Narratives are currently in beta

Key Takeaways

- Closure of brokerage and intermodal losses may pressure revenues and strain overall earnings and margins.

- Acquisitions and capital expenditures increase debt risk, potentially compressing margins without sufficient synergy or income growth.

- Strategic acquisitions and segment strengths suggest improved profitability, operating margins, and earnings stability, with robust performance in logistics and the trucking segment.

Catalysts

About Universal Logistics Holdings- Provides transportation and logistics solutions in the United States, Mexico, Canada, and Colombia.

- The closure of the company-managed brokerage business indicates a reduction in revenue streams as Universal exits non-core markets, potentially impacting future revenues negatively.

- The acquisition of Parsec and East Texas Heavy Haul implies increased capital expenditures and debt loads, which could stress financials and limit profit margins if anticipated synergies do not materialize as expected.

- The intermodal segment continues to underperform, and despite cost-cutting efforts, it is still experiencing losses. Prolonged underperformance could further strain overall earnings and operating margins.

- Specialized heavy-haul trucking depends on continued strong demand from niche markets such as wind energy, which, if it slows, could lead to reduced revenue in the trucking segment.

- Elevated capital expenditures projected into 2025, without a proportional increase in operating income, might compress net margins and limit earnings growth during this period.

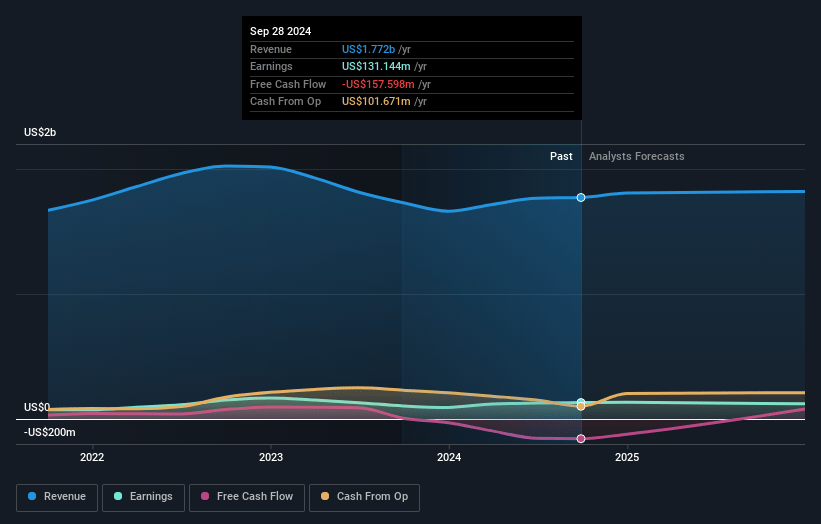

Universal Logistics Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Universal Logistics Holdings's revenue will grow by 2.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 7.4% today to 5.8% in 3 years time.

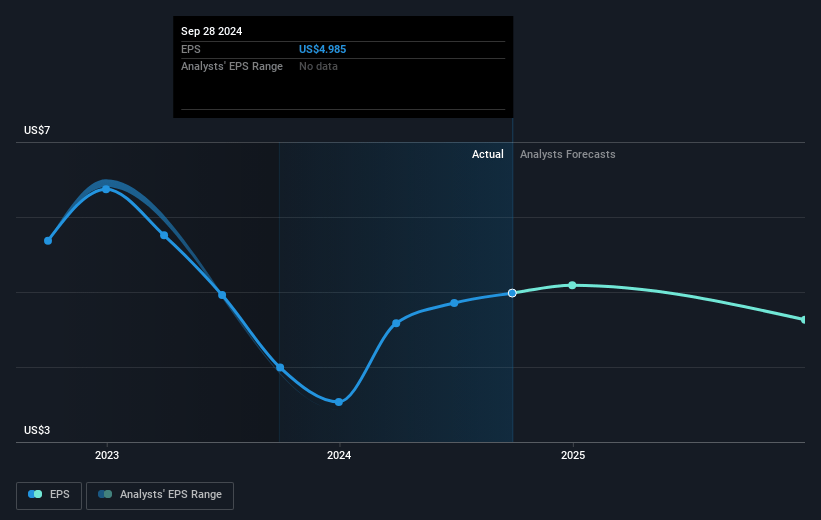

- Analysts expect earnings to reach $108.9 million (and earnings per share of $4.13) by about November 2027, down from $131.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.5x on those 2027 earnings, up from 10.1x today. This future PE is lower than the current PE for the US Transportation industry at 30.8x.

- Analysts expect the number of shares outstanding to grow by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.59%, as per the Simply Wall St company report.

Universal Logistics Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The acquisition of Parsec, a market-leading provider of rail terminal management services, is expected to add approximately $230 million of top line revenue and nearly $30 million of additional EBITDA annually. This could positively impact Universal's revenue and earnings growth.

- The robust performance and continued demand in their specialized heavy-haul wind business suggest that the trucking segment can maintain strong results despite broader market challenges, potentially supporting revenues and profit margins.

- Universal's Contract Logistics segment, described as the cornerstone of their success, appears insulated and highly profitable with consistent double-digit operating margins, likely sustaining net margins and overall profitability.

- Strategic acquisitions and the shutdown of underperforming divisions are expected to create a significant shift in profitability, suggesting improved operating margins and earnings stability.

- The anticipated positive outlook and stable demand within the automotive industry and the expected benefits from recent acquisitions may drive Universal's revenue growth and improve earnings in the future.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $42.0 for Universal Logistics Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.9 billion, earnings will come to $108.9 million, and it would be trading on a PE ratio of 12.5x, assuming you use a discount rate of 7.6%.

- Given the current share price of $50.26, the analyst's price target of $42.0 is 19.7% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives