Narratives are currently in beta

Key Takeaways

- Contractual rate increases and operational tech investments project revenue growth, but persistent cost pressures and competition could squeeze net margins.

- Expansion in Dedicated fleet and logistics suggest revenue potential, yet macroeconomic factors and interest expenses may challenge earnings growth.

- Strong operational performance and customer retention, coupled with strategic technology investments, drive revenue growth and cost management amid competitive pressures.

Catalysts

About Werner Enterprises- Engages in transporting truckload shipments of general commodities in interstate and intrastate commerce in the United States, Mexico, and internationally.

- Werner's contractual rate increases and improved freight mix indicate expectations for stronger revenue growth, but the current pressures on logistics gross margins and elevated health insurance claims could hinder net margins if such costs persist.

- Anticipated growth in the company’s Dedicated fleet and cross-border services suggest potential future revenue gains. However, increased competition and the macroeconomic backdrop could impact earnings if these growth opportunities do not realize expected returns.

- With a focus on operational excellence and leveraging cutting-edge technology, Werner aims to improve cost efficiencies. Yet, if operational cost savings do not materialize or if tech investments fail to drive expected efficiencies, net margins could be squeezed.

- Werner's logistics acquisitions and a transition to the EDGE TMS platform signal intent for long-term revenue growth. Nevertheless, if volume and transactional opportunities in logistics do not rebound as expected post-downturn, earnings growth could be muted.

- Despite a stronger balance sheet and liquidity position, heightened interest expense and lower operating income currently strain earnings potential. If these factors persist without revenue improvements, earnings growth could be challenged moving forward.

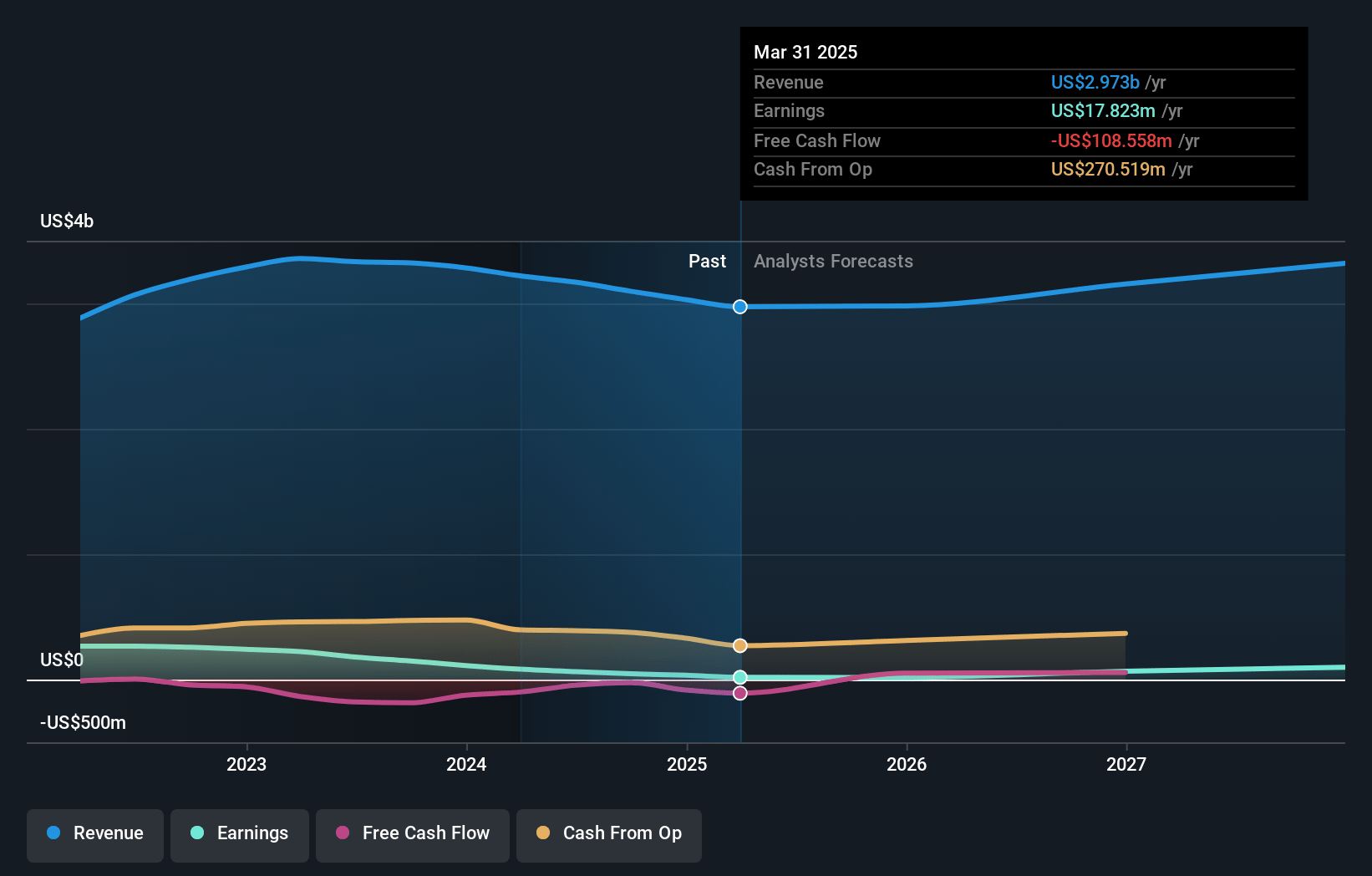

Werner Enterprises Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Werner Enterprises's revenue will grow by 4.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.5% today to 5.7% in 3 years time.

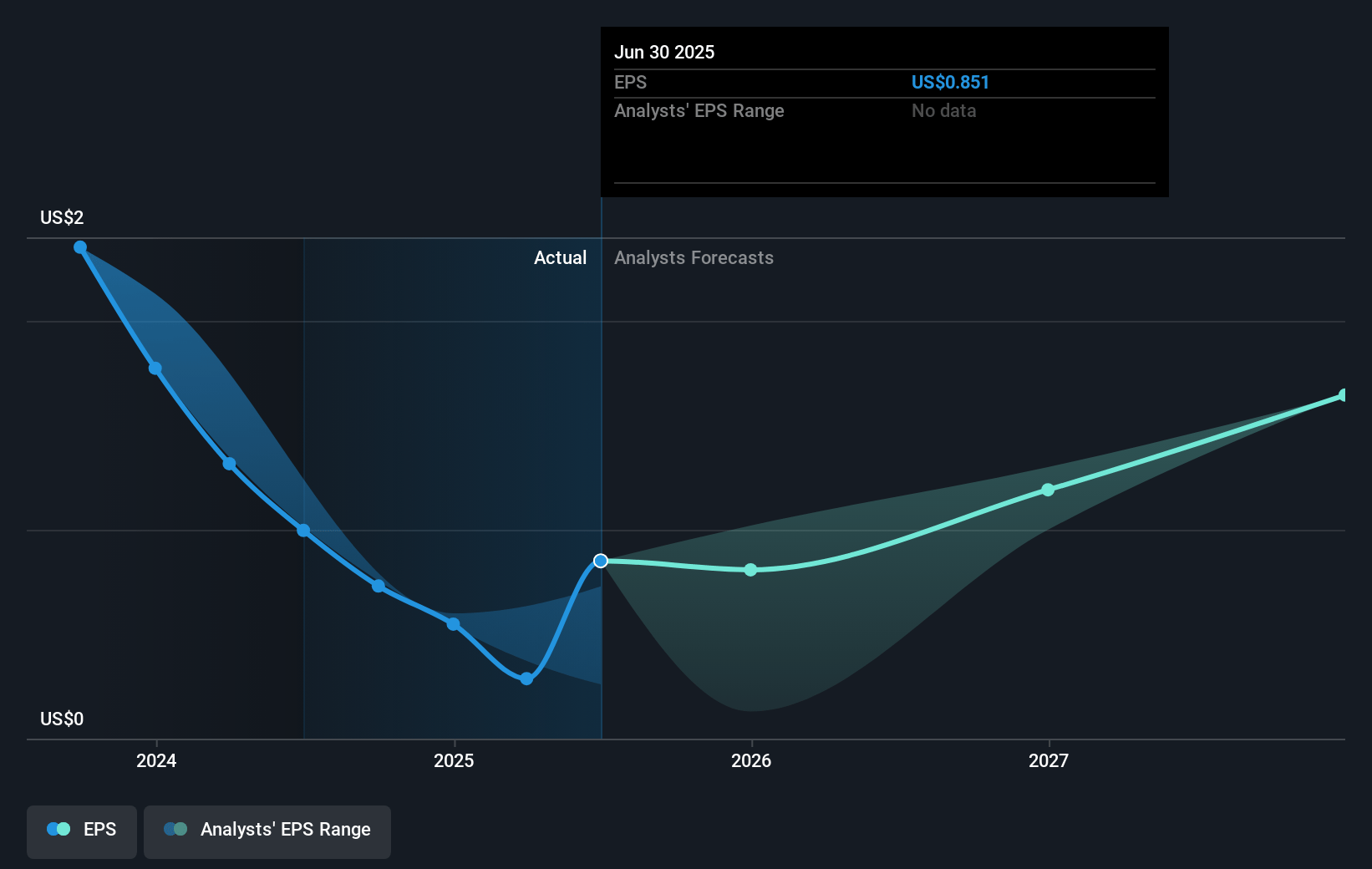

- Analysts expect earnings to reach $203.9 million (and earnings per share of $3.16) by about November 2027, up from $45.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.1x on those 2027 earnings, down from 54.9x today. This future PE is lower than the current PE for the US Transportation industry at 30.8x.

- Analysts expect the number of shares outstanding to grow by 1.42% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.18%, as per the Simply Wall St company report.

Werner Enterprises Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Werner Enterprises has seen six consecutive quarters of year-over-year improvement in One-Way utilization and rate per total mile, indicating potential for revenue growth as the market strengthens.

- The company reported strong retention rates in its Dedicated segment, maintaining over 90% customer retention, which suggests sustained revenue and stable net margins.

- Investments in technology, such as the EDGE TMS platform, have enhanced operational efficiency, potentially leading to better cost management and improved net margins.

- Werner's logistics business, despite being challenged by competitive pressures, demonstrated resilience with pockets of growth, notably in intermodal shipments, supporting incremental revenue growth opportunities.

- Significant cost savings initiatives have been implemented, and over 80% of the revised $50 million target has been achieved by Q3, contributing to improved earnings and cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $36.47 for Werner Enterprises based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $52.0, and the most bearish reporting a price target of just $28.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $3.6 billion, earnings will come to $203.9 million, and it would be trading on a PE ratio of 14.1x, assuming you use a discount rate of 7.2%.

- Given the current share price of $40.75, the analyst's price target of $36.47 is 11.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives