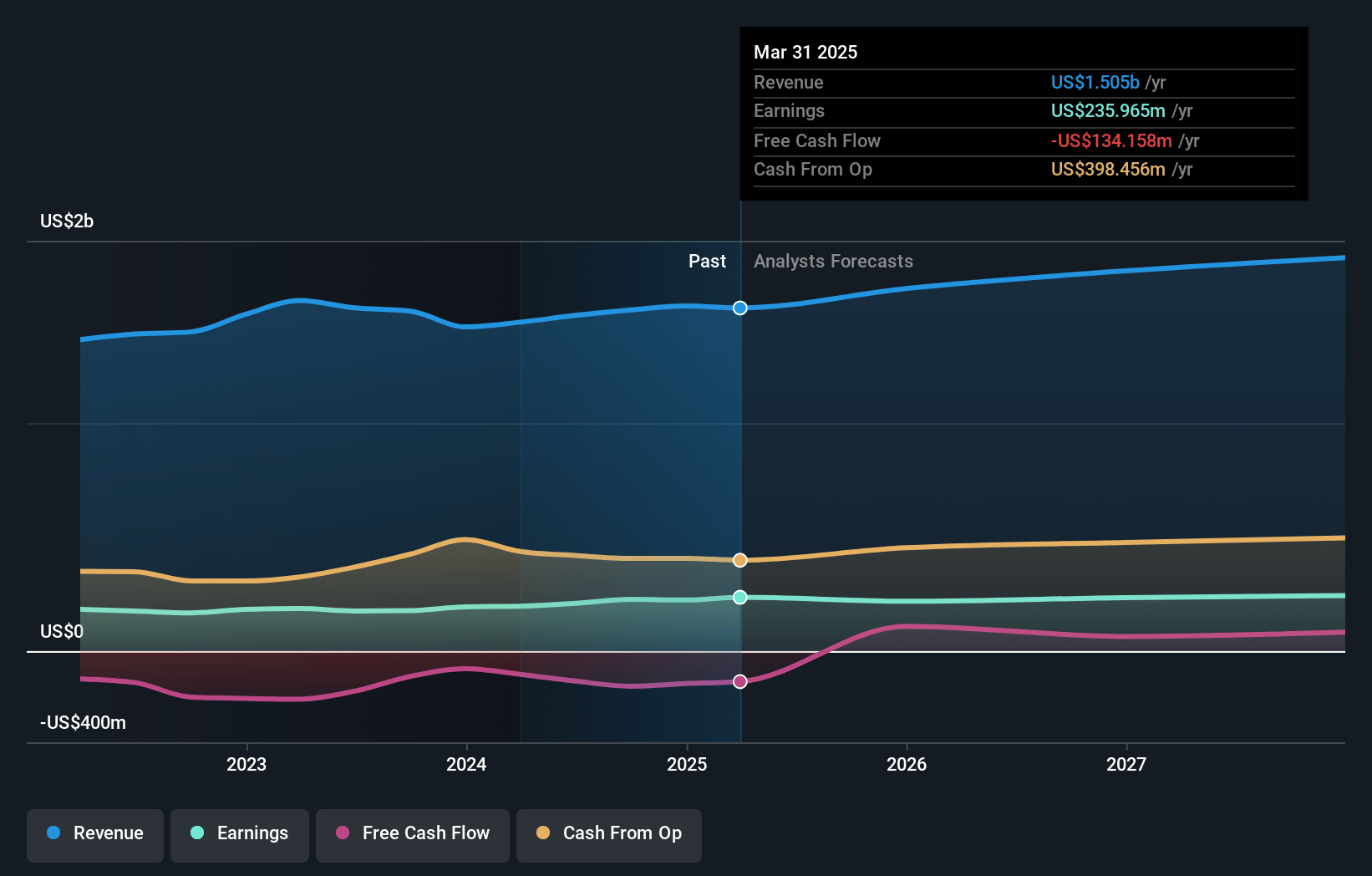

NorthWestern Energy Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NorthWestern Energy Group's revenue will grow by 3.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 15.1% today to 14.7% in 3 years time.

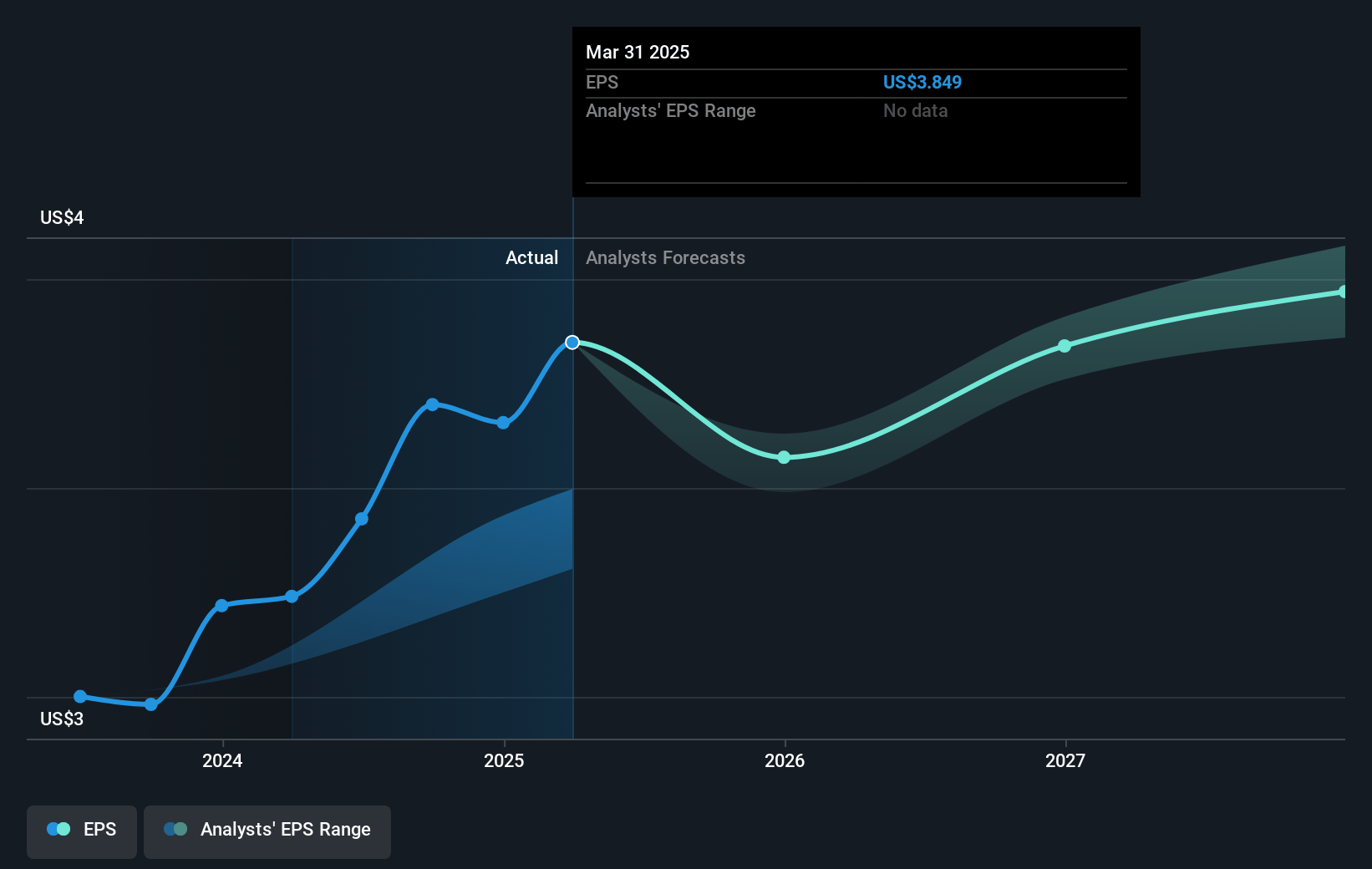

- Analysts expect earnings to reach $244.6 million (and earnings per share of $3.99) by about November 2027, up from $226.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.2x on those 2027 earnings, up from 14.9x today. This future PE is lower than the current PE for the US Integrated Utilities industry at 20.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

NorthWestern Energy Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The delay in interim rates in Montana could impact revenues and cash flow, affecting the financial outlook and increasing the cost of capital for NorthWestern Energy Group.

- Increased insurance costs due to wildfire coverage present a risk to net margins, as these higher expenses may offset earnings growth.

- The complex regulatory environment and election uncertainties may lead to financial unpredictability, which can undermine earnings targets and the company's growth prospects.

- The potential need for significant investment in environmental compliance for facilities like Colstrip could strain capital resources, impacting net income and dividend sustainability.

- High dividend yield relative to peers may indicate stock underperformance or market skepticism about future earnings growth, affecting stock price appreciation projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $58.0 for NorthWestern Energy Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $68.0, and the most bearish reporting a price target of just $51.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.7 billion, earnings will come to $244.6 million, and it would be trading on a PE ratio of 17.2x, assuming you use a discount rate of 5.9%.

- Given the current share price of $55.27, the analyst's price target of $58.0 is 4.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives