Last Update 13 Dec 25

Fair value Increased 4.71%NWE Q3 Momentum And Merger Progress Will Shape Moderate Outlook

Analysts have modestly raised their price target on NorthWestern Energy Group to approximately $62 from about $59. They cite the company’s better than expected recent results, slightly improved margin outlook, and reaffirmed earnings and capital investment plans as key supports for a higher fair value, despite a marginally higher discount rate and somewhat slower projected revenue growth.

Analyst Commentary

Analyst opinions on NorthWestern Energy Group reflect a balanced view, with recognition of solid recent execution alongside lingering questions about long term growth and financing risks.

Bullish Takeaways

- Bullish analysts highlight the consistent earnings delivery, with Q3 adjusted EPS and revenue both topping expectations, as evidence that management can execute within a regulated framework while managing cost pressures.

- The reaffirmed 4 percent to 6 percent long term EPS growth outlook and rate base growth guidance are seen as supportive of valuation, suggesting a visible, utility like growth runway anchored by a clearly defined capital plan.

- The $2.7 billion capital investment plan for 2025 to 2029 is viewed as a key driver of future earnings and cash flow, with incremental upside possible from additional generation, transmission, or strategic projects if they are structured on attractive regulatory terms.

- The planned merger with Black Hills Corporation is seen by some as a strategic positive that could enhance scale, diversify the portfolio, and ultimately improve the company’s cost of capital if regulatory approvals proceed as anticipated.

Bearish Takeaways

- Bearish analysts remain cautious on the stock’s ability to outperform if revenue growth slows relative to peers, particularly if regulatory or macro headwinds constrain the pace at which the rate base can expand.

- The reliance on secured debt issuances to fund the multi year capital program raises concerns about balance sheet flexibility and interest rate sensitivity, especially if additional equity is required to fund incremental investments.

- Some are wary that the merger timeline and regulatory approvals in multiple jurisdictions introduce execution risk, with the possibility of delays, additional conditions, or required concessions that could dilute the transaction’s expected benefits.

- The Equal Weight positioning from more neutral voices reflects a view that, while fundamentals are stable, current valuation may already discount much of the visible growth, leaving limited upside without clearer catalysts or stronger than guided earnings acceleration.

What's in the News

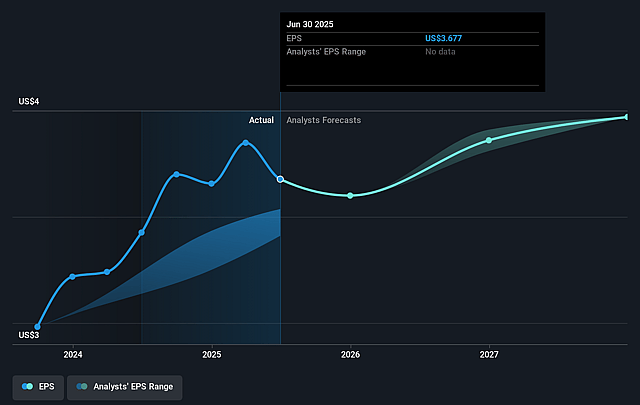

- Reaffirmed FY25 adjusted EPS guidance of 3.53 to 3.65 dollars, bracketing consensus of 3.58 dollars, and maintained a long-term 4 percent to 6 percent diluted EPS growth outlook off a 2024 adjusted EPS baseline of 3.40 dollars (Periodicals)

- Confirmed a 2.7 billion dollar capital investment plan for 2025 to 2029, expected to support 4 percent to 6 percent annual rate base growth from an updated 2024 base of approximately 5.4 billion dollars, funded primarily through cash from operations and secured debt (Periodicals)

- Posted Q3 adjusted EPS of 79 cents versus consensus of 75 cents and revenue of 387 million dollars versus 376.04 million dollars expected, reflecting continued operational and financial outperformance (Periodicals)

- Advanced strategic initiatives, including closing the Energy West acquisition, integrating natural gas distribution assets, and adding roughly 40 employees and 33,000 customers to the system (Periodicals)

- Progressed the proposed merger with Black Hills Corporation, with regulatory applications filed in Montana, South Dakota, and Nebraska and an anticipated closing in the back half of 2026, subject to approvals (Periodicals)

Valuation Changes

- Fair Value Estimate has risen modestly from approximately 59.40 dollars to about 62.20 dollars, reflecting a slightly higher assessed intrinsic value per share.

- Discount Rate has increased slightly from about 6.78 percent to roughly 6.96 percent, implying a modestly higher required return and risk assessment.

- Revenue Growth has slowed meaningfully in projections, from around 5.51 percent annually to roughly 4.20 percent, indicating more conservative top line expectations.

- Net Profit Margin has improved moderately from about 13.92 percent to approximately 14.61 percent, suggesting a more favorable long term profitability outlook.

- Future P/E has edged up slightly from roughly 17.66 times to about 17.89 times forward earnings, indicating a marginally higher valuation multiple on expected earnings.

Key Takeaways

- Accelerating data center demand and legislative reforms are driving strong growth prospects, reduced risks, and greater earnings stability for the company.

- Population growth and regulatory advantages provide a stable, expanding customer base and improved margins through proactive capital investment and flexible service strategies.

- Reliance on coal, regulatory and infrastructure risks, limited diversification, and potential disruption from distributed energy threaten earnings growth and stable returns.

Catalysts

About NorthWestern Energy Group- NorthWestern Energy Group, Inc., doing business as NorthWestern Energy, provides electricity and natural gas to residential, commercial, and various industrial customers.

- NorthWestern is poised to benefit from outsized load growth driven by accelerating data center demand in Montana and South Dakota, which is likely to support above-trend revenue and earnings growth as long-term electrification of industry and digital infrastructure unfolds.

- Recent legislative reform (Montana wildfire liability law and streamlined transmission approvals) meaningfully reduces operational risk and regulatory uncertainty, positioning the company to invest aggressively in grid modernization and transmission upgrades-supporting long-term capital deployment and earnings stability.

- Population growth and migration to the company's service territories (rural and secondary markets) provides a stable and potentially expanding customer base, undergirding consistent cash flow and reducing downside volatility in revenues.

- Near-term resolution of pending rate cases and the ability to retroactively recover certain costs (e.g., Montana rate review impacts, Colstrip facility acquisition filings) are set to improve margins and earnings visibility over the next several years.

- NorthWestern's flexible approach to serving large loads-including FERC-regulated options and utility-owned generation investments-allows for incremental growth opportunities as electrification and power demand for data centers continues to accelerate, supporting both rate base expansion and net margin improvement.

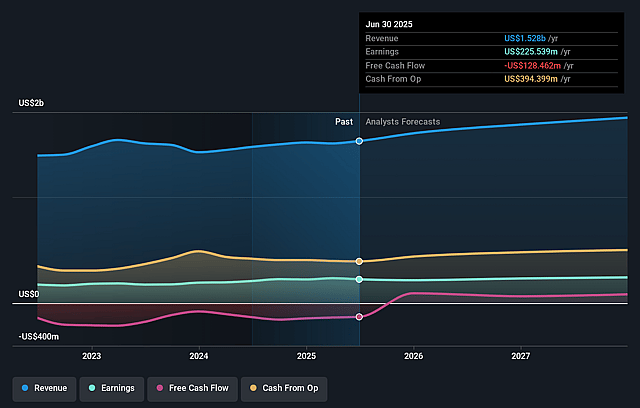

NorthWestern Energy Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NorthWestern Energy Group's revenue will grow by 5.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 14.8% today to 13.9% in 3 years time.

- Analysts expect earnings to reach $249.8 million (and earnings per share of $4.07) by about September 2028, up from $225.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.7x on those 2028 earnings, up from 15.4x today. This future PE is lower than the current PE for the US Integrated Utilities industry at 19.7x.

- Analysts expect the number of shares outstanding to grow by 0.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

NorthWestern Energy Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- NorthWestern's continued reliance on the Colstrip coal plant and recent acquisitions increasing its coal-fired generation exposure run counter to accelerating state and federal decarbonization policies, which could lead to future regulatory compliance costs, asset impairment risk, or stranded asset scenarios, negatively impacting net margins and long-term earnings.

- The recent decline in quarterly earnings and cash flows compared to prior periods, which management attributes to delayed rate recovery, exposes a vulnerability to regulatory lag and reliance on favorable rate case outcomes-if future state regulatory decisions (particularly for Colstrip cost recovery) are unfavorable, revenue and earnings growth could be significantly curtailed.

- Heavy capital expenditure requirements to modernize aging infrastructure and meet evolving load (including data centers) place sustained pressure on free cash flow and may necessitate higher debt levels, thus increasing interest expense and potentially constraining dividend growth or eroding returns on equity.

- NorthWestern's limited customer and geographic diversification, with key earnings driven by regulatory outcomes in Montana and South Dakota, heightens risk from localized economic downturns, policy changes (such as new Montana property tax legislation), or region-specific operational disruptions, leading to potential volatility in revenue streams and top-line stability.

- Dependence on centralized, utility-owned generation and transmission assets may be undercut over time by broadening adoption of distributed generation, customer-owned renewables, and energy storage, which could gradually reduce monopoly customer load and revenue base, challenging the traditional rate base growth model and pressuring long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $59.4 for NorthWestern Energy Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $69.0, and the most bearish reporting a price target of just $56.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.8 billion, earnings will come to $249.8 million, and it would be trading on a PE ratio of 17.7x, assuming you use a discount rate of 6.8%.

- Given the current share price of $56.65, the analyst price target of $59.4 is 4.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on NorthWestern Energy Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.