Key Takeaways

- Strong demand for advanced logistics and e-commerce fulfillment, boosted by global supply chain shifts and success in new high-growth sectors, drives robust revenue momentum.

- Investment in automation and AI enhances operational efficiency and margin expansion, while adaptability to regulatory trends strengthens global competitive positioning.

- Exposure to customer volume decline, industry automation, and high investment needs may compress margins, cut returns, and threaten revenue growth sustainability.

Catalysts

About GXO Logistics- Provides logistics services worldwide.

- GXO is poised to benefit from expanding demand for outsourced logistics services as global manufacturers and retailers look to streamline operations and improve supply chain resilience. This is already evident in the continued growth of its sales pipeline—which rose 15% year-over-year—and recurring large new multi-year contracts, which set up sustained revenue growth and longer visibility on future earnings.

- The acceleration in e-commerce and omnichannel retail is directly driving higher volumes of complex fulfillment needs, with GXO winning 60% more new e-commerce business year-over-year and record customer wins in sectors like healthcare and omnichannel retail. This structural shift supports outsized top-line revenue growth as more brands look to advanced third-party logistics partners.

- Continued investment in AI, warehouse automation, and proprietary technology is beginning to yield measurable productivity gains—such as 3-4x improvements in replenishment and significant increases in order allocation efficiency—which are expected to compound as the new AI modules are rolled out across more sites. These technological advances directly enhance operational efficiency and margin expansion, supporting stronger net income growth.

- GXO’s strategic expansion into high-growth and complex sectors like healthcare, aerospace, and technology has led to record wins and increased penetration in underexploited geographies such as Germany. The recent $2.5 billion healthcare contract and 60% revenue growth in Germany represent early indicators that these markets can drive above-market revenue growth and earnings as these verticals scale.

- GXO’s global scale and ability to support regulatory trends—such as increased ESG requirements, nearshoring, and supply chain localization—makes it a preferred partner for large multinationals navigating an evolving landscape. This strengthens competitive positioning and pricing power, supporting both sustained margin improvement and future earnings growth.

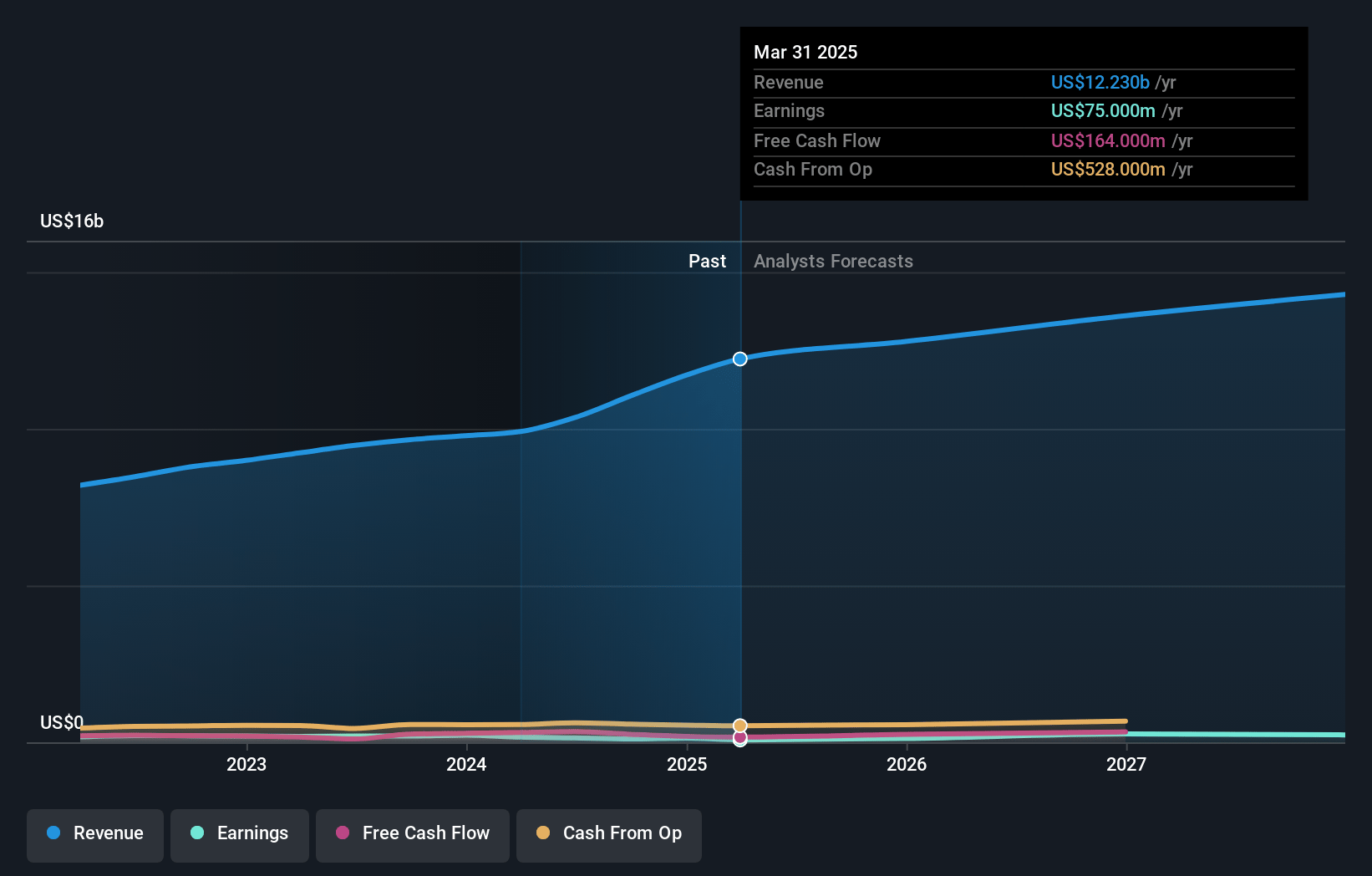

GXO Logistics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on GXO Logistics compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming GXO Logistics's revenue will grow by 7.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.1% today to 2.4% in 3 years time.

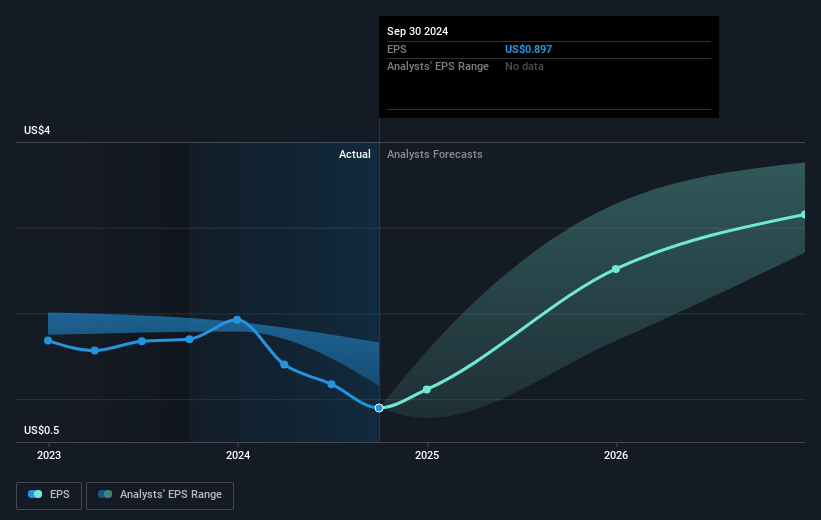

- The bullish analysts expect earnings to reach $343.0 million (and earnings per share of $3.07) by about April 2028, up from $134.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 29.7x on those 2028 earnings, down from 32.5x today. This future PE is greater than the current PE for the US Logistics industry at 18.9x.

- Analysts expect the number of shares outstanding to grow by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.06%, as per the Simply Wall St company report.

GXO Logistics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Customer contract realignments, where even strategic customers quickly scale down or exit mature sites due to changing business needs or lower consumer volumes, expose GXO to abrupt revenue and adjusted EBITDA hits, heightening risks of both revenue decline and margin compression if insourcing trends or similar events become more frequent in the future.

- Flat to slightly positive volume growth guidance from existing customers and the acknowledgment that underlying volumes are expected to be flattish throughout 2025 suggest long-term softness in transactional growth, which, if persistent, would undermine GXO’s ability to deliver sustained revenue and earnings expansion.

- Rapid industry advances in automation and proprietary AI solutions mean large customers could increasingly choose to automate and manage logistics in-house, eroding GXO’s differentiation and shrinking its addressable market, which would suppress long-term top-line growth, compressing both net margins and earnings.

- Management openly notes that GXO’s organic revenue growth has settled into mid-single digits since 2022 and hesitates to reaffirm earlier higher long-term growth targets, signaling possible structural changes in fulfillment and retail logistics that could permanently reduce revenue growth rates and shareholder returns.

- The ongoing need for heavy investment in technology, combined with regulatory uncertainties around major acquisitions such as Wincanton and FX headwinds in Europe, may lead to capital inefficiency, integration delays, and increased compliance costs, all of which risk lowering returns on invested capital and diminishing long-term earnings and free cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for GXO Logistics is $66.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of GXO Logistics's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $66.0, and the most bearish reporting a price target of just $35.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $14.4 billion, earnings will come to $343.0 million, and it would be trading on a PE ratio of 29.7x, assuming you use a discount rate of 9.1%.

- Given the current share price of $36.48, the bullish analyst price target of $66.0 is 44.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:GXO. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.