Narratives are currently in beta

Key Takeaways

- Expansion into less densely populated markets and an advertising boost can significantly enhance Uber's future revenue and user base.

- Strategic improvements in membership, autonomous tech, and capital allocation may drive higher margins and create long-term shareholder value.

- Rising insurance costs, competitive pressures, and macroeconomic factors pose risks to revenue and margin growth, while AV strategy execution remains crucial for future success.

Catalysts

About Uber Technologies- Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and Asia excluding China and Southeast Asia.

- Expansion into less densely populated markets presents significant growth potential, likely boosting Uber's future revenue and user base as these areas are expected to grow faster than urban centers.

- The growth of Uber's advertising business, which expanded nearly 80% year-on-year, could considerably enhance revenue streams by tapping new areas like grocery sponsored listings and mobility solutions, thus impacting overall earnings.

- Increased membership in Uber One, up 70% year-on-year to 25 million, is expected to drive higher user frequency and retention, contributing to elevated revenue and potentially improved net margins through enhanced customer loyalty.

- The advancement in autonomous vehicle partnerships and fleet operations positions Uber to capture efficiency gains and cost reductions over time, which could improve net margins and operational profitability in the future.

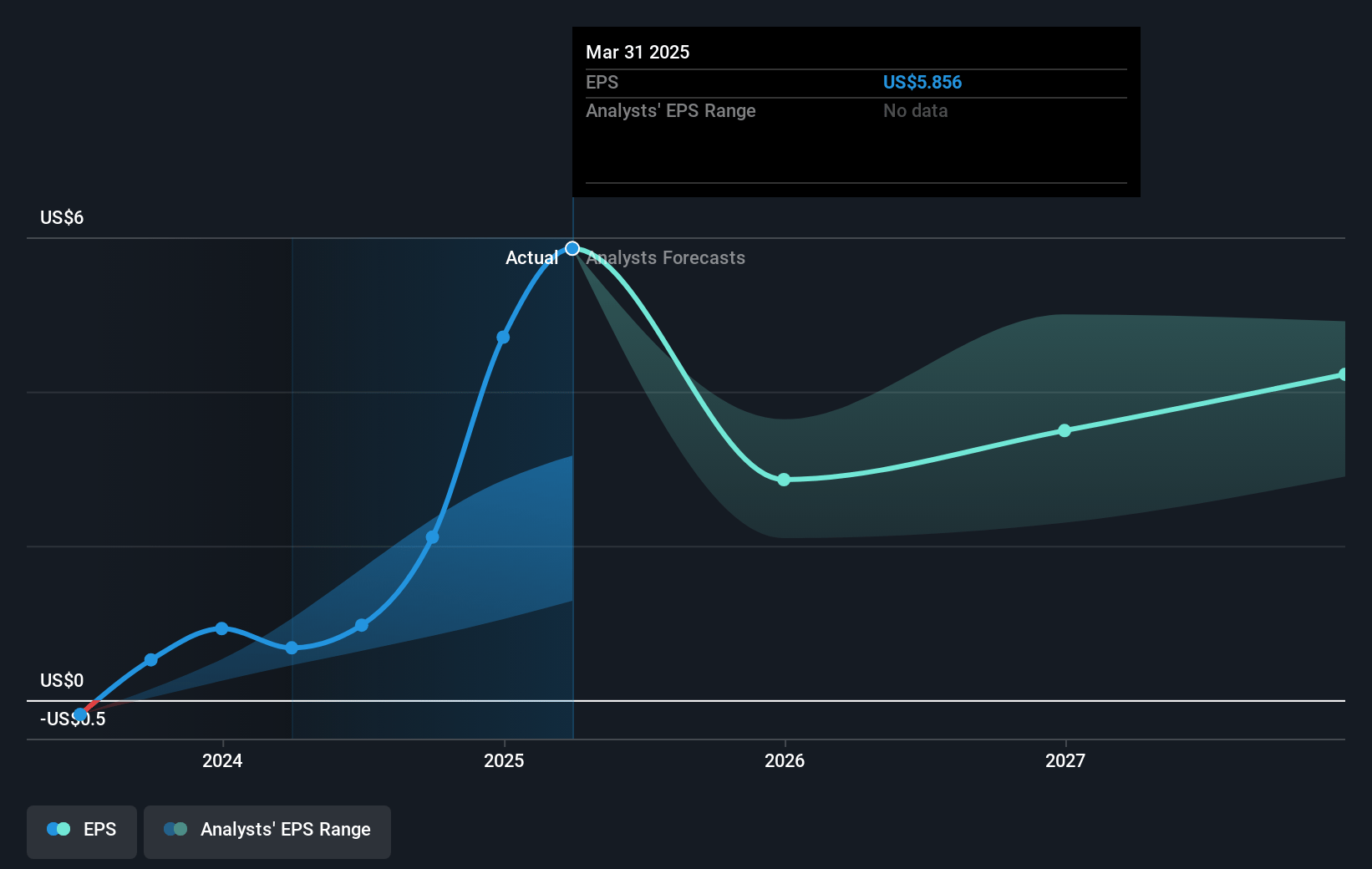

- Strategic capital allocation with plans for increased share repurchasing indicates potential EPS growth and shareholder value creation as Uber moves towards durable share count reduction in 2025.

Uber Technologies Future Earnings and Revenue Growth

Assumptions

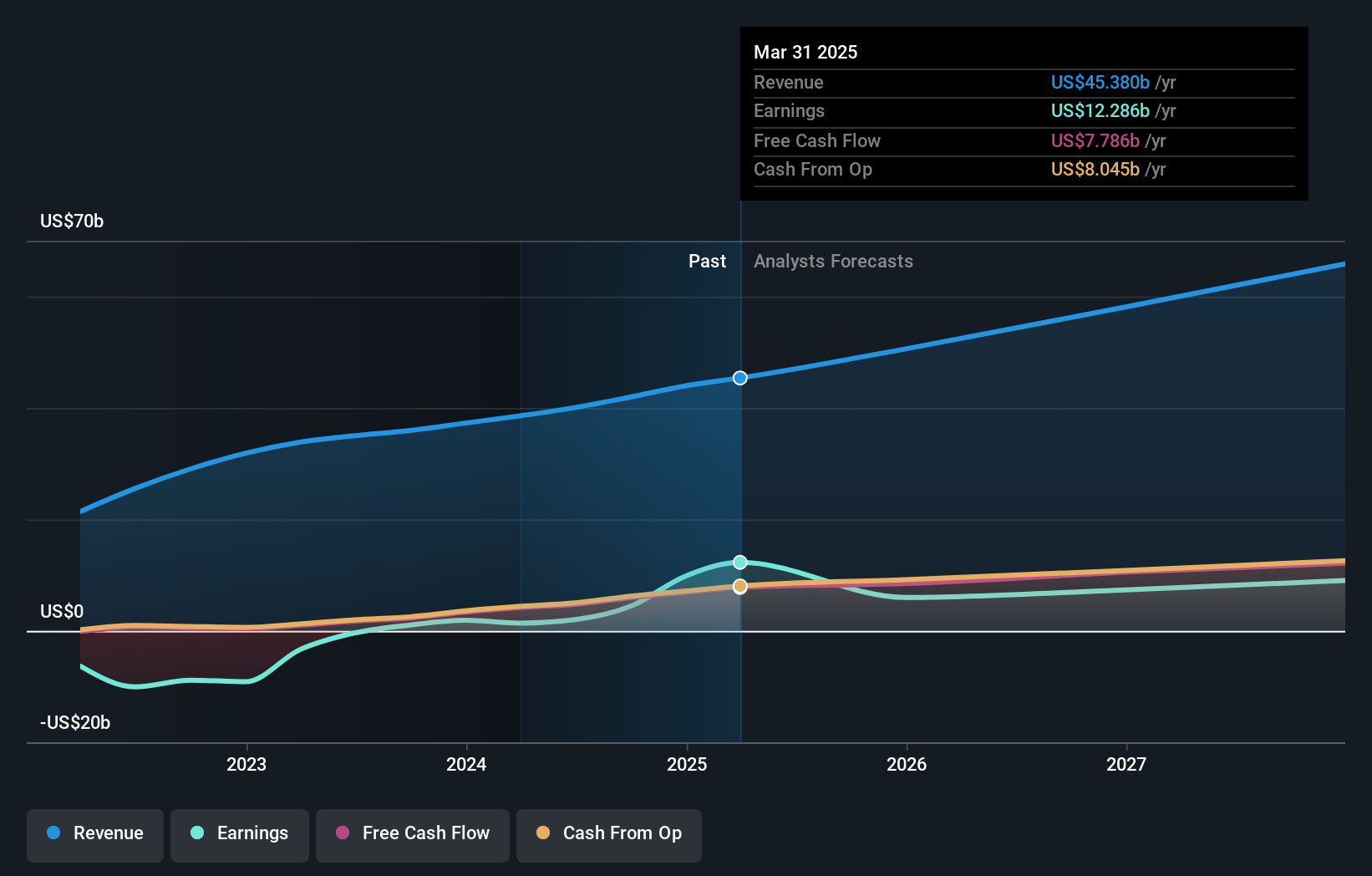

How have these above catalysts been quantified?- Analysts are assuming Uber Technologies's revenue will grow by 14.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.5% today to 12.6% in 3 years time.

- Analysts expect earnings to reach $8.0 billion (and earnings per share of $3.66) by about November 2027, up from $4.4 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $9.9 billion in earnings, and the most bearish expecting $3.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.6x on those 2027 earnings, down from 35.5x today. This future PE is lower than the current PE for the US Transportation industry at 31.6x.

- Analysts expect the number of shares outstanding to grow by 1.29% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 6.66%, as per the Simply Wall St company report.

Uber Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising insurance costs, particularly in the U.S., could lead to increased expenses and pricing adjustments, potentially affecting transaction growth and impacting revenue and net margins.

- Expansion into less dense markets comes with operational challenges such as building supply and stimulating demand, raising concerns about execution risk and potential impacts on revenue growth and net margins.

- The autonomous vehicle (AV) strategy, while promising, is still in early stages and requires significant capital and successful partnerships with multiple players, which could affect earnings and profit margins if not executed efficiently.

- Competitive pressures in the mobility and delivery sectors, particularly from players like Waymo, could impact Uber's market share and result in slower revenue growth or squeezed profit margins.

- Macroeconomic factors, such as fluctuating commercial insurance costs and potential consumer sensitivity to price increases, could impact user demand and retention, affecting revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $89.34 for Uber Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $120.0, and the most bearish reporting a price target of just $66.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $63.5 billion, earnings will come to $8.0 billion, and it would be trading on a PE ratio of 29.6x, assuming you use a discount rate of 6.7%.

- Given the current share price of $74.15, the analyst's price target of $89.34 is 17.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

WA

WallStreetWontons

Community Contributor

UBER: Expanding Autonomous Ride-Hailing with Waymo

Catalysts Products and Services Impacting Uber’s Sales and Earnings Uber has several key products and services that could significantly impact its sales and earnings: Ride-Hailing Services : This remains Uber’s core revenue generator. The company continues to innovate and expand its ride-hailing services globally.

View narrativeUS$72.92

FV

0.3% overvalued intrinsic discount13.05%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

1users have followed this narrative

about 2 months ago author updated this narrative