Key Takeaways

- Evergy's infrastructure investments and favorable legislation are expected to drive revenue growth and enhance financial stability in Kansas and Missouri.

- Load growth from economic projects and planned facilities is anticipated to boost earnings, supporting operational efficiency and shareholder value.

- Evergy faces significant financial risks from an aggressive investment plan, climate variability impacts, intense competition, potential share value dilution, and regulatory uncertainties.

Catalysts

About Evergy- Engages in the generation, transmission, distribution, and sale of electricity in the United States.

- Evergy's substantial $17.5 billion capital investment plan, aimed at grid modernization and infrastructure improvements, is expected to drive significant rate base growth and support economic prosperity in Kansas and Missouri, which should result in increased revenue and earnings.

- The passage of supportive legislation in Kansas and Missouri that mitigates regulatory lag and promotes infrastructure investments, such as Missouri's Senate Bill 4, creates a more favorable regulatory environment, potentially enhancing net margins and financial stability.

- The development of large-scale economic projects like Google's, Panasonic's, and Meta's data centers, contributing up to 1.6 gigawatts in demand, are expected to drive load growth and, subsequently, revenue and earnings growth through increased electricity sales.

- Planned construction of new natural gas facilities and solar farms totaling over 2,100 megawatts is expected to bolster Evergy's generation capacity, supporting increased future demand and revenue while enhancing operational efficiency and potentially improving net margins.

- Incremental load growth beyond the initially announced large customer projects presents upside potential for Evergy's financial performance, suggesting the possibility of growing earnings per share (EPS) and moderating future equity issuances, positively affecting shareholder value.

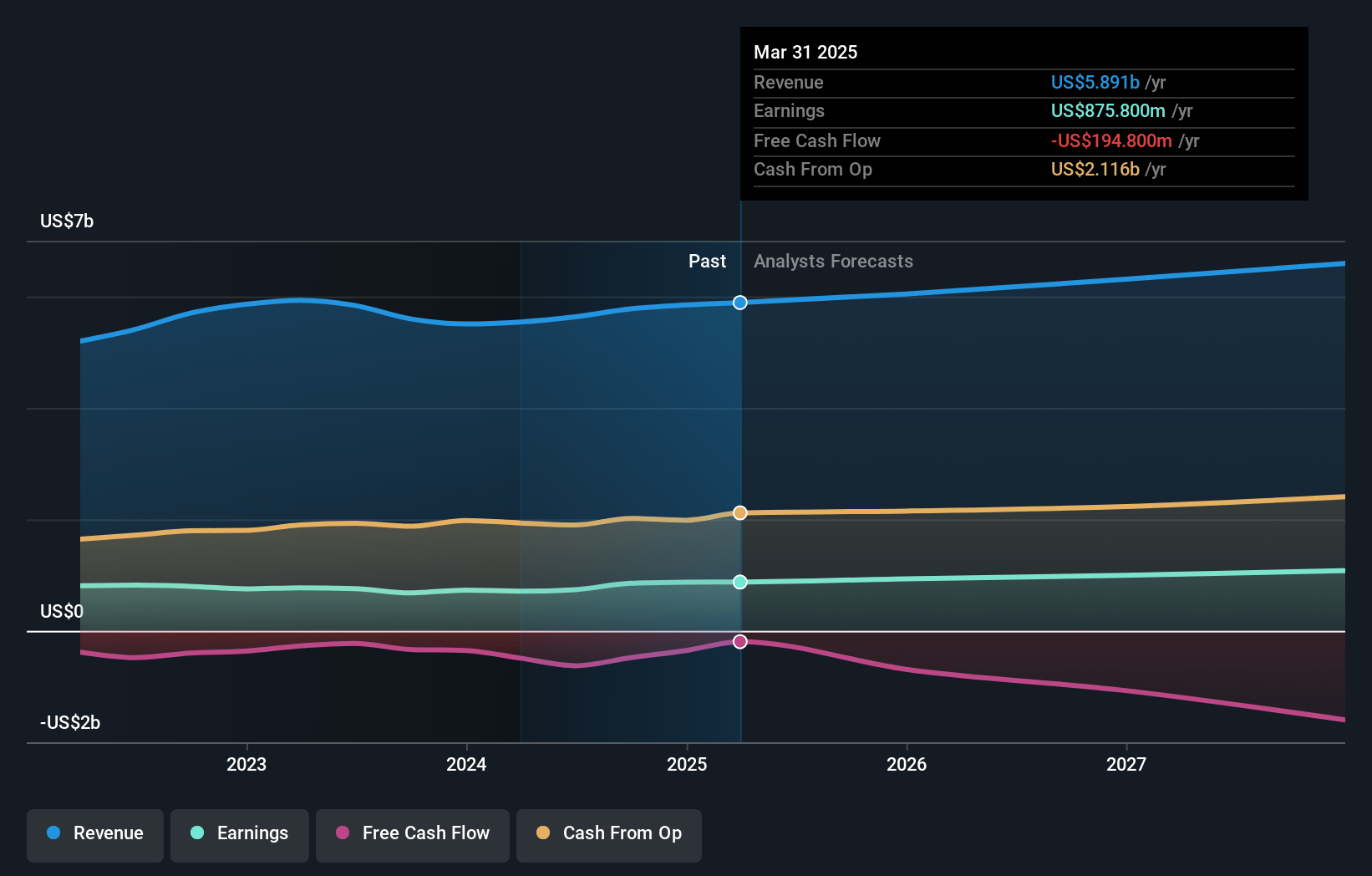

Evergy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Evergy's revenue will grow by 3.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.9% today to 16.4% in 3 years time.

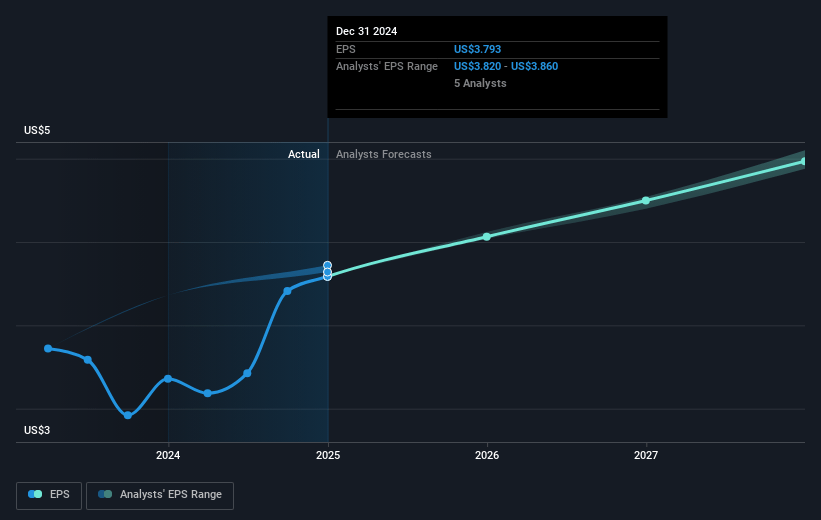

- Analysts expect earnings to reach $1.1 billion (and earnings per share of $4.48) by about March 2028, up from $873.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.9x on those 2028 earnings, up from 17.3x today. This future PE is lower than the current PE for the US Electric Utilities industry at 20.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Evergy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The execution of Evergy's aggressive $17.5 billion capital investment plan over five years involves significant financial risks, particularly if regulatory approvals or cost overruns occur, potentially impacting net margins and earnings.

- Weather fluctuations significantly impacted earnings in 2024, highlighting ongoing vulnerabilities to climate variability, which can continue to negatively affect revenue and profitability.

- Despite plans for economic growth acceleration in Kansas and Missouri, there's intense regional and national competition for new projects, which may limit successful client acquisitions, affecting future revenue streams.

- The need for substantial equity issuance to fund capital investments could dilute existing share value and put pressure on earnings per share, impacting investor returns and financial stability.

- Regulatory uncertainties, such as approval of large-load power tariffs and new generation facilities, could lead to delays or increased costs, affecting planned revenue growth and financial projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $69.657 for Evergy based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.5 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 17.9x, assuming you use a discount rate of 6.2%.

- Given the current share price of $65.8, the analyst price target of $69.66 is 5.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.