Narratives are currently in beta

Key Takeaways

- New agreements and fleet expansion are expected to boost revenue and market share, with improved efficiencies contributing to better earnings.

- Strategic debt reduction and share repurchases enhance financial flexibility and position SkyWest for future growth opportunities.

- Increased maintenance costs and competitive pressures in underserved markets may constrain revenue growth and impact SkyWest's financial health.

Catalysts

About SkyWest- Through its subsidiaries, engages in the operation of a regional airline in the United States.

- SkyWest has reached a multiyear agreement with United to place 40 CRJ550s into service, which could lead to an increase in both contract revenue and market share in regional markets. This aligns with expected future growth in revenue.

- The delivery of 20 additional E175 aircraft by the end of 2026 will likely improve fleet utilization and expand capacity to meet rising demand, directly impacting revenue growth and possibly net income as operational efficiencies improve.

- SkyWest's plan to restore block hour production to pre-COVID levels by 2025, supported by a restored pilot balance, suggests a forthcoming increase in production capacity that is expected to drive revenue growth and improve earnings.

- The possibility of expanding into new markets, partially driven by demand in previously underserved regions, has the potential to boost overall revenue, leveraging SkyWest's existing platform and market positioning.

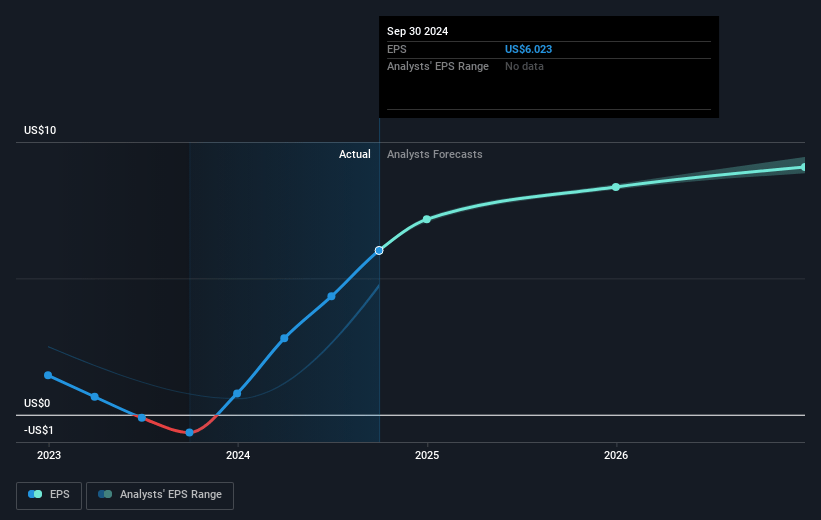

- The company's commitment to debt reduction and strategic share repurchases, funded by strong cash flows, positions it for improved EPS growth and better financial flexibility to capitalize on future growth opportunities.

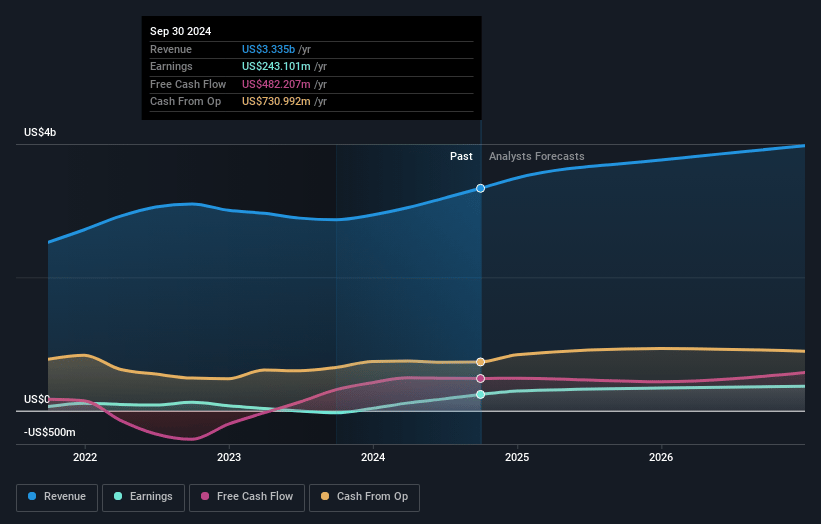

SkyWest Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SkyWest's revenue will grow by 7.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.3% today to 10.0% in 3 years time.

- Analysts expect earnings to reach $416.2 million (and earnings per share of $10.35) by about November 2027, up from $243.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.1x on those 2027 earnings, down from 18.6x today. This future PE is greater than the current PE for the US Airlines industry at 10.7x.

- Analysts expect the number of shares outstanding to decline by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.76%, as per the Simply Wall St company report.

SkyWest Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increased maintenance expenses are anticipated as aircraft are returned to service and utilization rises, potentially affecting net margins and earnings.

- Constraints in the third-party MRO (maintenance repair and overhaul) network, including labor and parts challenges, may hinder the ability to restore production levels, impacting revenue from increased block hours.

- The financial requirement to convert and integrate new aircraft, such as CRJ550s, represents a significant CapEx increase, which could affect cash flow and leverage ratios.

- The growing competition in underserved small and midsize markets might limit SkyWest's ability to capitalize on new growth opportunities, affecting revenue projections.

- Uncertainty regarding the impact of economic conditions and pilot availability could inhibit reaching optimal block hour production, which could lead to lower-than-expected revenue and EPS growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $108.75 for SkyWest based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $120.0, and the most bearish reporting a price target of just $85.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $4.2 billion, earnings will come to $416.2 million, and it would be trading on a PE ratio of 13.1x, assuming you use a discount rate of 7.8%.

- Given the current share price of $111.97, the analyst's price target of $108.75 is 3.0% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives