Key Takeaways

- Expansion of national network and investment in technology are driving improved efficiency, greater operational scale, and positioning for rising e-commerce demand.

- Geographic diversification and high service reliability are strengthening pricing power and supporting long-term, sustainable revenue and margin growth.

- Capital-intensive expansion, domestic market reliance, labor pressures, technological disruption, and rising regulatory costs threaten future profitability and earnings stability.

Catalysts

About Saia- Operates as a transportation company in North America.

- Saia's aggressive national network and terminal expansion positions it to capture outsized volume and revenue growth as e-commerce continues to rise and drive incremental LTL demand, particularly with shippers valuing direct coverage of the 48 contiguous states.

- The company’s substantial investment in fleet modernization and technology enhances operational efficiency and readies Saia to leverage automation and data-driven logistics, leading to improved asset utilization and ultimately higher net margins over time.

- Strengthening presence in high-growth Sunbelt and suburban markets, combined with ongoing geographic diversification, allows Saia to capitalize on shifting U.S. population and freight patterns, driving sustainable shipment and yield growth across new and existing customer bases.

- Saia’s demonstrated ability to integrate and mature newly opened terminals rapidly, along with repeatable operational expansion competency, is expected to deliver sequential margin improvement and unlock higher long-term earnings power as these locations scale.

- Emphasis on differentiated, high-reliability service and successful mix optimization initiatives are providing the company with pricing power, which supports improved contractual renewals and higher revenue per shipment, bolstering both revenue growth and long-term margin expansion.

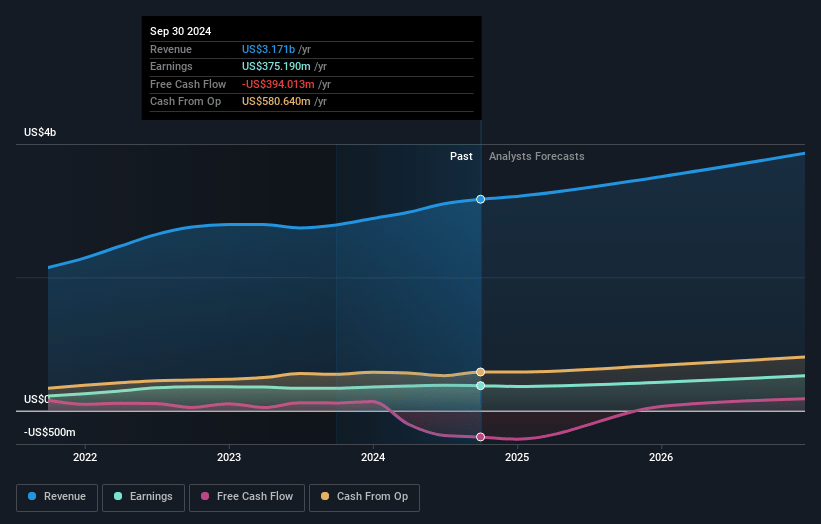

Saia Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Saia compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Saia's revenue will grow by 9.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 11.3% today to 14.3% in 3 years time.

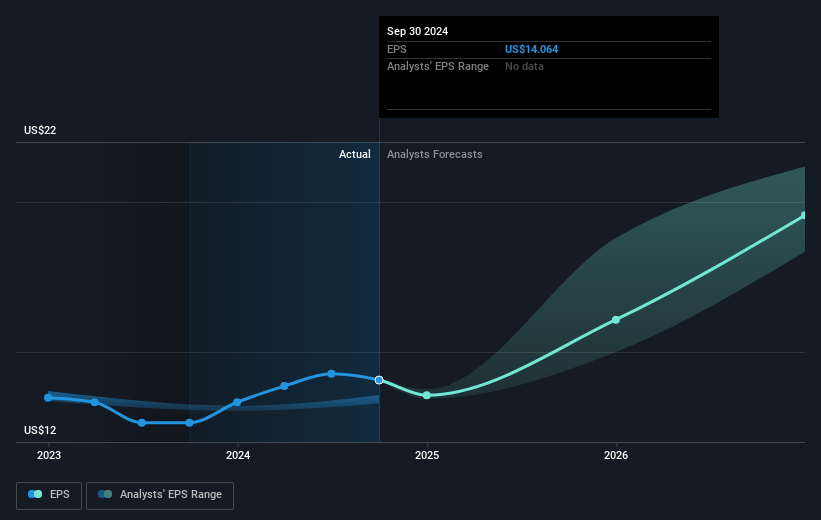

- The bullish analysts expect earnings to reach $608.3 million (and earnings per share of $22.7) by about April 2028, up from $362.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 27.1x on those 2028 earnings, up from 24.3x today. This future PE is greater than the current PE for the US Transportation industry at 24.4x.

- Analysts expect the number of shares outstanding to grow by 0.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.17%, as per the Simply Wall St company report.

Saia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Saia’s long-term capital-intensive expansion strategy, with over $1 billion in capital expenditures in 2024 and plans for continued high investment, increases the risk of overcapacity and misallocated capital; if freight demand weakens or the network fails to deliver anticipated efficiencies, returns on invested capital and future earnings could be negatively impacted.

- The company’s heavy reliance on the U.S. domestic market—with cross-border exposure to Canada and Mexico under 2%—leaves Saia vulnerable to stagnation or declines in U.S. freight demand, which could constrain long-term revenue growth and earnings potential if the domestic market softens.

- Saia’s traditional LTL (less-than-truckload) model is labor-intensive and saw a nearly 10% increase in workforce last year; ongoing driver recruitment and wage inflation, as well as persistent industry-wide labor shortages, may continue to pressure operating expenses and compress net margins over time.

- The rise of automation, autonomous vehicles, alternative logistics models, and digital freight brokers threatens the conventional trucking and LTL sector by potentially reducing demand for traditional driver-based services and altering pricing power, which could erode Saia’s future revenue base and profit margins.

- Increasing regulatory pressure on decarbonization and emissions compliance, alongside Saia’s continued reliance on diesel trucks, may result in higher compliance costs, required capital expenditures for fleet upgrades, and operational challenges—all of which could significantly weigh on operating margins and long-term earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Saia is $515.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Saia's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $515.0, and the most bearish reporting a price target of just $270.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $4.3 billion, earnings will come to $608.3 million, and it would be trading on a PE ratio of 27.1x, assuming you use a discount rate of 7.2%.

- Given the current share price of $331.28, the bullish analyst price target of $515.0 is 35.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NasdaqGS:SAIA. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives