Narratives are currently in beta

Key Takeaways

- Strategic acquisitions and expansion into water-stressed regions and the Bahamas drive growth and enhance revenue opportunities.

- Strong financial health and low debt enable long-term project investments and future earnings growth.

- Reduced construction revenue due to project completions, seasonal retail fluctuations, execution risks, competition, and regulatory challenges threaten revenue stability and profitability.

Catalysts

About Consolidated Water- Designs, constructs, manages, and operates water production and water treatment plants primarily in the Cayman Islands, the Bahamas, and the United States.

- Consolidated Water's ongoing development of a $147 million desalination project in Hawaii, expected to enter the construction phase in Q4 2025, represents a significant future revenue stream that will enhance earnings over the project's lifecycle.

- The company's strategic acquisition of REC broadens its operational footprint into water-stressed regions of Colorado, which is anticipated to boost recurring revenue through expanded design-build and O&M contracts, positively impacting net margins.

- The potential to secure additional projects in the Bahamas beyond the current Cat Island development offers growth in Bulk and Retail revenues, leveraging Consolidated Water's strong position and expertise in the region.

- The growth in Grand Cayman's water sales, driven by increased business activity and customer connections, is likely to support continued revenue expansion in the Retail segment despite seasonality.

- The company's robust balance sheet and low debt enable opportunistic acquisitions and investments in long-term projects, positioning it for sustained earnings growth and shareholder value.

Consolidated Water Future Earnings and Revenue Growth

Assumptions

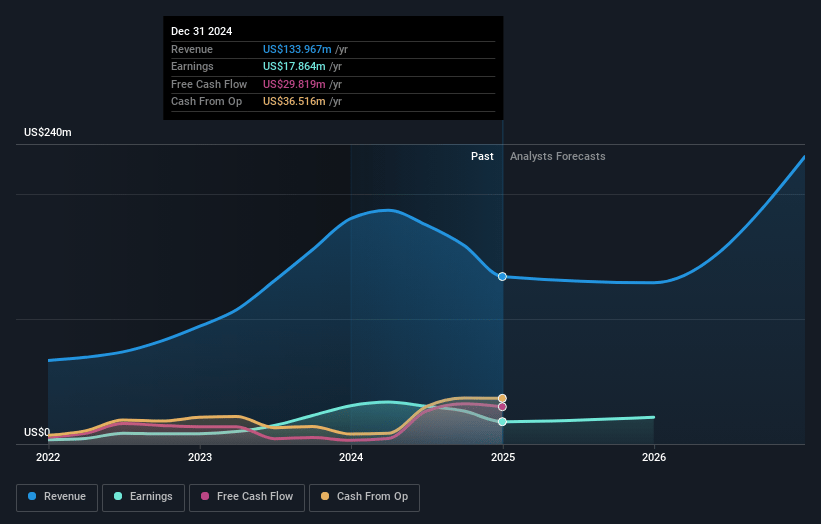

How have these above catalysts been quantified?- Analysts are assuming Consolidated Water's revenue will grow by 15.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 16.6% today to 6.9% in 3 years time.

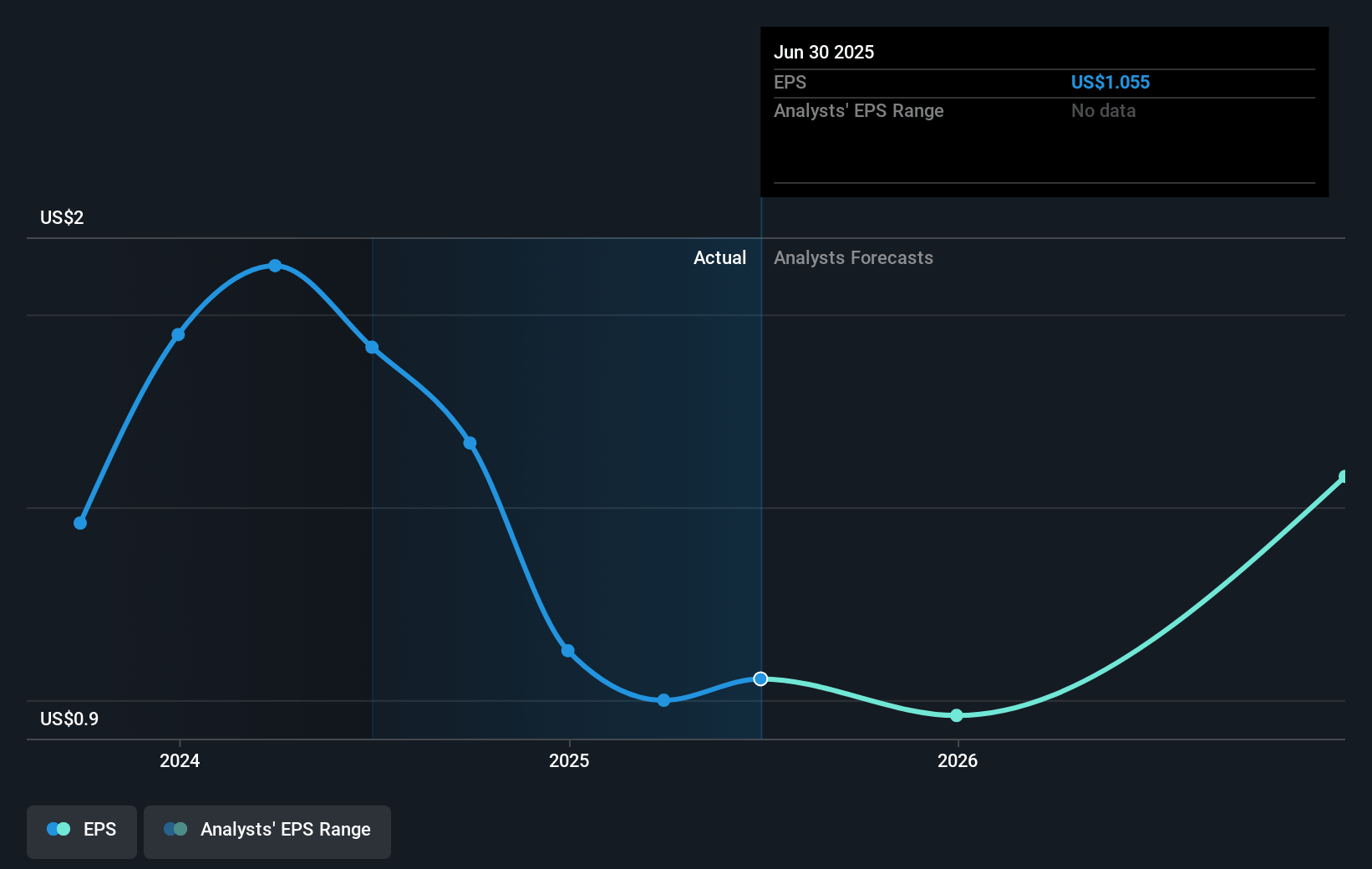

- Analysts expect earnings to reach $16.8 million (and earnings per share of $1.04) by about November 2027, down from $26.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 43.6x on those 2027 earnings, up from 15.8x today. This future PE is greater than the current PE for the US Water Utilities industry at 24.3x.

- Analysts expect the number of shares outstanding to grow by 0.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Consolidated Water Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A significant reduction in construction revenue due to the completion of large projects is impacting current revenue, posing a risk if new projects are not secured soon. This trend may result in declines in overall earnings if not offset by other sources of income.

- The seasonality of retail revenue, with the fourth quarter typically being weaker, may contribute to fluctuations in revenue and earnings, potentially impacting investor confidence and share price stability.

- The dependence on successful execution and timing of the large Hawaii desalination project introduces execution risk that could delay revenue recognition and profitability, impacting future earnings forecasts.

- Ongoing competition in the U.S. market for water projects and the challenge of maintaining a competitive edge, as highlighted in the discussion about the PERC and REC subsidiaries, may lead to lower margins and reduced profitability.

- Regulatory and political risks, especially in international markets like the Bahamas and Grand Cayman, could influence operational stability and revenue generation, affecting long-term financial performance and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $38.5 for Consolidated Water based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $243.7 million, earnings will come to $16.8 million, and it would be trading on a PE ratio of 43.6x, assuming you use a discount rate of 5.9%.

- Given the current share price of $26.35, the analyst's price target of $38.5 is 31.6% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives