Key Takeaways

- Rate increases and strategic CSA adjustments are set to enhance revenue and earnings stability by addressing inflation and cost reflection.

- Infrastructure investment, organic growth, and acquisitions aim to expand service capacity, customer base, and improve future earnings potential.

- Regulatory risks, declining ICFA revenue, rising expenses, and inflation pressures challenge Global Water Resources, impacting earnings stability and future growth amid necessary capital investment.

Catalysts

About Global Water Resources- A water resource management company, owns, operates, and manages regulated water, wastewater, and recycled water systems primarily in metropolitan Phoenix and Tucson, Arizona.

- The proposed rate increases totaling over $7.5 million, expected to be effective in phases starting in 2025, are likely to enhance future revenue by adjusting for inflation and increased operating costs since the last rate case in 2019.

- Significant investment in infrastructure, with $32.3 million spent in 2024 to improve utilities, is anticipated to support expanded service capacity and meet growing demand, potentially boosting future earnings.

- Organic growth driven by increasing active service connections, supported by a 20.3% increase in building permits in the Phoenix metropolitan area and a significant jump in multifamily housing permits, is expected to amplify future revenue streams.

- The approval of acquisitions, such as the City of Tucson assets, and settlements of rate cases increase customer base and revenue potential, which will likely drive economies of scale and improve net margins.

- Strategic initiatives like the proposed Cost of Service Adjustment (CSA) could lead to more timely rate adjustments reflecting current costs and investments, reducing regulatory lag and improving earnings stability.

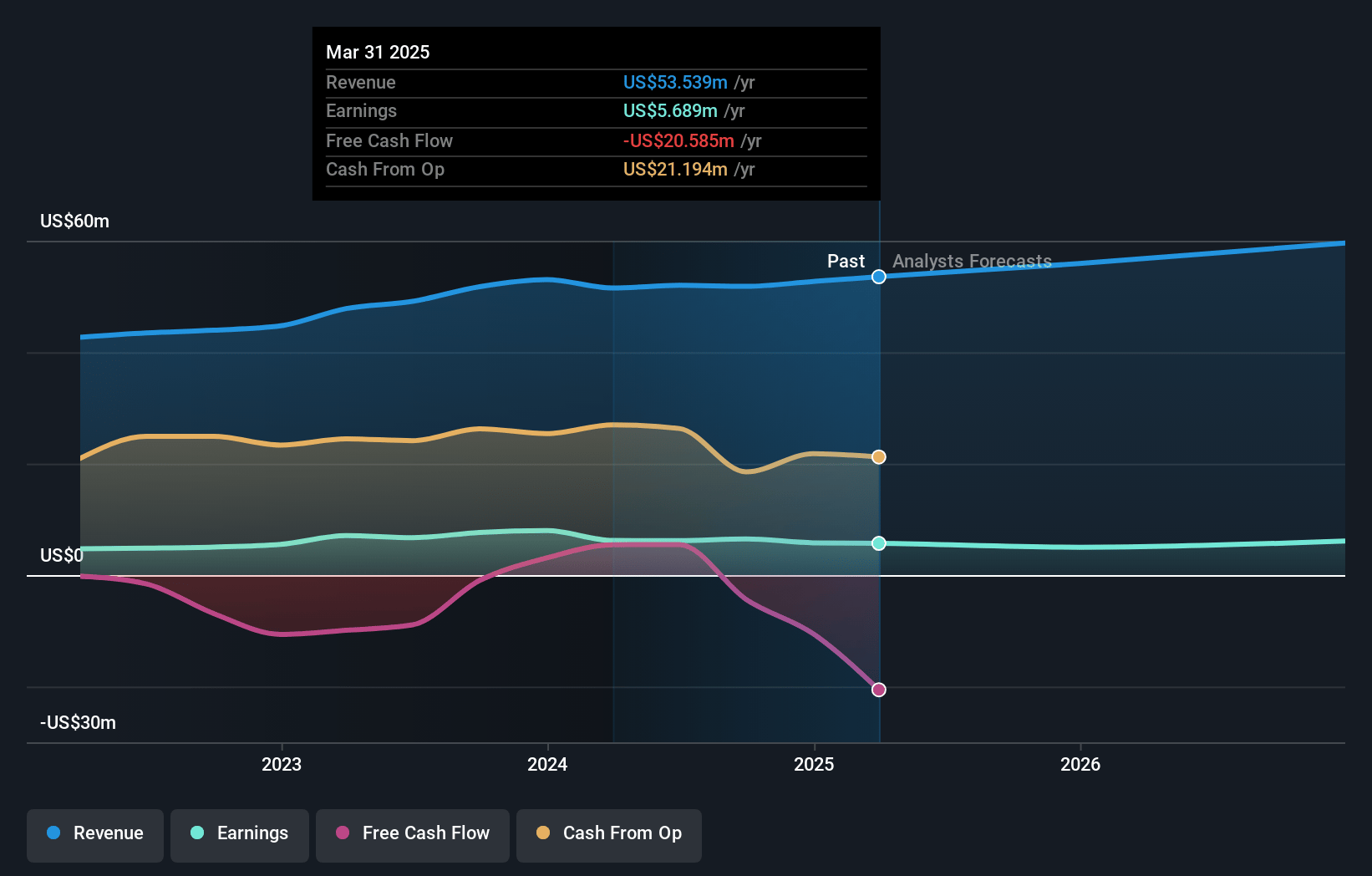

Global Water Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Global Water Resources's revenue will grow by 5.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 11.0% today to 8.9% in 3 years time.

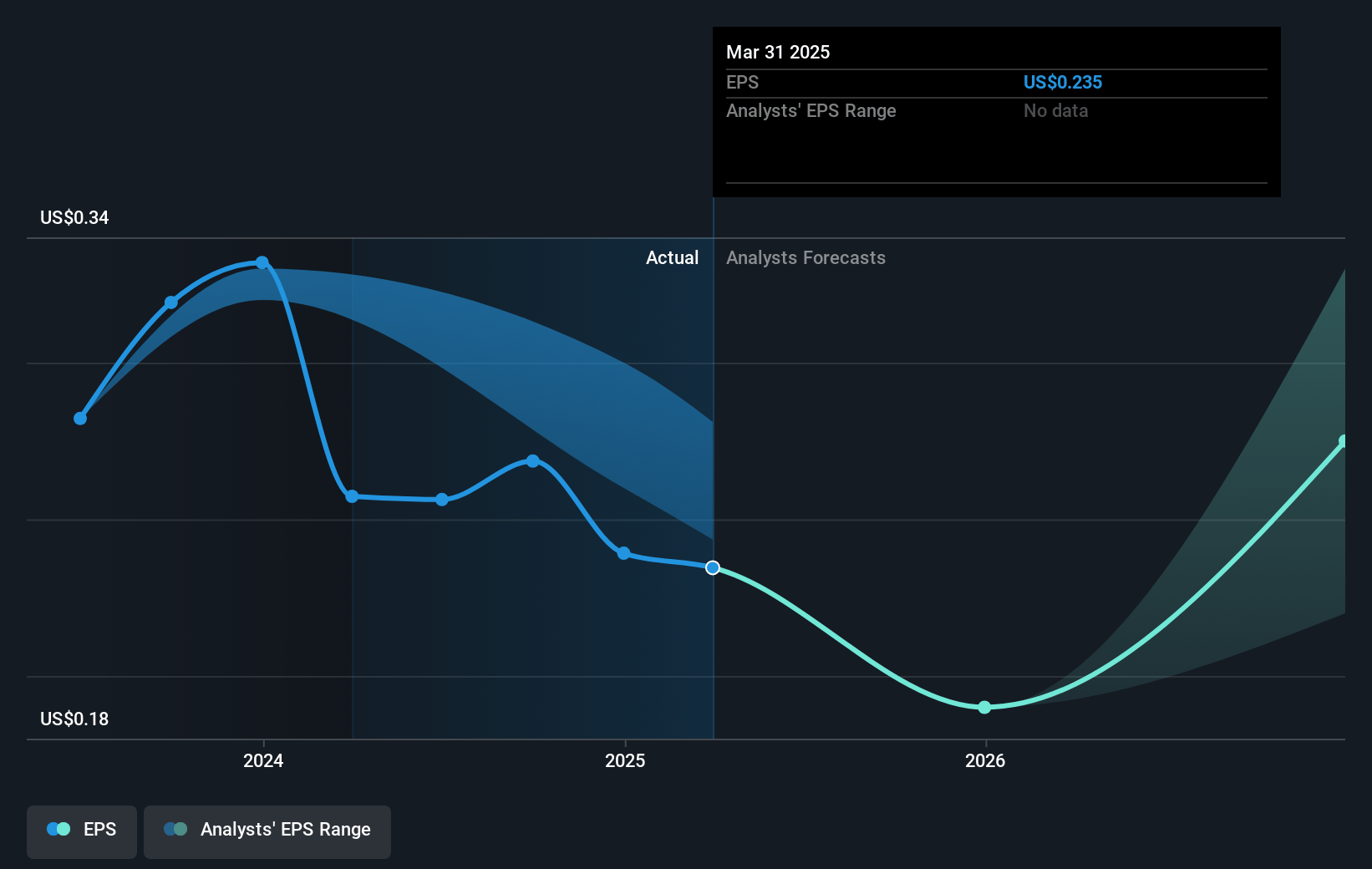

- Analysts expect earnings to reach $5.5 million (and earnings per share of $0.34) by about March 2028, down from $5.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 86.2x on those 2028 earnings, up from 46.7x today. This future PE is greater than the current PE for the US Water Utilities industry at 24.1x.

- Analysts expect the number of shares outstanding to grow by 0.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Global Water Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The proposed rate increase for Global Water Resources relies on approval from the Arizona Corporation Commission, which involves regulatory risks that could impact future revenue if the requested $6.5 million increase is not granted in full.

- Decline in revenue from infrastructure coordination and financing agreements (ICFAs), which are variable and dependent on developer activity, introduced volatility and led to a decrease in total revenue by 0.6% in 2024, potentially impacting earnings stability.

- Operating expenses increased by 6.3% in 2024, driven by higher depreciation, medical expenses, and wages, which could further pressure net margins if not offset by increased revenue or rate adjustments.

- Inflation and cost increases that have not yet been addressed in current rates pose a risk to future earnings growth, as evident from net income declining by 27.5% from 2023 to 2024.

- The anticipated industrial and residential growth requires significant capital investment and has long lead times, potentially delaying revenue recognition and straining cash flows in the short term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $16.5 for Global Water Resources based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $61.9 million, earnings will come to $5.5 million, and it would be trading on a PE ratio of 86.2x, assuming you use a discount rate of 6.2%.

- Given the current share price of $11.17, the analyst price target of $16.5 is 32.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.