Narratives are currently in beta

Key Takeaways

- Strategic investment in premium experiences and SkyMiles expansion aims to boost revenue, loyalty, and customer lifetime value through enhanced offerings and partnerships.

- Operational efficiency and debt reduction efforts are set to improve competitiveness, net margins, and future growth opportunities via effective cash flow use.

- Rising fuel costs, external disruptions, and air traffic constraints could squeeze profitability, despite growth in premium products and international market exposure.

Catalysts

About Delta Air Lines- Provides scheduled air transportation for passengers and cargo in the United States and internationally.

- Delta Air Lines' operational efficiency improvements, including a 60-day record of zero cancellations and advancing fuel efficiency, are expected to boost net margins and earnings in the future.

- The company's strategic investment in premium experiences, such as Delta One Lounges and Delta Premium Select, is likely to drive increased revenue through enhanced customer loyalty and higher yield from premium product offerings.

- The return to full utilization of Delta's core hubs and regional feed, coupled with leveraging new fleet investments, is poised to enhance operational efficiency and competitiveness, positively impacting revenue and net margins.

- Delta's continued focus on strengthening its balance sheet through debt reduction, while achieving investment-grade ratings, positions the company to use future free cash flow more effectively for growth or shareholder returns, which may drive future earnings growth.

- Growing SkyMiles membership with a focus on younger consumers and expanding non-air partnerships presents an opportunity for diversified revenue streams and higher lifetime customer value, positively impacting overall revenue growth.

Delta Air Lines Future Earnings and Revenue Growth

Assumptions

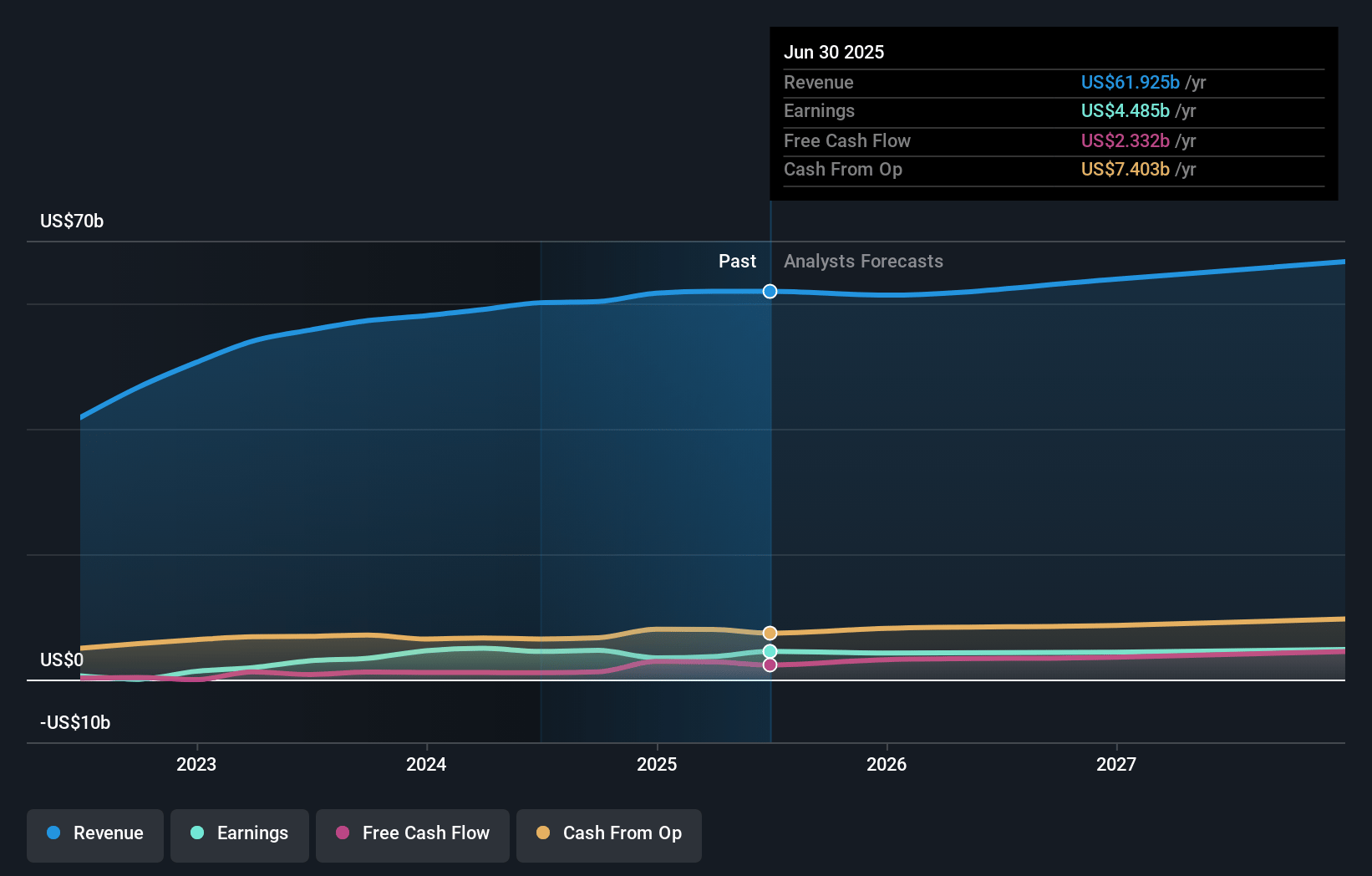

How have these above catalysts been quantified?- Analysts are assuming Delta Air Lines's revenue will grow by 2.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.7% today to 7.8% in 3 years time.

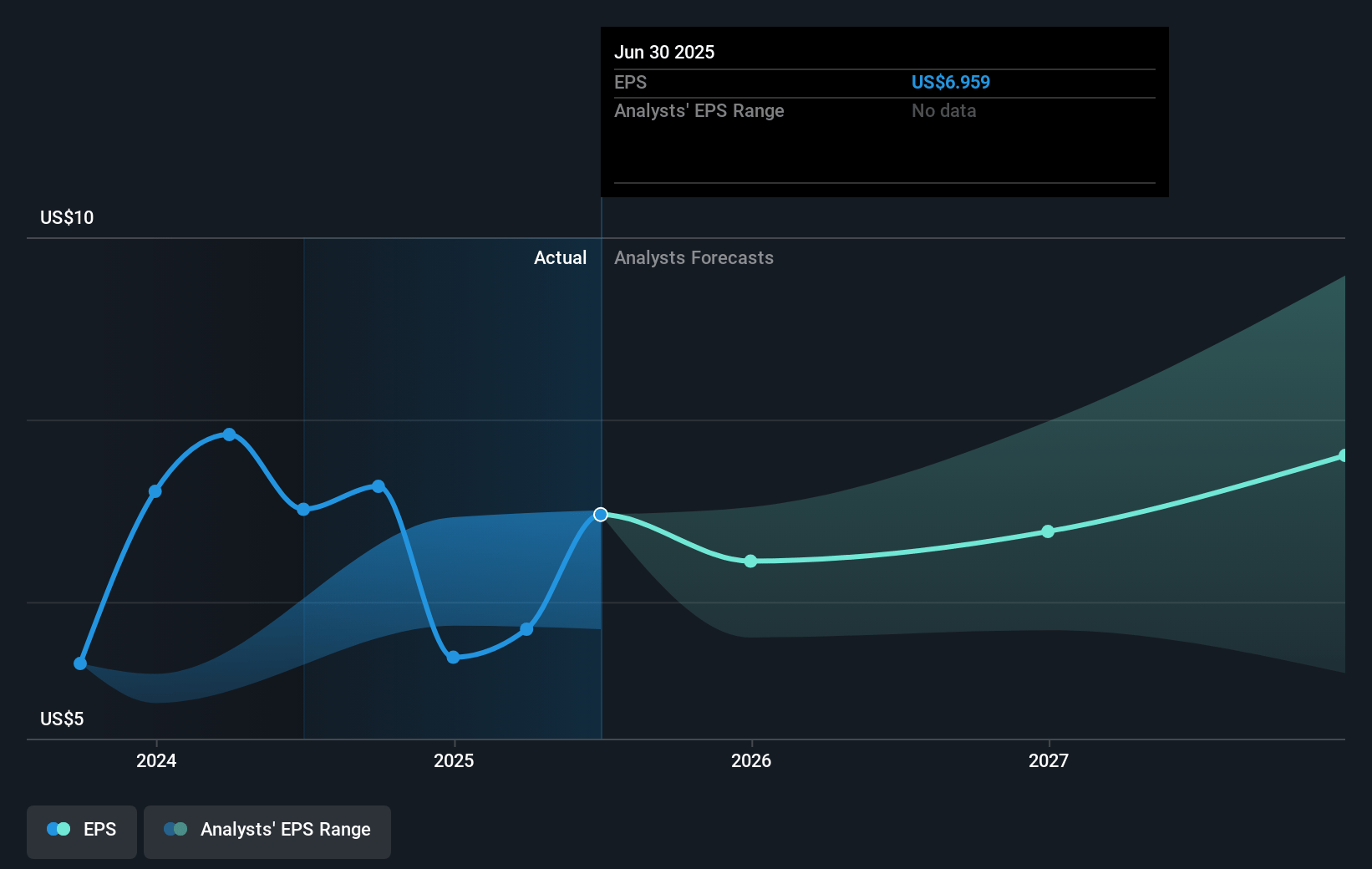

- Analysts expect earnings to reach $5.0 billion (and earnings per share of $8.01) by about November 2027, up from $4.7 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $5.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.3x on those 2027 earnings, up from 8.9x today. This future PE is lower than the current PE for the US Airlines industry at 10.7x.

- Analysts expect the number of shares outstanding to decline by 0.59% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.77%, as per the Simply Wall St company report.

Delta Air Lines Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The impact of external events and disruptions such as the CrowdStrike-caused outage and Hurricane Milton could lead to financial setbacks that affect Delta's quarterly profitability and unit metrics, impacting overall earnings.

- Rising fuel costs, despite recent declines, could still reduce profit margins if the trend reverses or stabilizes at a higher level, affecting Delta's operating expenses and net margins.

- Ongoing air traffic control constraints, particularly in congested airspaces like New York and Florida, might limit Delta's operational efficiency and increase delay-related costs, impacting overall productivity and costs.

- Delta's growth in premium products and customer loyalty is offset by underperforming main cabin yields, indicating potential challenges in maximizing revenue from all customer segments.

- Delta's exposure to international markets, while a growth area, carries risks of underperformance in specific regions like South Korea, as well as sensitivity to geopolitical and macroeconomic factors, affecting revenue diversity and profit stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $65.92 for Delta Air Lines based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $85.0, and the most bearish reporting a price target of just $36.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $64.6 billion, earnings will come to $5.0 billion, and it would be trading on a PE ratio of 10.3x, assuming you use a discount rate of 7.8%.

- Given the current share price of $64.46, the analyst's price target of $65.92 is 2.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives