Key Takeaways

- Superapp ecosystem growth and fintech expansion are driving higher user engagement, new revenue streams, and long-term earnings potential.

- Tech investments and operational efficiencies are boosting margins, while advancements in urban mobility may further enhance future profitability.

- Increasing competition, regulatory risks, heavy incentive spending, and large tech investments threaten Grab's margins, revenue growth, and long-term profitability in core Southeast Asian markets.

Catalysts

About Grab Holdings- Engages in the provision of superapps in Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam.

- Accelerated digital payments and fintech adoption in Southeast Asia is expanding Grab's addressable market and boosting transaction volumes, as evidenced by the rapid growth in GrabFin and digital bank loan disbursals; this supports strong long-term revenue and earnings potential.

- Rising smartphone and internet penetration, alongside urbanization and expanding middle-class affluence across the region, is driving higher user engagement and increased frequency of usage within Grab's superapp ecosystem, underpinning robust GMV and top-line growth.

- Expansion and monetization of cross-vertical products (e.g., Mart, food delivery, premium rides, loyalty programs, and bundled services) are increasing revenue per user and creating new avenues for higher-margin advertising and financial services; this is expected to enhance margin and earnings over time.

- Operational efficiencies from continued tech investments (AI, automation, product-led growth, cost discipline) are producing operating leverage and improving net margins, as shown by margin improvement despite increased investment in affordability and new user acquisition.

- The ongoing development of autonomous vehicle fleets and partnerships positions Grab to benefit from future advancements in urban mobility, which could lower long-term costs, boost utilization, and drive new revenue streams, positively impacting profitability and long-term earnings growth.

Grab Holdings Future Earnings and Revenue Growth

Assumptions

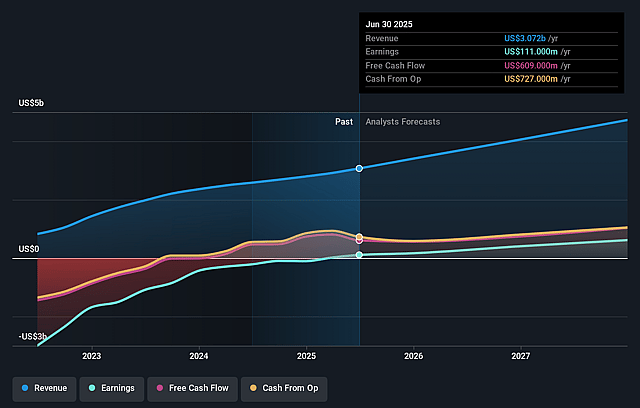

How have these above catalysts been quantified?- Analysts are assuming Grab Holdings's revenue will grow by 20.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.6% today to 15.0% in 3 years time.

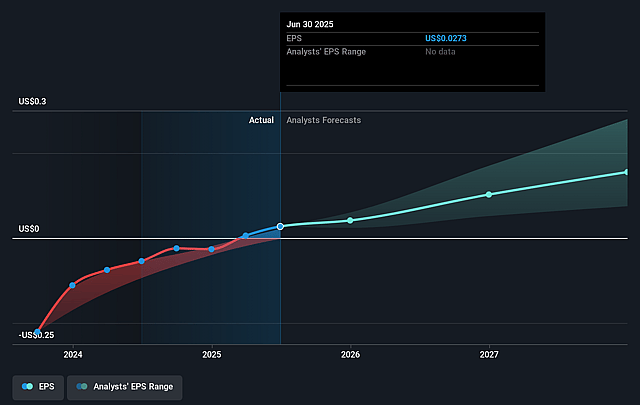

- Analysts expect earnings to reach $802.4 million (and earnings per share of $0.2) by about August 2028, up from $111.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.1 billion in earnings, and the most bearish expecting $319.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 42.1x on those 2028 earnings, down from 181.8x today. This future PE is greater than the current PE for the US Transportation industry at 26.0x.

- Analysts expect the number of shares outstanding to grow by 2.91% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.67%, as per the Simply Wall St company report.

Grab Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition in key markets, particularly Vietnam (with new food delivery entrants) and across Southeast Asia from both local and regional players, risks compressing take rates and increasing promotional spending, which may erode net margins and limit Grab's ability to sustainably grow earnings.

- Ongoing heavy investments in affordability (Saver rides/delivery) and persistent reliance on incentives (consumer incentive spending at 7%+ of GMV) could delay operating leverage, suppress underlying margins in Delivery and Mobility segments, and weigh on both revenue per user and overall earnings growth.

- Looming macroeconomic uncertainties in major markets (Thailand, Indonesia) and globally-such as consumption slowdowns and political/trade tensions-could constrain consumer discretionary spending, increasing volatility in core revenue streams.

- The prospect of regulatory changes (e.g., labor laws affecting driver classification, fintech/lending oversight) or licensing hurdles in Southeast Asian markets threatens to increase compliance costs and operational complexity, pressuring long-term profitability.

- High capital expenditure required for autonomous vehicle rollout and electrification, as well as the uncertain timeline and monetization path for these technologies, could strain free cash flow, raise fixed costs, and dilute returns if adoption or regulatory frameworks do not progress as expected.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $6.1 for Grab Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $8.0, and the most bearish reporting a price target of just $5.1.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $5.4 billion, earnings will come to $802.4 million, and it would be trading on a PE ratio of 42.1x, assuming you use a discount rate of 7.7%.

- Given the current share price of $4.95, the analyst price target of $6.1 is 18.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.