Key Takeaways

- Diversified fleet and contracted revenue provide stability and reduce risks from market volatility and geopolitical disruptions.

- Fleet modernization with eco-friendly tech and unit repurchase program target cost reduction and higher shareholder value.

- Geopolitical and macroeconomic uncertainties, combined with increased competition, could negatively impact Navios Maritime Partners' revenue, margins, and shipping demand.

Catalysts

About Navios Maritime Partners- Owns and operates dry cargo vessels in Asia, Europe, North America, and Australia.

- Navios Maritime Partners is taking advantage of a diversified fleet and significant contracted revenue of $3.6 billion, providing stability and cushioning against market volatility. This forward-looking strategy supports consistent revenue streams and mitigates risks associated with geopolitical and economic disruptions.

- The company's significant reduction in net Loan-to-Value (LTV) by 23% since year-end 2022 demonstrates prudent financial management and increased asset value, which could improve net margins and overall financial health moving forward.

- Navios is heavily investing in fleet modernization and efficiency, having acquired 46 new vessels and focusing on environmentally friendly technology. This strategic renewal is expected to increase energy efficiency and promote higher earnings through reduced operational costs.

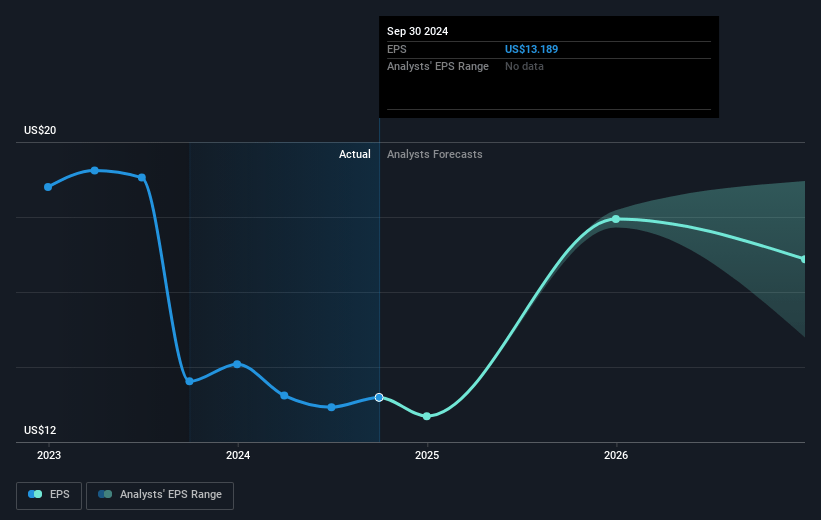

- The implementation of an aggressive unit repurchase program, valued at $70.8 million remaining capacity, alongside dividends, aims to improve earnings per share (EPS) through NAV accretion, thus targeting higher shareholder value.

- With 63% of 2025's available days already fixed at favorable rates, Navios has secured substantial forward revenue and cash flow predictability, contributing to potentially stable earnings and reduced volatility in financial performance.

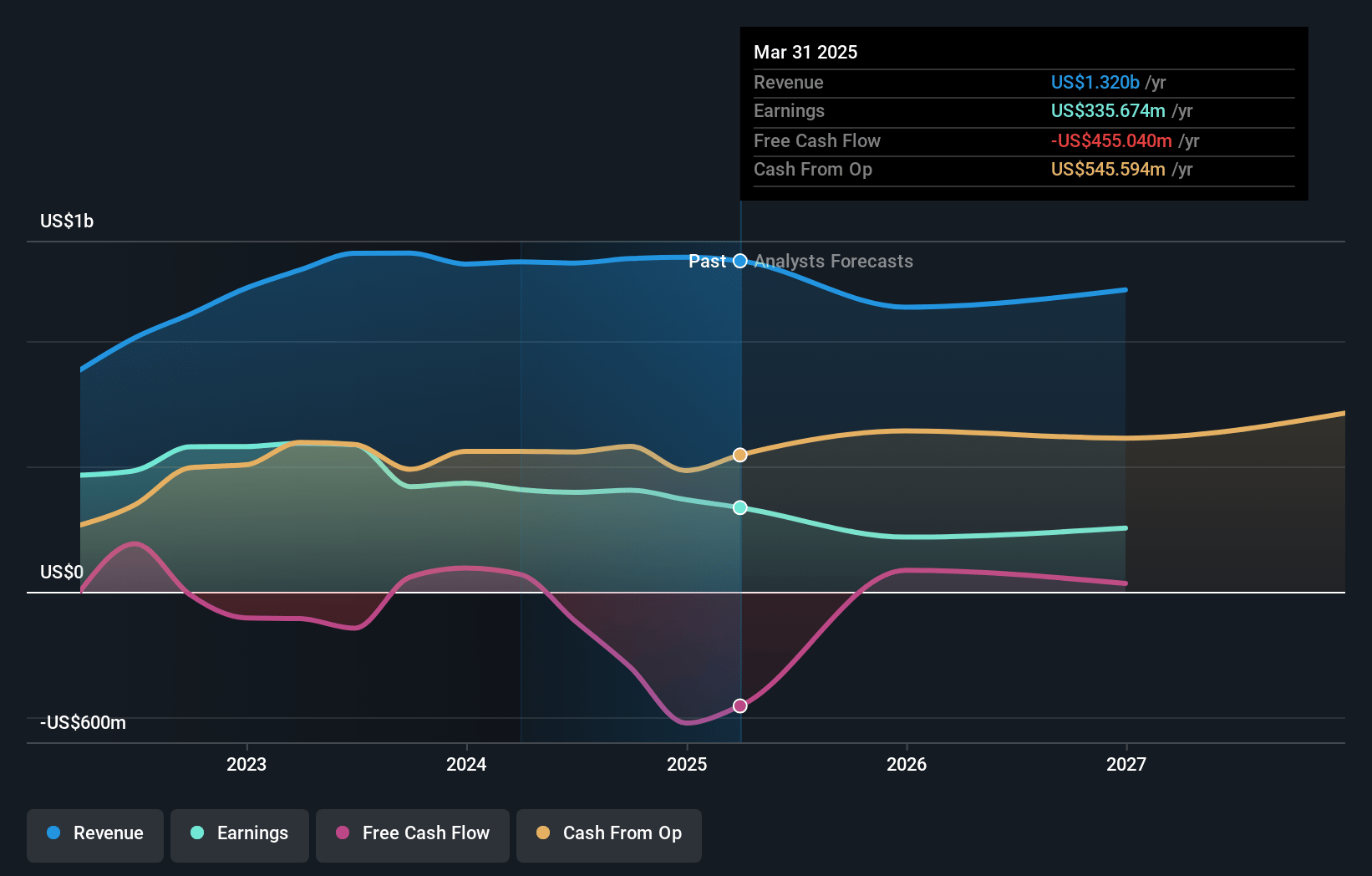

Navios Maritime Partners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Navios Maritime Partners's revenue will decrease by 0.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 27.5% today to 26.3% in 3 years time.

- Analysts expect earnings to reach $353.0 million (and earnings per share of $12.07) by about April 2028, down from $367.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.0x on those 2028 earnings, up from 2.6x today. This future PE is greater than the current PE for the US Shipping industry at 4.5x.

- Analysts expect the number of shares outstanding to decline by 2.26% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.8%, as per the Simply Wall St company report.

Navios Maritime Partners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Geopolitical uncertainties, particularly the ongoing conflicts in Ukraine and the Middle East, create unpredictability in terms of sanctions and global trade patterns, which could significantly impact Navios Maritime Partners' contracted revenue and net margins.

- The introduction of new tariffs, particularly under U.S. trade policies, could alter global shipping patterns and demand, potentially affecting Navios's earnings and revenue projections.

- Increased competition and fleet supply in the container shipping market, combined with a high order book for new vessels, could lead to downward pressure on charter rates, impacting future revenues and net margins.

- The tanker segment faces potential challenges from increased geopolitical risks and regulatory changes, such as U.S. sanctions, which could affect vessel utilization rates and earnings.

- Macroeconomic factors like slowing GDP growth in key markets such as China could lead to reduced demand for shipping services, adversely affecting Navios's revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $73.0 for Navios Maritime Partners based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.3 billion, earnings will come to $353.0 million, and it would be trading on a PE ratio of 9.0x, assuming you use a discount rate of 15.8%.

- Given the current share price of $31.95, the analyst price target of $73.0 is 56.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.