Last Update 14 Dec 25

Fair value Increased 4.12%JBHT: Cost-Led Margin Gains Will Prove Fragile In Prolonged Weak Freight Cycle

Analysts raised their average price target for J.B. Hunt Transport Services by about $7 to roughly $172, citing sustained cost-driven margin improvements, better-than-expected Q3 execution, and an improving earnings trajectory supported by intermodal and cost efficiency gains.

Analyst Commentary

Recent research updates highlight a generally constructive stance on J.B. Hunt, with most firms lifting price targets following a stronger than expected Q3 and visible margin progress from cost initiatives. However, views remain mixed on how durable these gains will be and how quickly the freight cycle will improve.

Bullish Takeaways

- Bullish analysts point to a meaningful Q3 earnings beat and margin expansion in key segments as evidence that cost initiatives are driving sustainable efficiency gains, supporting higher earnings power into 2026.

- Several updated models assume continued cost improvements and operating leverage. These suggest that if the freight cycle strengthens, upside to current earnings and valuation could be significant.

- Improving intermodal margins and early benefits from self help actions are seen as validating management's strategy, leading to higher price targets that reflect a better growth and execution profile.

- Some views emphasize that the company entered peak season from a position of strength, with cost progress and operational execution positioning it well to capture incremental volume and profit improvement.

Bearish Takeaways

- Bearish analysts caution that shipper uncertainty and limited visibility on the freight cycle cap near term growth expectations, which justifies more tempered valuation multiples despite recent margin improvement.

- There is concern that elevated inflation and a still challenging industrial backdrop could erode part of the recent cost and margin gains, making it difficult to fully extrapolate Q3 performance.

- Some research notes highlight ongoing oversupply in the transports market and weak demand trends, which may restrict pricing power and constrain upside to earnings forecasts.

- Equal weight and hold stances reflect a view that, while execution has improved, the balance of cycle risk and macro headwinds limits the risk reward profile at current price levels.

What's in the News

- The Board of Directors authorized a new share repurchase plan on October 22, 2025, signaling continued confidence in the company and capital return to shareholders (Key Developments).

- Under the new authorization, J.B. Hunt Transport Services, Inc. announced a share repurchase program of up to $1 billion in common stock, with no stated expiration date (Key Developments).

- From July 1 to September 30, 2025, the company repurchased 1,602,783 shares, or 1.66% of outstanding shares, for $230.45 million. This completed a prior buyback of 6,126,864 shares, or 6.18%, for $903.93 million announced in August 2024 (Key Developments).

- For 2025, J.B. Hunt guided to operating income that is expected to be approximately flat compared to 2024, reflecting a cautious outlook despite ongoing efficiency and cost initiatives (Key Developments).

Valuation Changes

- Fair Value Estimate has risen slightly from approximately $165.57 to about $172.39 per share, reflecting modestly higher long term earnings expectations.

- Discount Rate has edged down marginally from about 8.11% to roughly 8.10%, implying a slightly lower required return on equity risk.

- Revenue Growth has decreased slightly from around 5.40% to about 5.29% annually, indicating a modestly more conservative top line outlook.

- Net Profit Margin has improved slightly from roughly 6.15% to about 6.22%, incorporating incremental cost efficiency and margin gains.

- Future P/E has increased modestly from about 19.8x to roughly 20.4x, suggesting a small uptick in the valuation multiple applied to forward earnings.

Key Takeaways

- Improved equipment utilization and cost optimization efforts enhance operational efficiencies, positively affecting net margins and profitability.

- Strategic investments in technology and capacity expansion support long-term revenue growth by accessing large addressable markets.

- Inflationary pressures, competitive rates, and muted demand in key segments challenge margins and earnings amidst an uncertain macroeconomic and policy environment.

Catalysts

About J.B. Hunt Transport Services- Provides surface transportation, delivery, and logistic services in the United States.

- Record first quarter intermodal volumes could indicate an ability to capture more market share, contributing to potential revenue growth.

- Efforts to improve equipment utilization and reduce empty move costs may enhance operational efficiencies, positively impacting net margins.

- Strategic investments in technology and capacity expansion may provide a platform for long-term revenue growth by better serving large addressable markets.

- Successful bid season outcomes, including modest rate increases and filling costly empty lanes, could drive better revenue and profitability metrics.

- The focus on reducing and optimizing costs, combined with a disciplined capital allocation strategy, suggests improvements in earnings as the company scales operations.

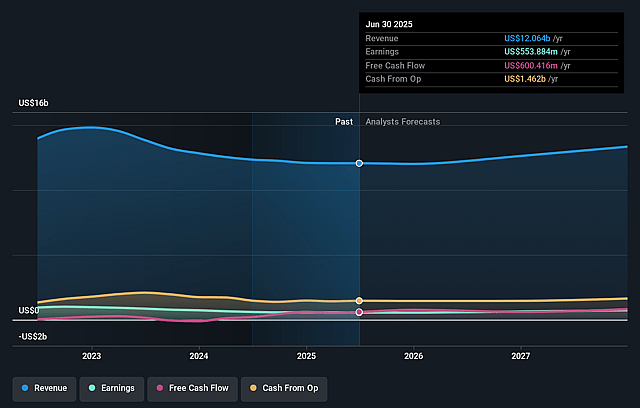

J.B. Hunt Transport Services Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming J.B. Hunt Transport Services's revenue will grow by 5.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.6% today to 5.9% in 3 years time.

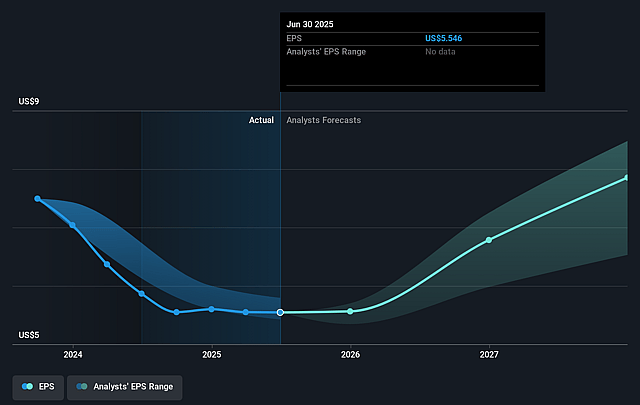

- Analysts expect earnings to reach $830.2 million (and earnings per share of $9.07) by about September 2028, up from $553.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.7x on those 2028 earnings, down from 24.6x today. This future PE is lower than the current PE for the US Transportation industry at 24.6x.

- Analysts expect the number of shares outstanding to decline by 4.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.17%, as per the Simply Wall St company report.

J.B. Hunt Transport Services Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces a challenging operating environment with inflationary cost pressures more than offsetting productivity improvements, affecting margins and earnings.

- Lower yields and increased insurance premiums have been weighing on operating income, indicating potential pressure on net margins and earnings.

- Seasonally lower volume and rate pressure coupled with competitive truckload rates, especially in the Eastern network, may limit the ability to achieve desired price increases and hurt revenue and margins.

- Demand for Final Mile services such as furniture and appliances remains muted, potentially impacting revenue and margin growth in this segment.

- The uncertain macro environment and changing trade policies, including tariffs, pose risks to supply and demand dynamics, which could impact revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $159.375 for J.B. Hunt Transport Services based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $180.0, and the most bearish reporting a price target of just $133.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $14.0 billion, earnings will come to $830.2 million, and it would be trading on a PE ratio of 20.7x, assuming you use a discount rate of 8.2%.

- Given the current share price of $141.0, the analyst price target of $159.38 is 11.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on J.B. Hunt Transport Services?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.